Ronald Muhlenkamp's Firm Buys 2 Stocks in 2nd Quarter

Muhlenkamp & Co. Inc., the investment firm founded by Ronald Muhlenkamp (Trades, Portfolio), released its second-quarter portfolio earlier this week, listing two new holdings.

Last February, Muhlenkamp announced his retirement. While he is still acting as the firm's chairman, he passed the operational responsibilities on to his sons.

With the goal of maximizing returns through capital appreciation, as well as income from dividends and interest, the guru's Wexford, Pennsylvania-based firm typically invests in highly profitable companies trading at a discount. When picking stocks, it seeks companies with strong balance sheets and high returns on equity. The firm believes that over time, stock prices reflect the companies' underlying value and that the long-term business of investing offers a higher chance of profitability and reliability.

Based on these criteria, the firm established positions in Meritage Homes Corp. (NYSE:MTH) and Corteva Inc. (NYSE:CTVA) during the quarter, GuruFocus portfolio data shows.

Meritage Homes

Muhlenkamp's firm invested in 117,704 shares of Meritage Homes, allocating 2.94% of the equity portfolio to the holding. The stock traded for an average price of $50.51 per share during the quarter.

The Scottsdale, Arizona-based homebuilder has a $2.48 billion market cap; its shares were trading around $65.34 on Thursday with a price-earnings ratio of 12.45, a price-book ratio of 1.36 and a price-sales ratio of 0.74.

The Peter Lynch chart shows the stock is trading below its fair value, suggesting it is undervalued.

GuruFocus rated Meritage Homes' financial strength 6 out of 10. Despite having comfortable interest coverage, the Altman Z-Score of 2.77 indicates the company is under some financial pressure.

The company's profitability and growth scored an 8 out of 10 rating. Although the operating margin is in decline, Meritage's returns are outperforming at least 50% of competitors. It also has a high Piotroski F-Score of 8, which implies operations are strong, and a business predictability rank of one out of five stars. According to GuruFocus, companies with this rank typically see their stocks gain an average of 1.1% per annum over a 10-year period.

Of the gurus invested in Meritage Homes, Ken Fisher (Trades, Portfolio) has the largest stake with 3.96% of outstanding shares. During the quarter, Lee Ainslie (Trades, Portfolio), George Soros (Trades, Portfolio), Chuck Royce (Trades, Portfolio) and Steven Cohen (Trades, Portfolio) also established positions in the stock, while Hotchkis & Wiley reduced its holding.

Read more here:

Mawer Canadian Equity Fund Buys 2 Stocks in 2nd Quarter

5 Stocks These Socially Responsible Gurus Agree On

Oakmark International Small Cap Fund Buys 4 Stocks in 2nd Quarter

Corteva

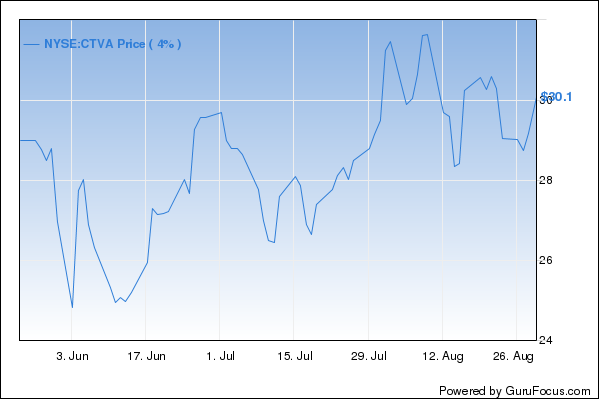

The firm picked up 37,648 shares of Corteva, dedicating 0.54% of the equity portfolio to the position. During the quarter, shares traded for an average price of $27.28.

The Wilmington, Delaware-based agriculture company, which completed its spinoff from DowDuPont in June, has a market cap of $21.85 billion; its shares were trading around $29.17 on Thursday with a forward price-earnings ratio of 25.13, a price-book ratio of 0.91 and a price-sales ratio of 1.53.

According to GuruFocus, the stock has gained 4% since it began trading.

Corteva's financial strength was rated 6.1 out of 10 by GuruFocus. While the company has adequate interest coverage and a strong cash-debt ratio, the Altman Z-Score of 0.70 warns it could be in danger of going bankrupt.

The company's profitability and growth did not fare as well, scoring a 2 out of 10 rating on the back of margins and returns that underperform a majority of industry peers.

With 2.62% of outstanding shares, investment firm Barrow, Hanley, Mewhinney & Strauss is the company's largest guru shareholder. Other gurus who took positions in the stock during the quarter include Ainslie, the T Rowe Price Equity Income Fund (Trades, Portfolio), PRIMECAP Management (Trades, Portfolio), NWQ Managers (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Leon Cooperman (Trades, Portfolio), Dodge & Cox, Jeff Auxier (Trades, Portfolio), Cohen, Mario Gabelli (Trades, Portfolio), Michael Price (Trades, Portfolio), Tom Russo (Trades, Portfolio) and Fisher.

Additional trades

During the quarter, Muhlenkamp's firm also boosted its holding of the SPDR Gold Trust (GLD) exchange-traded fund by 0.33% and its Pfizer Inc. (NYSE:PFE) position by 0.39%.

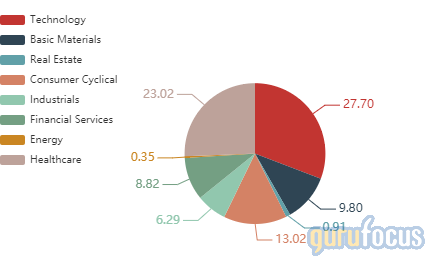

The firm's $206 million equity portfolio, which is composed of 33 stocks, is largely invested in the technology and health care sectors.

According to the firm's website, the Muhlenkamp Fund returned -13.29% in 2018, underperforming the S&P 500 Index's return of -4.38%.

Disclosure: No positions.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.