Russia’s Overseas Crude Shipments Slump to a Six-Month Low

- Oops!Something went wrong.Please try again later.

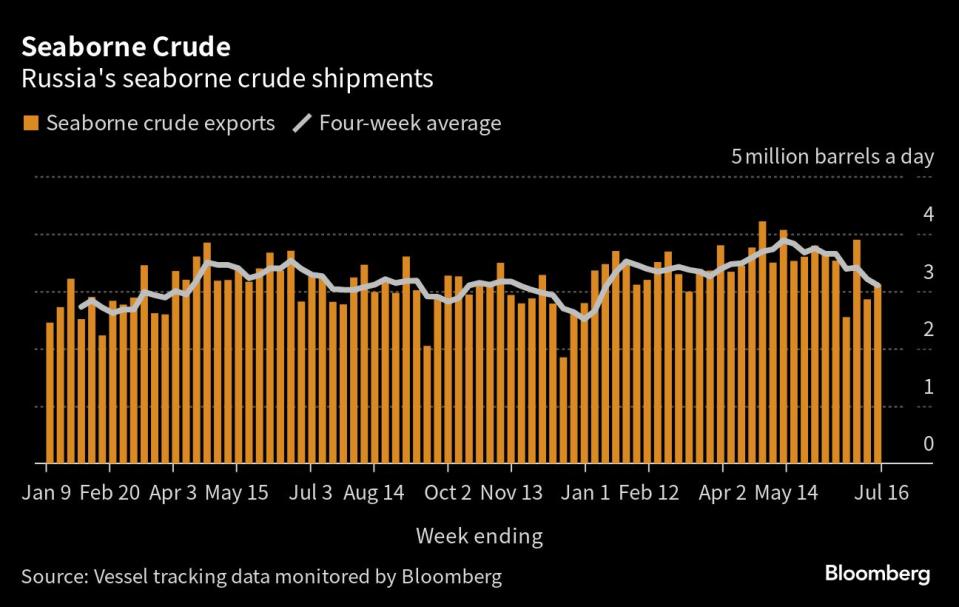

(Bloomberg) -- Russia’s seaborne crude flows sank to a six-month low in the latest four-week period as Moscow finally appears to be making good on its pledge to cut supply to international markets.

Most Read from Bloomberg

Singapore Passport Is World’s Most Powerful, Replacing Japan

Tesla Investor Rode a 14,800% Gain Thanks to 27-Year-Old Analyst

Morgan Stanley Moves 200 Tech Experts From China on Data Law

Meet the Billionaire Who Convinced Messi to Pick MLS Over Saudi Arabia

Massive US Oil Caverns Sit Empty and Will Take Years to Refill

Crude shipments in the four weeks to July 16 dropped to 3.1 million barrels a day, according to vessel-tracking data monitored by Bloomberg and corroborated by other data sources. That’s down by 780,000 barrels a day from their peak in the 28 days to May 14. Shipments were 270,000 barrels a day below the level in February, the baseline month cited when the Russian government announced an output cut to come into effect in March.

Russia initially said that it would cut oil production by 500,000 barrels a day in retaliation for Western sanctions and price caps on its oil imposed after the invasion of Ukraine, but subsequently overseas shipments increased. The reduction being seen now comes after the Kremlin said it would reduce exports by the same amount in August, following a further unilateral output cut by Saudi Arabia. Russia’s export curtailment was hailed as meaningful by Saudi Energy Minister Prince Abdulaziz bin Salman, who had urged Moscow to provide greater transparency on its oil flows.The move comes at the most advantageous moment possible for Moscow, with domestic refineries ending spring maintenance and condensate production dipping on a seasonal slump in natural gas production.

With few buyers left in Europe, the impact of the lower flows is being felt in shipments to Asia, which dropped to their lowest since mid-January. The smaller volumes undermined the Kremlin’s income from export taxes, which fell to the lowest since April in the latest four-week period.

Urals prices breached a price cap set by the Group of Seven nations, which could complicate shipments. Russian crude cannot be transported on Western ships — or make use of Western services — unless it is priced under the $60 a barrel threshold. Prices above that level will force buyers to use the shadow fleet of vessels that operate without Western insurance or other services.

Shipping firms relying on Western services can expect delays from financial and technical service providers to check the shipments weren’t sold above the G7 price cap, according to the Standard Club, a protection and indemnity provider for shipowners.

Rising prices and a narrowing discount against international benchmarks is also making Russia’s crude less attractive to Indian refiners, who are in talks with traditional Middle East exporters for increased purchases as Russian imports lose their pricing edge. Russia aims to reduce its third-quarter crude exports by 2.1 million tons in total, which corresponds to the nation’s pledge to cut overseas supplies by 500,000 barrels a day in the month of August. Moscow will curtail exports both from its key western ports as well as pipeline flows, according to the Energy Ministry, though it’s difficult to see which pipeline deliveries can be cut without breaching contract terms.

Crude Flows by Destination

On a four-week average basis, overall seaborne exports in the period to July 16 were down by 105,000 barrels a day to 3.1 million barrels a day. This compares with an average of 3.38 million barrels a day in the four weeks to Feb. 26. More volatile weekly flows moved in the opposite direction, rising by about 260,000 barrels a day to 3.11 million barrels a day.

Weekly data are affected by the scheduling of tankers and loading delays caused by bad weather. Port maintenance can also disrupt exports for several days at a time. Four-week average figures are likely to rise next, as the very low shipments seen in the seven days to June 25, when flows through Primorsk were curtailed by maintenance work, will drop out of the calculation.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through the Baltic ports of Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from European Union sanctions.

Asia

Most Read from Bloomberg

Singapore Passport Is World’s Most Powerful, Replacing Japan

Tesla Investor Rode a 14,800% Gain Thanks to 27-Year-Old Analyst

Morgan Stanley Moves 200 Tech Experts From China on Data Law

Meet the Billionaire Who Convinced Messi to Pick MLS Over Saudi Arabia

Massive US Oil Caverns Sit Empty and Will Take Years to Refill

Four-week average shipments to Russia’s Asian customers, plus those on vessels showing no final destination, fell to 2.77 million barrels a day in the period to July 16 from 2.9 million barrels a day in the four weeks to July 9. That’s the lowest in six months.

Most of the cargoes on ships without an initial destination eventually end up in India. Even so, the volumes heading to the country that has become the biggest buyer of Russia’s seaborne crude are down from their recent highs. Adding the “Unknown Asia” and “Other Unknown” volumes to the total for India gives a figure of 1.75 million barrels a day in the four weeks to July 16. That’s down from a high of 2.2 million barrels a day in the four weeks to May 21.

The equivalent of 346,000 barrels a day was on vessels showing destinations as either Port Said or Suez in Egypt, or which already have been or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at 214,000 barrels a day in the four weeks to July 16, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey, while other cargoes are transferred from one vessel to another, either in the Mediterranean or, more recently, in the Atlantic Ocean.

Europe

Most Read from Bloomberg

Singapore Passport Is World’s Most Powerful, Replacing Japan

Tesla Investor Rode a 14,800% Gain Thanks to 27-Year-Old Analyst

Morgan Stanley Moves 200 Tech Experts From China on Data Law

Meet the Billionaire Who Convinced Messi to Pick MLS Over Saudi Arabia

Massive US Oil Caverns Sit Empty and Will Take Years to Refill

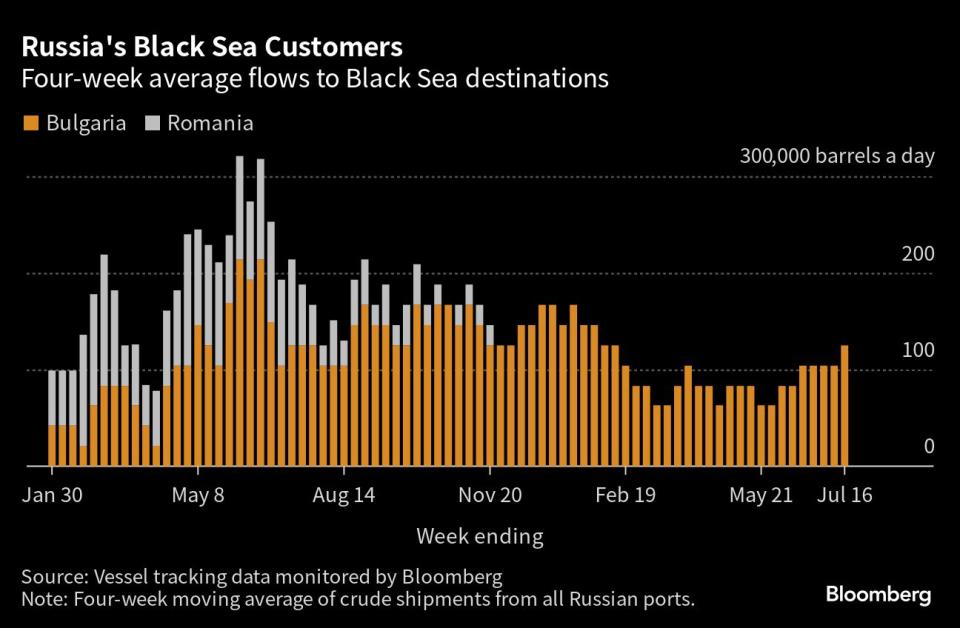

Russia’s seaborne crude exports to European countries edged up to 125,000 barrels a day in the 28 days to July 16, with Bulgaria the sole destination. These figures do not include shipments to Turkey.

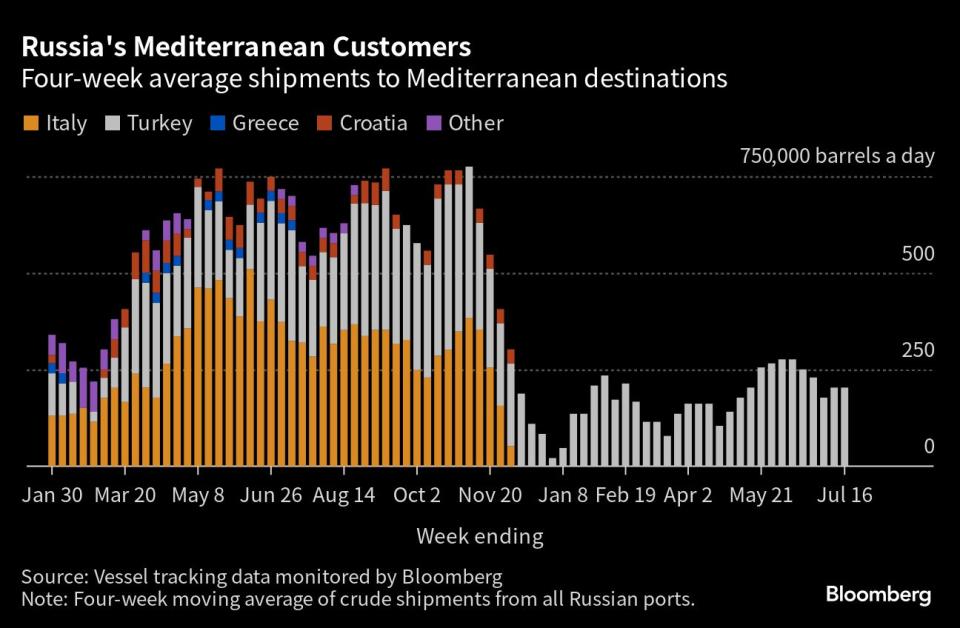

A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

No Russian crude was shipped to northern European countries in the four weeks to July 16.

Exports to Turkey, Russia’s only remaining Mediterranean customer, were unchanged at 203,000 barrels a day in the four weeks to July 16. Flows to the country had topped 425,000 barrels a day in October.

Flows to Bulgaria, now Russia’s only Black Sea market for crude, rose to 125,000 barrels a day. That’s the highest since February.

Flows by Export Location

Aggregate flows of Russian crude rose to 3.11 million barrels a day in the seven days to July 16, from 2.86 million barrels a day the previous week. A small drop is shipments from the Pacific, which may have been affected by strong winds at Kozmino towards the end of the week, was more than offset by increases from all other export regions.

Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

Vessel tracking data are cross-checked against port agent reports as well as flows and ship movements reported other data providers including Kpler SAS and Vortexa Ltd.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty rose to $46 million in the seven days to July 16, an increase of $4 million or 9%. Four-week average income fell by $2 million to $47 million.

Russia’s government calculates oil taxes, including export duty, using a discount to Brent, which sets the floor price for the nation’s crude for budget purposes. If Russian oil trades above that threshold, the Finance Ministry uses the market price for tax calculations, as has been the case in recent months. From July the discount is currently set at $25/bbl, but the budget and tax committee of the Russian State Duma has supported a Finance Ministry proposal to reduce the discount to $20 a barrel from September.

The duty rate for July has been set at $2.13 a barrel, based on an average Urals price of $54.57, which was $20.89 a barrel below Brent during the period between May 15 and June 14. The levy will be increased to about $2.31 a barrel for August, based on an average Urals price of $58.03, which was $18.02 a barrel below Brent during the period between June 15 and July 14.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

A total of 29 tankers loaded 21.78 million barrels of Russian crude in the week to July 16, vessel-tracking data and port agent reports show. That’s up by 1.78 million barrels from the previous week’s figure, but down by about 3 million barrels from the average weekly shipments seen this year until mid-June. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

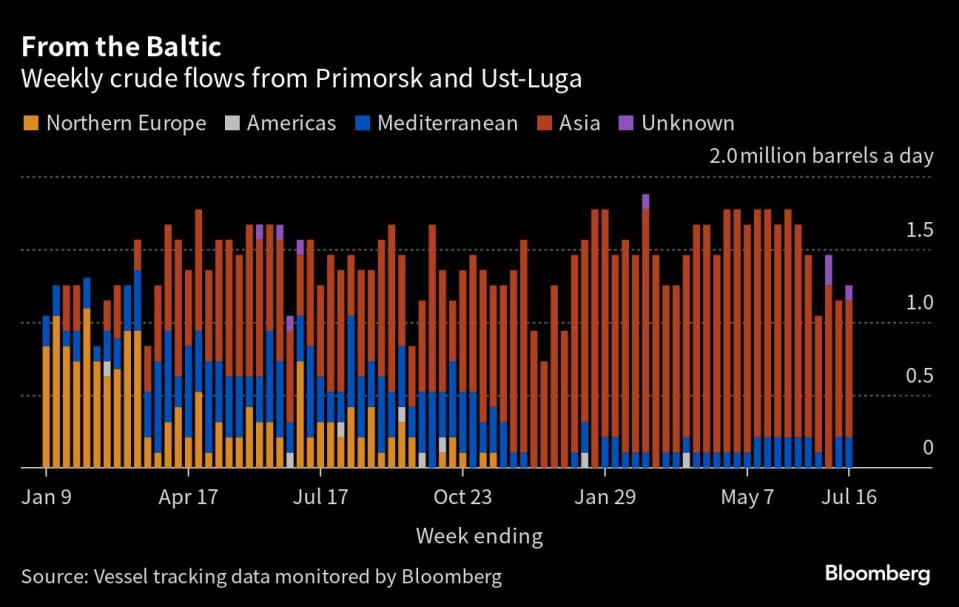

The total volume on ships loading Russian crude from the Baltic terminals edged up to 1.25 million barrels a day, recovering one-third of the drop seen the previous week. The increase was concentrated at Ust-Luga, where there was one more shipment than during the previous week. No cargoes of Kazakhstani crude were loaded at the port during the week.

Shipments of Russian crude from Novorossiysk in the Black Sea also increased, rising by 63,000 barrels a day. One cargo of Kazakhstani crude was also loaded at the port during the week.

Arctic shipments rebounded to 286,000 barrels a day. Two Suezmax tankers completed loading during the week ended July 16.

Ten tankers loaded at Russia’s three Pacific export terminals, down from 11 the previous week. The volume of crude shipped from the region fell to 1.03 million barrels a day.

High winds, with speeds in excess of 20 miles per hour recorded, around July 15 may have disrupted loading operations at Kozmino terminal.

Shipments from the Sakhalin Island terminal remained low last week due to maintenance at one of the Sakhalin 2 project’s oil production platforms.

The volumes heading to unknown destinations are mostly Sokol cargoes that recently have been transferred to other vessels at Yeosu, or are currently being shuttled to an area off the South Korean port from the loading terminal at De Kastri. Most of these are ending up in India.

Some Sokol cargoes are now being transferred a second time in the waters off southern Malaysia. A small number of ESPO shipments are also being moved from one vessel to another in the same area. All bar one of these cargoes have, so far, gone on to India. That one cargo was transferred onto a floating storage vessel off Malaysia, where it remains.

NOTES

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

Note: Weeks have been revised to run from Monday to Sunday, rather than Saturday to Friday. This change has been implemented throughout the data series and previous weeks’ figures have been revised.

Note: The next update will be published on Tuesday July 25, with future updates also to be published on TuesdaysIf you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.