Russia’s Seaborne Crude Flows Slump to the Lowest Since January

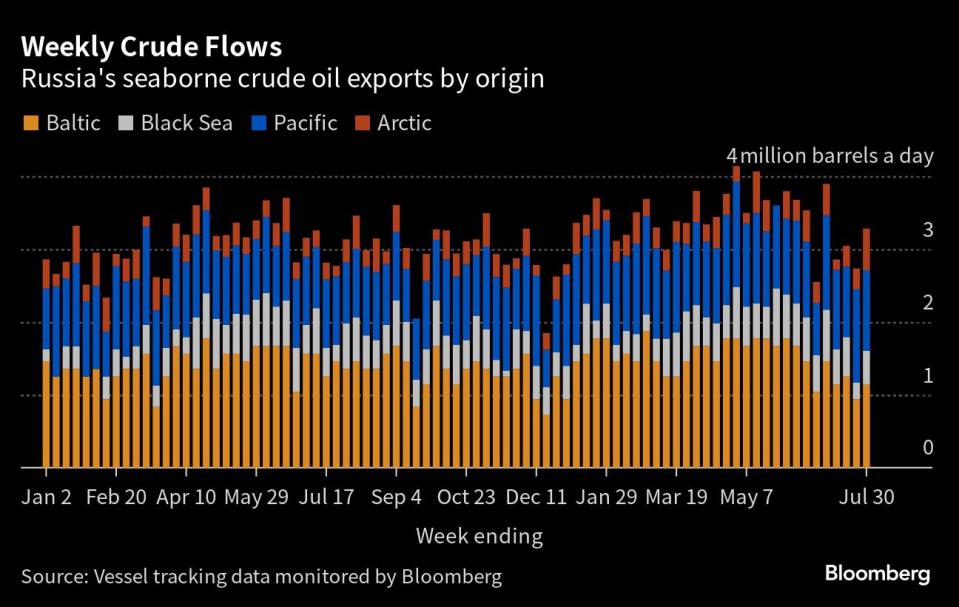

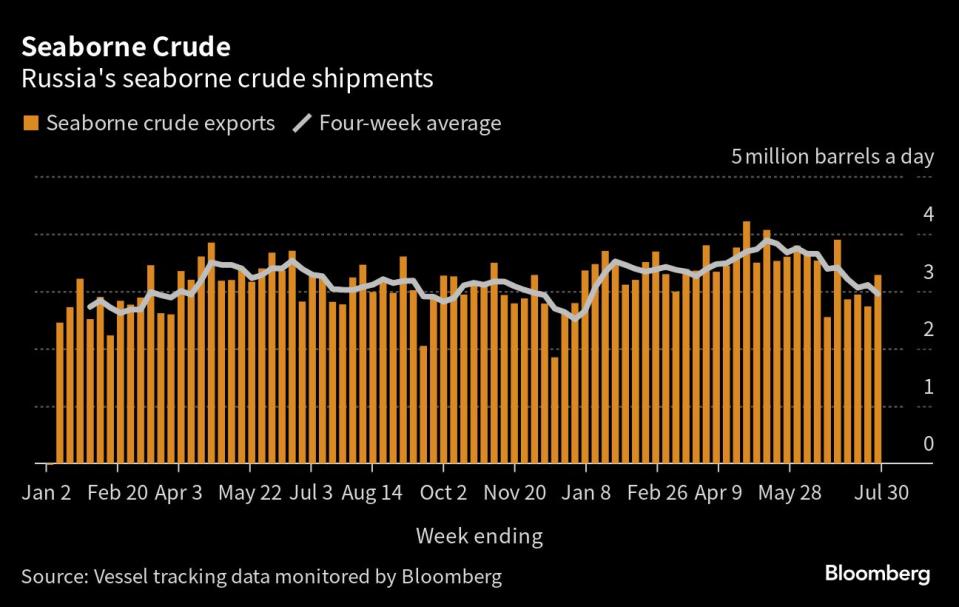

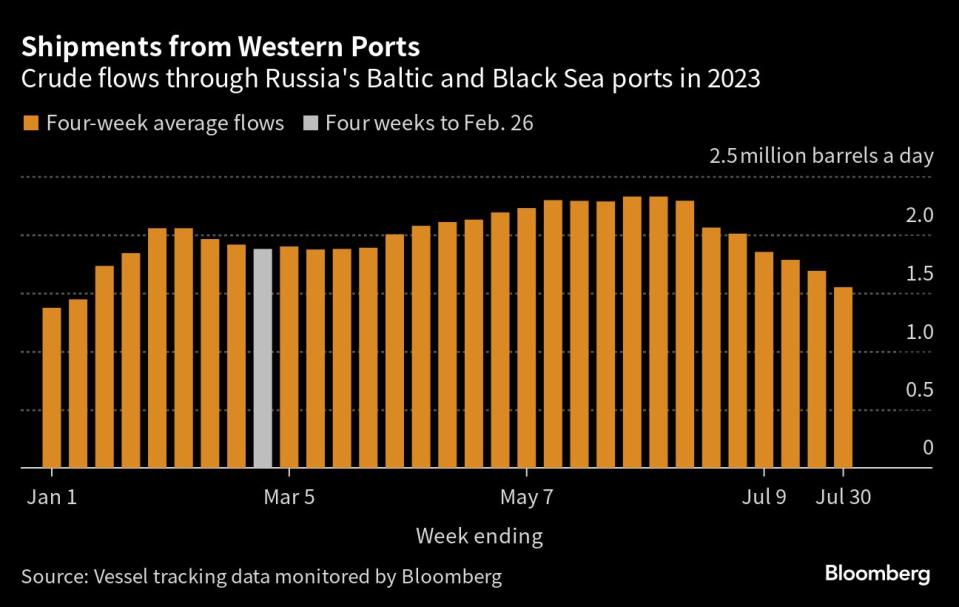

(Bloomberg) -- Russia’s seaborne crude flows in the four weeks to July 30 fell to the lowest since early January, shortly after a European Union import ban and a wider price cap on the country’s exports came into effect.

Most Read from Bloomberg

Fitch’s US Credit Downgrade Sparks Criticism Along With Unease

Missing Goldman Sachs Analyst Confirmed Dead by New York Police

US, Europe Growing Alarmed by China’s Rush Into Legacy Chips

Four-week average shipments dropped to 2.98 million barrels a day, the smallest since the 28-day period ending Jan. 8 and down by more than 900,000 barrels a day from the peak seen in mid-May. More volatile weekly flows rose, with record-equaling shipments from the Arctic.

As overseas shipments fell, more crude was processed in Russia’s refineries in July, with several plants completing major maintenance.

The figures support the notion that Moscow is honoring a pledge to keep supply off the global market alongside its allies in the OPEC+ producer coalition. Russia initially said that it would cut oil production in retaliation for Western sanctions and price caps on its oil imposed after the invasion of Ukraine, using February as a baseline. But seaborne flows continued to rise, only dropping significantly in the last few weeks.

Now, the tighter availability of Russian crude alongside fewer barrels from the Middle East has narrowed discounts offered for ESPO crude deliveries to Chinese buyers for September delivery. More generally, rising prices and a narrowing discount against international benchmarks is also making Russia’s crude less attractive to Indian refiners, whose purchases declined for a second month in July.

Warming temperatures are allowing Russia to use the shorter route along its northern coast to China. At least four tankers are hauling crude along the Northern Sea Route from ports in the Arctic and Baltic. But it remains unlikely that many of the shadow fleet of aging tankers used to ship Russian crude will be able to use the route, which still requires ice breaker assistance at some points.

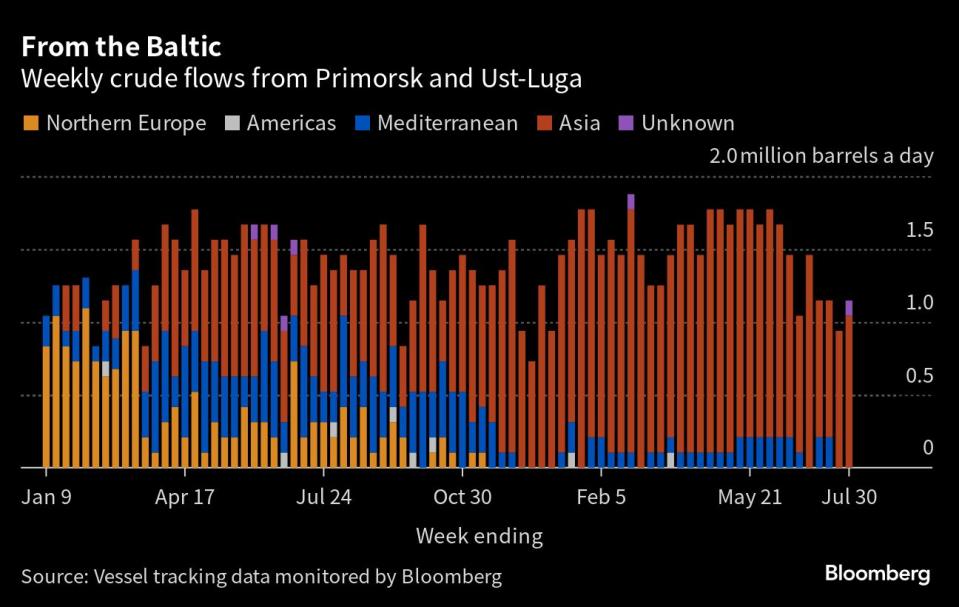

Weekly data are affected by the scheduling of tankers and loading delays caused by bad weather. Port and pipeline maintenance can also disrupt exports for several days at a time. Four-week average shipments, which smooth out some of the volatility in the weekly numbers, fell by 154,000 barrels a day. The very high shipments seen in the seven days to July 2 dropped out of the calculation, though the effect was partly offset by a rebound in shipments from Ust-Luga last week.

Overseas shipments of Russian crude from Baltic and Black Sea ports increased after the output cut was due to come into effect, peaking in late May. The reduction being seen now comes after fellow OPEC+ oil producer Saudi Arabia extended its own unilateral output cut. Russia’s export curtailment was hailed as meaningful by Saudi Energy Minister Prince Abdulaziz bin Salman, who had urged Moscow to provide greater transparency on its oil flows.

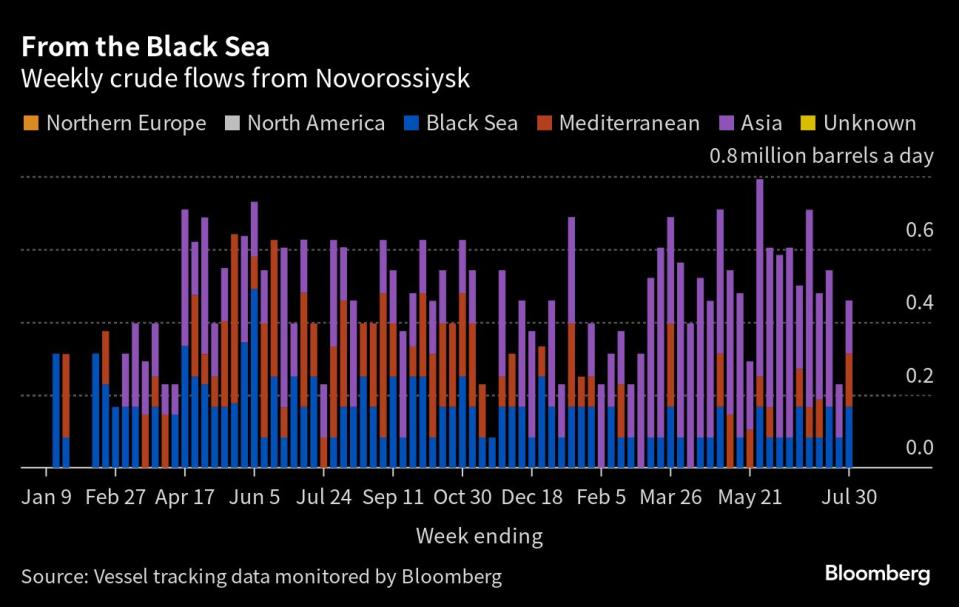

Crude Flows by Destination

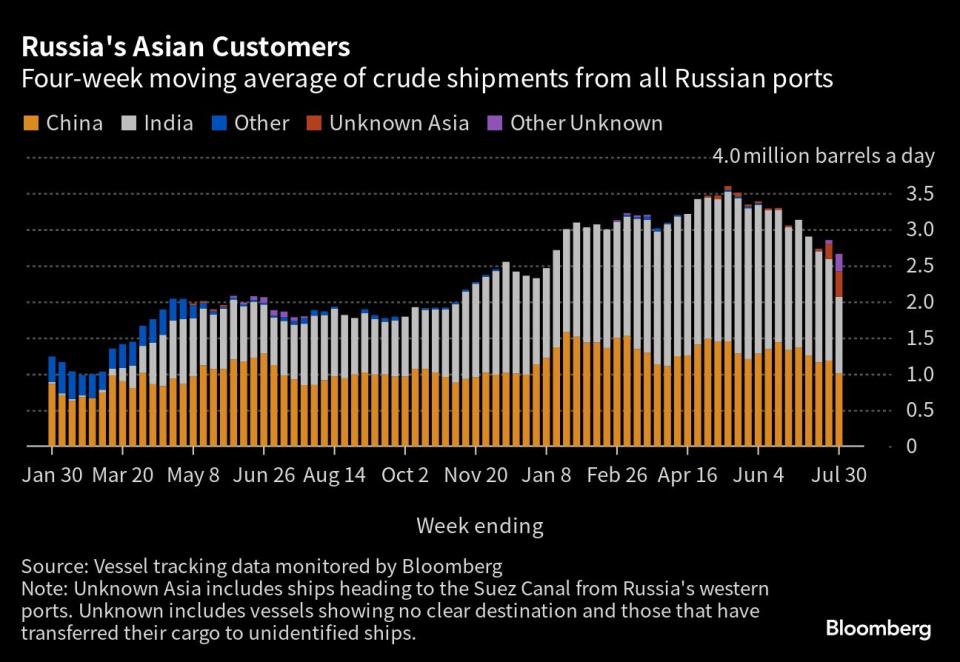

With few buyers left in Europe, the impact of the lower flows is being felt in shipments to Asia, which dropped again in the four weeks to July 30 to their lowest since early January.

On a four-week average basis, overall seaborne exports to Asian countries, plus the volumes on ships showing no final destination, have fallen by about 940,000 barrels a day since their peak in mid-May.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through the Baltic ports of Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from European Union sanctions.

Asia

Most Read from Bloomberg

Four-week average shipments to Russia’s Asian customers, plus those on vessels showing no final destination, fell to 2.66 million barrels a day in the period to July 30 from a revised 2.85 million barrels a day in the four weeks to July 23. That took flows to Asian buyers to their lowest since January on both a weekly and four-week average basis.

Most of the cargoes on ships without an initial destination eventually end up in India. Even so, the volumes heading to the country that has become the biggest buyer of Russia’s seaborne crude are down from their recent highs. Adding the “Unknown Asia” and “Other Unknown” volumes to the total for India gives a figure of 1.66 million barrels a day in the four weeks to July 30. That’s down from a high of 2.2 million barrels a day in the four weeks to May 21.

The equivalent of 352,000 barrels a day was on vessels showing destinations as either Port Said or Suez in Egypt, or which already have been or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at 243,000 barrels a day in the four weeks to July 30, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey, while other cargoes are transferred from one vessel to another, either in the Mediterranean or, more recently, in the Atlantic Ocean.

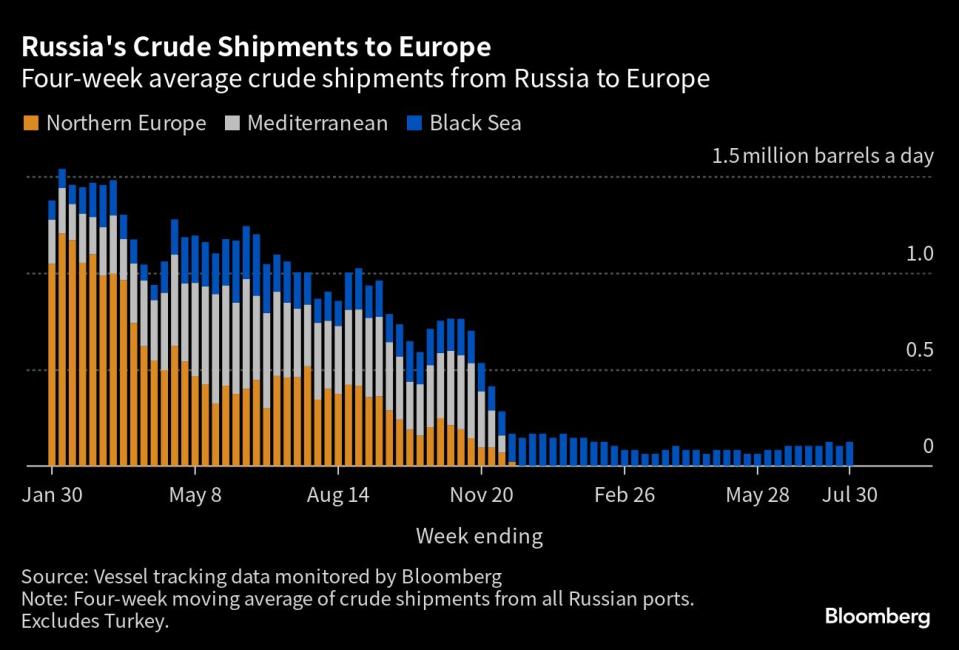

Europe

Most Read from Bloomberg

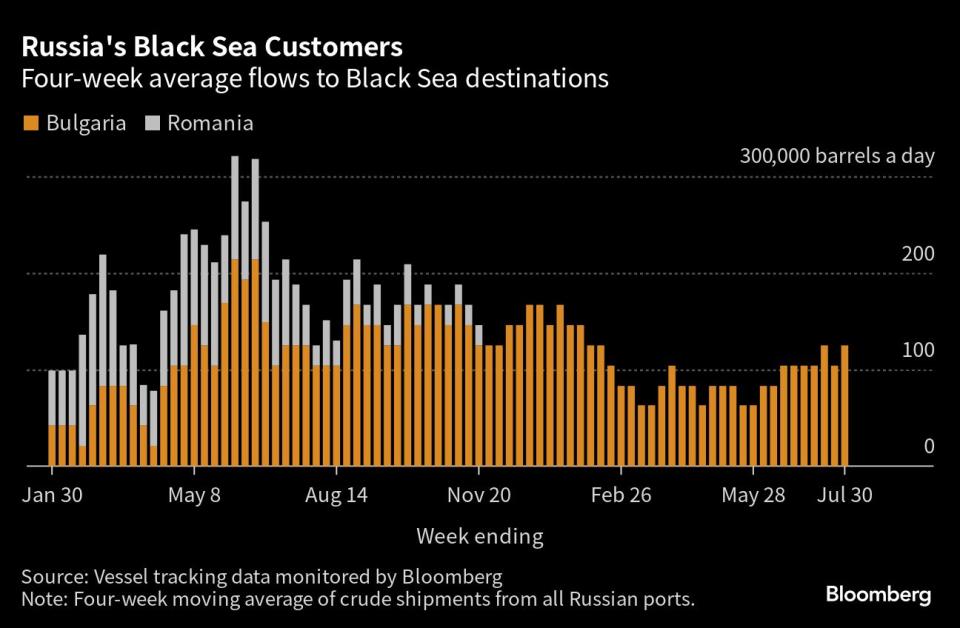

Russia’s seaborne crude exports to European countries edged up to 125,000 barrels a day in the 28 days to July 30, with Bulgaria the sole destination. These figures do not include shipments to Turkey.

A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

No Russian crude was shipped to northern European countries in the four weeks to July 30.

Exports to Turkey, Russia’s only remaining Mediterranean customer, edged higher to 167,000 barrels a day in the four weeks to July 30. Flows to the country had topped 425,000 barrels a day in October.

Flows to Bulgaria, now Russia’s only Black Sea market for crude, recovered to 125,000 barrels a day, equaling their highest since January.

Flows by Export Location

Aggregate flows of Russian crude rose to 3.28 million barrels a day in the seven days to July 30, from 2.73 million barrels a day the previous week. The jump took shipments to their highest in four weeks. The increases came from western ports, with higher flows from the Baltic, Black Sea and Arctic partly offset by a drop in flows from the Pacific.

Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler SAS and Vortexa Ltd.

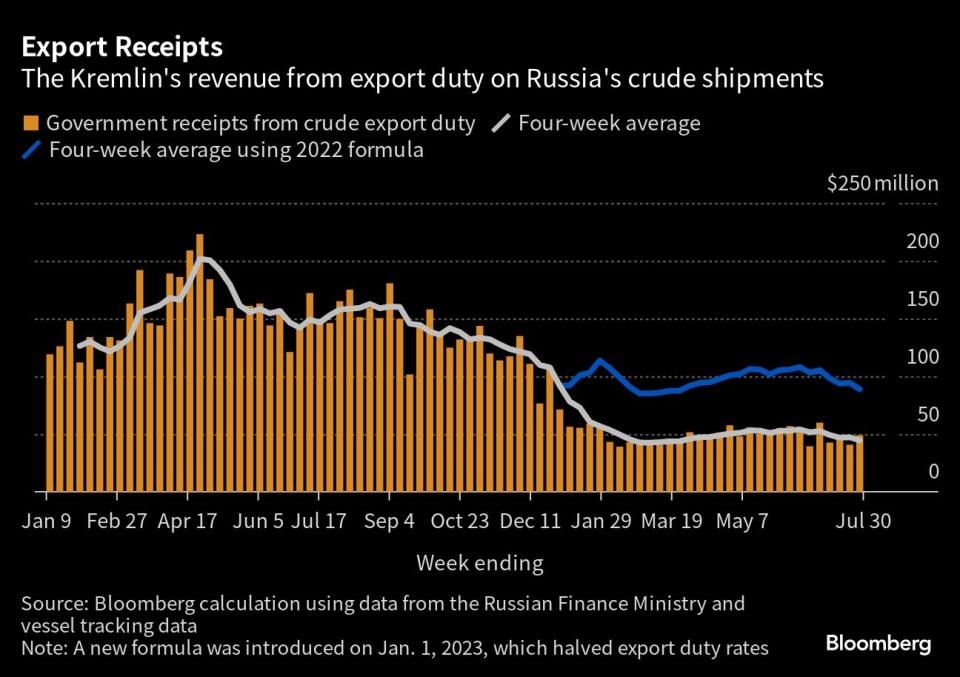

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty rose to $49 million in the seven days to July 30, an increase of $8 million or 20%. Four-week average income fell to just above $44 million, with the very high value for the week ending July 2 dropping out of the calculation.

Russia’s government calculates oil taxes, including export duty, using a discount to Brent, which sets the floor price for the nation’s crude for budget purposes. If Russian oil trades above that threshold, the Finance Ministry uses the market price for tax calculations, as has been the case in recent months. The discount is set at $25 a barrel for July and August, but President Vladimir Putin signed amendments to the tax code that will narrow it to $20 a barrel from September to calculate taxes including export duty.

The duty rate for July has been set at $2.13 a barrel, based on an average Urals price of $54.57, which was $20.89 a barrel below Brent during the period between May 15 and June 14. The levy will be increased to about $2.31 a barrel for August, based on an average Urals price of $58.03, which was $18.02 a barrel below Brent during the period between June 15 and July 14.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

A total of 31 tankers loaded 22.97 million barrels of Russian crude in the week to July 30, vessel-tracking data and port agent reports show. That’s up by 3.83 million barrels from the previous week’s figure and the most in four weeks.

Shipments from Ust-Luga rebounded, adding weight to the circumstantial evidence suggesting that work at Ust-Luga, or the pipeline serving it, may have reduced flows from the port the previous week.

Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

The total volume on ships loading Russian crude from the Baltic terminals rebounded from the previous week’s dip below 1 million barrels a day. One cargo of Kazakhstani crude was loaded at Ust-Luga during the week. Shipments from the Baltic are down by about 625,000 barrels a day from the highs seen between April and June.

Shipments of Russian crude from Novorossiysk in the Black Sea also rebounded, recovering most of the previous week’s drop. One cargo of Kazakhstani crude was also loaded at the port during the week.

Arctic shipments soared in the week to July 30, jumping to 572,000 barrels a day, equaling the highest weekly volume in data going back to the start of 2022. Three Suezmax tankers and one Aframax completed loading at Murmansk during the week ended July 30.

Volumes from Russia’s Arctic ports were boosted further by a direct shipment of about 300,000 barrels from Gazprom Neft PJSC’s Arctic Gates terminal to China via the Northern Sea Route. The shuttle tanker Shturman Koshelev, which usually carries oil from the terminal to Murmansk, turned east when it entered the Kara Sea from the Ob Gulf on Sunday. This shipment is included in the chart below.

The SCF Baltica, which loaded about 1 million barrels of crude at Murmansk last week, is also taking the northerly route to China.

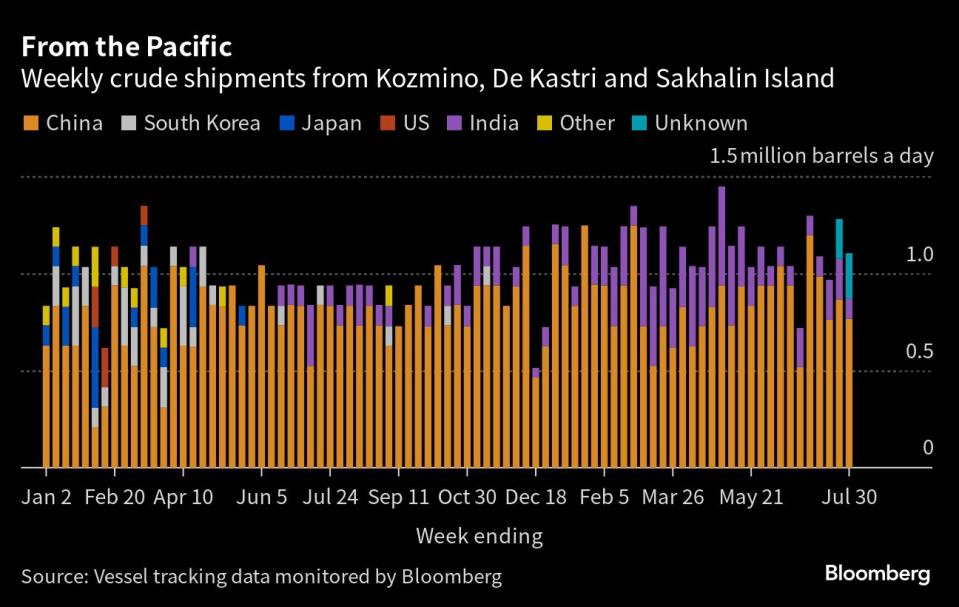

Twelve tankers loaded at Russia’s three Pacific export terminals, down from 13 the previous week. The volume of crude shipped from the region slipped to 1.1 million barrels a day.

Shipments from the Sakhalin Island terminal remained low last week due to maintenance at one of the Sakhalin 2 project’s oil production platforms. The work is due to run until September. Two vessels loaded part cargoes of Sakhalin Blend crude from the terminal.

The volumes heading to unknown destinations are mostly Sokol cargoes that recently have been transferred to other vessels at Yeosu, or are currently being shuttled to an area off the South Korean port from the loading terminal at De Kastri. Most of these are ending up in India.

Some Sokol cargoes are now being transferred a second time in the waters off southern Malaysia. A small number of ESPO shipments are also being moved from one vessel to another in the same area. All bar one of these cargoes have, so far, gone on to India. That one cargo was transferred onto a floating storage vessel off Malaysia. It was then transferred onto another tanker, which is now showing a destination in China, though the vessel remains anchored off Johor, to the east of Singapore.

Shipments of flagship Sokol crude to India have slumped since April, when they were running at more than 200,000 barrels a day. No ESPO crude went to India in June and shipments in July are running at less than 120,000 barrels a day.

NOTES

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

Note: Weeks have been revised to run from Monday to Sunday, rather than Saturday to Friday. This change has been implemented throughout the data series and previous weeks’ figures have been revised.

Note: The next update will be published on Tuesday Aug. 8, with future updates also to be published on TuesdaysIf you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

Influencers Built Up This Wellness Startup—Until They Started Getting Sick

AI in Hollywood Has Gone From Contract Sticking Point to Existential Crisis

The Stainless-Steel Boom Is Tearing a South African Mining Region Apart

Economist Behind Popular Recession Gauge Worries She Created a ‘Monster’

What China’s Real Estate Market Will Look Like in Five Years

©2023 Bloomberg L.P.