Robert Half International Inc. Just Released Its Annual Earnings: Here's What Analysts Think

Last week, you might have seen that Robert Half International Inc. (NYSE:RHI) released its annual result to the market. The early response was not positive, with shares down 6.1% to US$58.17 in the past week. Robert Half International reported in line with analyst predictions, delivering revenues of US$6.1b and statutory earnings per share of US$3.90, suggesting the business is executing well and in line with its plan. Following the result, analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Robert Half International

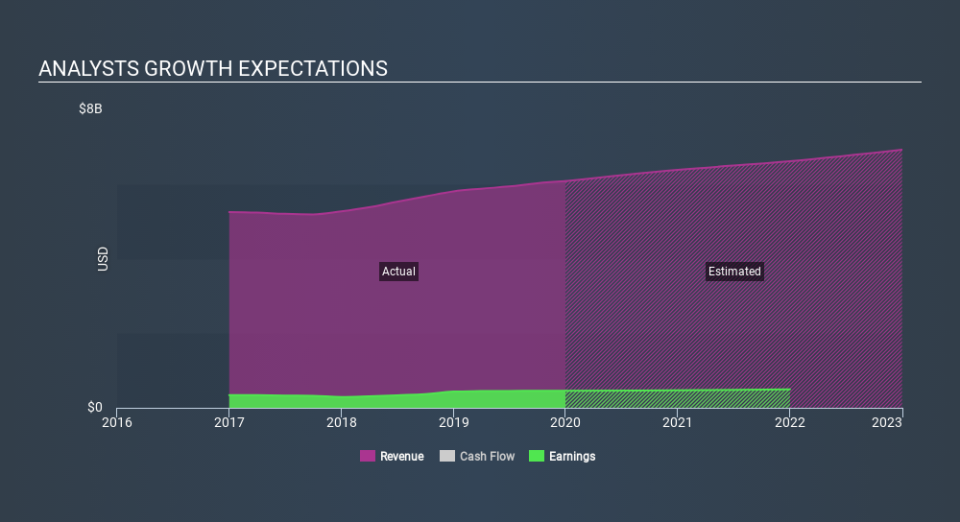

Taking into account the latest results, the latest consensus from Robert Half International's 13 analysts is for revenues of US$6.38b in 2020, which would reflect a credible 5.0% improvement in sales compared to the last 12 months. Statutory earnings per share are expected to accumulate 5.8% to US$4.16. Yet prior to the latest earnings, analysts had been forecasting revenues of US$6.34b and earnings per share (EPS) of US$4.16 in 2020. So it's pretty clear that, although analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

There were no changes to revenue or earnings estimates or the price target of US$61.64, suggesting that the company has met expectations in its recent result. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic Robert Half International analyst has a price target of US$70.00 per share, while the most pessimistic values it at US$45.00. As you can see, analysts are not all in agreement on the stock's future, but the range of estimates is still reasonably narrow, which could suggest that the outcome is not totally unpredictable.

Another way to assess these estimates is by comparing them to past performance, and seeing whether analysts are more or less bullish relative to other companies in the market. Next year brings more of the same, according to analysts, with revenue forecast to grow 5.0%, in line with its 4.5% annual growth over the past five years. Compare this with the wider market (in aggregate), which analyst estimates suggest will see revenues fall 6.8% next year. So although Robert Half International is expected to maintain its revenue growth rate, it's forecast to grow slower than the wider market.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with analysts reconfirming that earnings per share are expected to continue performing in line with their prior expectations. On the plus side, there were no major changes to revenue estimates; although analyst forecasts imply revenues will perform worse than the wider market. The consensus price target held steady at US$61.64, with the latest estimates not enough to have an impact on analysts' estimated valuations.

Still, the long-term prospects of the business are much more relevant than next year's earnings. At Simply Wall St, we have a full range of analyst estimates for Robert Half International going out to 2022, and you can see them free on our platform here..

You can also see our analysis of Robert Half International's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.