Rollins (ROL) Gains From Top-Line Strength Amid Expense Woes

Rollins, Inc. ROL is currently benefiting from a balanced approach to organic and inorganic growth.

The company recently reported better-than-expected fourth-quarter 2020 results. Adjusted earnings of 13 cents per share came ahead of the Zacks Consensus Estimate as well as the year-ago figure by 18.2%. Revenues of $536.3 million beat the consensus mark by 1.7% and improved 6% year over year.

The company’s shares have gained 19.6% in the past year, underperforming the 20.5% rally of the industry it belongs to.

Top Line is in Good Shape

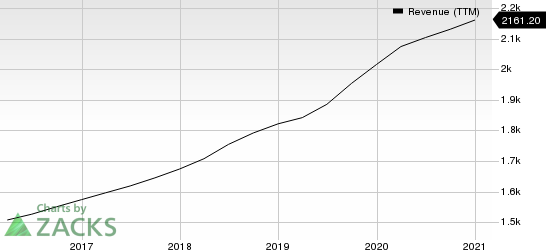

Demand environment for this building maintenance servicer remains in good shape driven by decent construction activity. A balanced approach to organic and inorganic growth has been benefiting the company’s revenues that have increased at a compounded annual growth rate of 6.6% over the past five years.

Rollins, Inc. Revenue (TTM)

Rollins, Inc. revenue-ttm | Rollins, Inc. Quote

Enhancing benefits are expected to improve employee and customer retention for the upcoming years, driving organic growth. Further, with the help of strategic acquisitions, the company continues to expand its global brand recognition and geographical footprint, while also boosting revenues. Rollins completed 31 acquisitions in 2020. It made 30 acquisitions in 2019 and 38 in 2018.

Costs Stay High

Rollins is witnessing escalation in costs, resulting from acquisitions and IT-related expenses. Notably, sales, general and administrative expenses increased 2.8% year over year in fourth-quarter 2020 and 5.3% in full-year 2020. So, the company's bottom line is likely to remain under pressure going forward.

Zacks Rank and Stocks to Consider

Rollins currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader Zacks Business Services sector are Omnicom OMC, Gartner IT and TeleTech Holdings TTEC, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The long-term expected earnings per share (three to five years) growth rate for Omnicom Gartner and TeleTech is pegged at 4.7%, 13.5% and 14.7%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

TeleTech Holdings, Inc. (TTEC) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research