Roku (NASDAQ:ROKU) Is Improving Its Returns, Shareholders Are Hopeful

This article was originally published on Simply Wall St News.

Roku ( NASDAQ:ROKU ) is an aggressive contender for streaming entertainment. Mostly focused on the US market, Roku seeks to provide a free streaming service for its 53 million plus users.

While other platforms such as Netflix ( NASDAQ:NFLX ), Disney+ ( NYSE:DIS ), AmazonPrime ( NASDAQ:AMZN ), HBO GO ( NYSE:T ), offer primarily a paid service, Roku seeks to prosper within an AD based business model for streaming.

In this article we are going to analyze the return on capital employed for Roku and compare it to their cost of capital. By doing this we want to understand if there are excess returns being generated by Roku, or if there is relative (%) value added with its business model.

So what trends should we look for if we want to identify stocks that can multiply in value over the long term?

Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Put simply, these types of businesses are continually reinvesting their earnings at ever-higher rates of return.

Speaking of which, we noticed some great changes in Roku's ( NASDAQ:ROKU ) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Roku:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.039 = US$111m ÷ (US$3.5b - US$628m) (Based on the trailing twelve months to March 2021) .

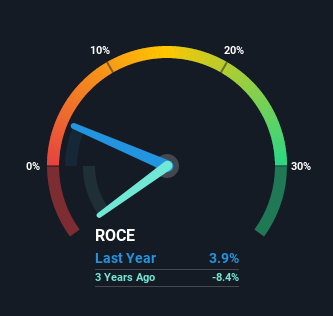

So, Roku has an ROCE of 3.9%. In absolute terms, that's a low return and it also under-performs the Entertainment industry average of 12%.

See our latest analysis for Roku

NasdaqGS:ROKU Return on Capital Employed June 7th 2021

Above you can see how the current ROCE for Roku compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Roku .

What Does the ROCE Trend For Roku Tell Us?

We're delighted to see that Roku is reaping rewards from its investments and is now generating some pre-tax profits. About five years ago the company was generating losses and had a ROCE of -8.4% but things have turned around because it's now earning 3.9% on its capital.

For a company to be profitable in the long term, we need to compare the ROCE to the cost of capital.

An intuitive way to think of this is that a company should have a return which is larger to the cost (of capital). For Roku, we estimated the cost of capital at 6.44%, which is higher than the return of 3.9%.

This means that Roku needs to keep optimizing the ROCE in order to be a value creating company.

Also, on a positive note, the company is utilizing 3,068% more capital than before, but that's to be expected from a company trying to break into profitability.

We like this trend, because it tells us the company has profitable reinvestment opportunities available to it.

The Key Takeaway

To the delight of most shareholders, Roku has now broken into profitability.

Since the stock has returned a staggering 734% to shareholders over the last three years, it looks like investors are recognizing these changes.

The return on capital employed still needs to catch up with the cost of capital, or else Roku will be forced to finance its operations from sources other than profits.

This can mean taking on additional debt or issuing new shares - as the 9.4% dilution they did in the past year .

If you'd like to know about the risks facing Roku, we've discovered 3 warning signs that you should be aware of.

While Roku isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com