Is Rollatainers (NSE:ROLLT) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Rollatainers Limited (NSE:ROLLT) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Rollatainers

How Much Debt Does Rollatainers Carry?

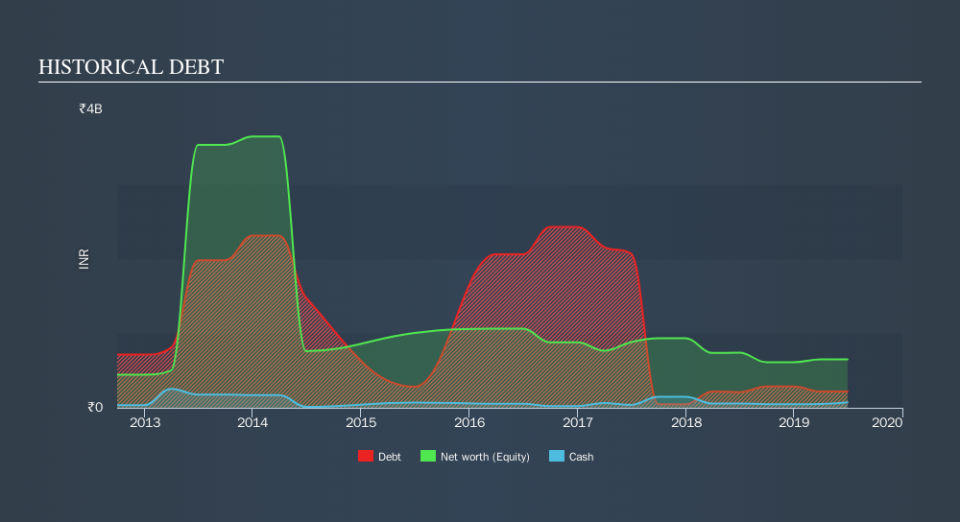

As you can see below, at the end of March 2019, Rollatainers had ₹219.3m of debt, up from ₹209.5m a year ago. Click the image for more detail. However, because it has a cash reserve of ₹73.6m, its net debt is less, at about ₹145.7m.

How Strong Is Rollatainers's Balance Sheet?

The latest balance sheet data shows that Rollatainers had liabilities of ₹1.46b due within a year, and liabilities of ₹268.2m falling due after that. On the other hand, it had cash of ₹73.6m and ₹475.2m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹1.18b.

The deficiency here weighs heavily on the ₹547.8m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we definitely think shareholders need to watch this one closely. After all, Rollatainers would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Rollatainers will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Rollatainers wasn't profitable at an EBIT level, but managed to grow its revenue by11%, to ₹1.4b. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Importantly, Rollatainers had negative earnings before interest and tax (EBIT), over the last year. Indeed, it lost a very considerable ₹190m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it burned through ₹268m in negative free cash flow over the last year. That means it's on the risky side of things. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Rollatainers's profit, revenue, and operating cashflow have changed over the last few years.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.