Russian Crude Flows Defy Red Sea Chaos to Exceed OPEC+ Target

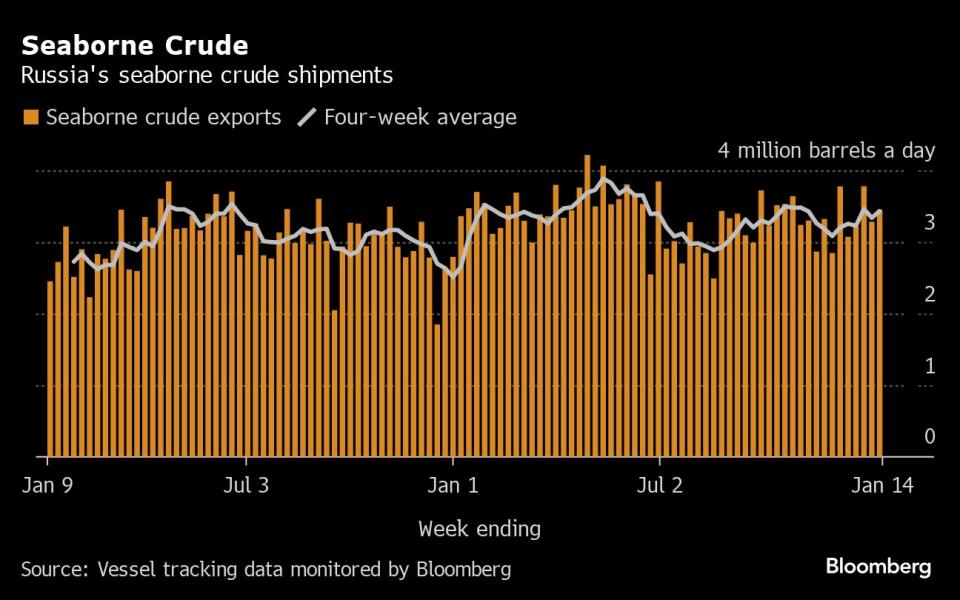

(Bloomberg) -- Russia’s seaborne crude shipments shrugged off attacks on shipping in the southern Red Sea to register gains in the latest week, as Moscow failed to match export cuts that it pledged to its OPEC+ allies.

Most Read from Bloomberg

Bonds Slide as Fed’s Waller Downplays Need to Rush: Markets Wrap

Musk Pressures Tesla’s Board for Another Massive Stock Award

What Is Disease X? How Scientists Are Preparing for the Next Pandemic

About 3.43 million barrels a day of crude were shipped from Russian ports in the four weeks to Jan. 14, tanker-tracking data monitored by Bloomberg show. That was up by 94,000 barrels a day from the period to Jan. 7.

The more volatile weekly average rose by 166,000 barrels a day to 3.45 million. While that was 134,000 barrels below the average export level seen by Bloomberg during the benchmark months of May and June, it was still less than half the cut Moscow pledged to its OPEC+ partners for the first quarter of 2024.

Russia has said it will deepen its oil export cuts to 500,000 barrels a day below the May-June average during the first quarter, after Saudi Arabia said it would prolong its unilateral one-million-barrel-a-day supply reduction and several other members of the OPEC+ group agreed to make further output curbs. The Russian cut will be shared between crude shipments, which will be reduced by 300,000 barrels a day, and refined products. The four-week average crude measure was only about 150,000 barrels a day below the May-June level.

All Russian crude destined for Asian buyers after being loaded at western ports continues to pass through the Red Sea, despite attacks on merchant vessels from Yemen-based Houthi rebels. While tankers hauling Moscow’s oil are thought unlikely to be targeted deliberately, ships carrying Russian supplies are still at risk of being hit by mistake.

Indeed, the only oil tanker reported to have been struck off Yemen was carrying Russian crude. The Sai Baba, carrying a cargo of Russian Urals, was hit by a drone off Yemen on Dec. 23, according to a post by the US Central Command on X, formerly known as Twitter. On Friday, a Houthi missile landed 400 to 500 meters away from a vessel carrying Russian oil, which was also followed by three small boats, according to the British navy. The vessel was likely the Khalissa, carrying oil from the Russian port of Ust-Luga, according to Ambrey Analytics, which provides intelligence to merchant ships.

Russia still appears to be struggling to place cargoes of its Sokol crude. Sixteen cargoes, totaling more than 11 million barrels, are sitting on tankers that appear to be going nowhere.

Six ships that were heading for the Indian ports of Paradip and Vadinar came to a halt in December before heading back through the Strait of Malacca. Three of those tankers signaled a new destination of Qingdao in China, but have stopped for a second time in the South China Sea.

Another 10 cargoes of Sokol have been loaded onto ships via ship-to-ship transfers off the South Korean port of Yeosu. They too are showing no sign of heading to their designated destinations.

The gross value of Russia’s crude exports, calculated from weekly shipments and Argus Media pricing data, rose to $1.56 billion in the seven days to Jan. 14 from $1.45 billion the previous week. Four-week average income also was also up, increasing by $58 million to a seven-week high of $1.55 billion a week.

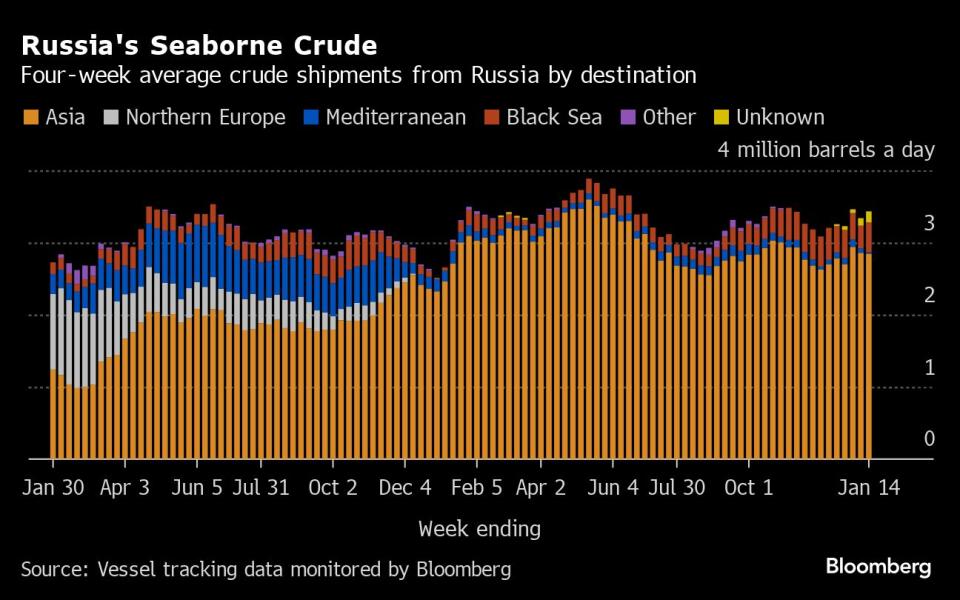

Flows by Destination

Russia’s seaborne crude flows in the four weeks to Jan. 14 rose to 3.43 million barrels a day. That was up from 3.34 million barrels a day in the period to Jan. 7. Shipments were about 150,000 barrels a day below the average seen in May and June.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and the Baltic port of Ust-Luga and are not subject to European Union sanctions or a price cap.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Asia

Most Read from Bloomberg

Observed shipments to Russia’s Asian customers, including those showing no final destination, edged higher to 3 million barrels a day in the four weeks to Jan. 14. That’s the highest in two months.

About 1.15 million barrels a day of crude was loaded onto tankers heading to China in the four weeks to Jan. 14. China’s seaborne imports are supplemented by about 800,000 barrels a day of crude delivered directly from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 980,000 barrels a day in the four weeks to Jan. 14.

Both the Chinese and Indian figures will rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 720,000 barrels a day was on vessels signaling Port Said or Suez in Egypt, or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 150,000 barrels a day in the four weeks to Jan. 14, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others could be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, off the coast of Greece.

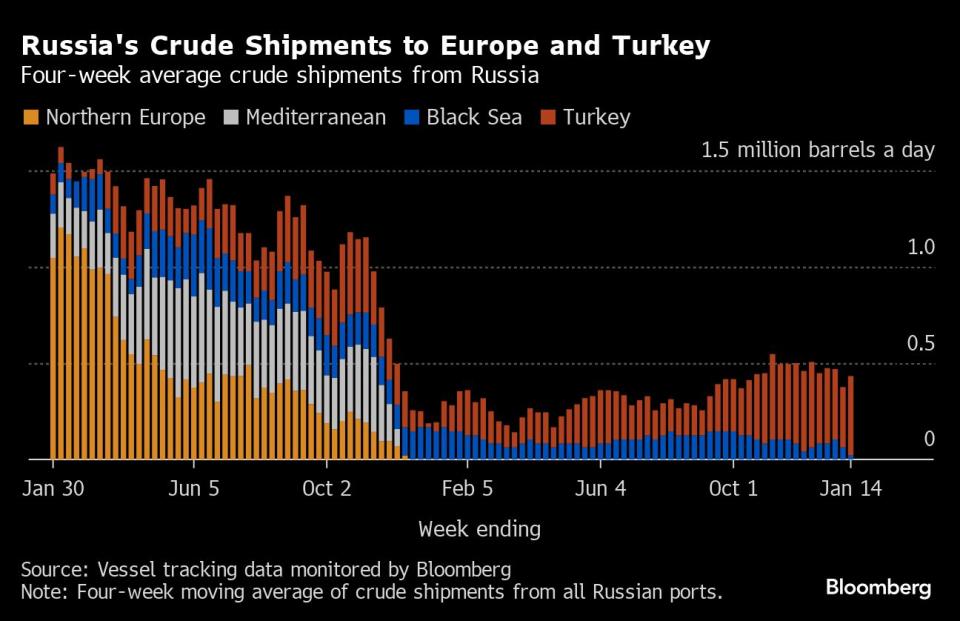

Europe and Turkey

Russia’s seaborne crude exports to European countries have collapsed since Moscow’s troops invaded Ukraine in February 2022. A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

Combined flows to Turkey and Bulgaria, Russia’s only two remaining buyers close to its western ports, recovered to about 430,000 barrels a day in the four weeks to Jan. 14, tanker-tracking data show. That’s up from about 380,000 barrels a day in the period to Jan. 7.

Exports to Turkey rose to a five-week high of about 412,000 barrels a day in the four weeks to Jan. 14.

Flows to Bulgaria, now Russia’s only European market for crude, slipped to a four-week low of about 21,000 barrels a day in the most recent four-week period. That’s the lowest in data going back to the start of 2022. Bulgaria’s parliament has approved a measure that will end imports of Russian oil from March, nine months earlier than permitted under an exemption to EU sanctions on purchases of Moscow's oil. Storms at Novorossiysk continue to hamper shipments across the Black Sea.

No Russian crude was shipped to northern European countries, or those in the Mediterranean in the four weeks to Jan. 14.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

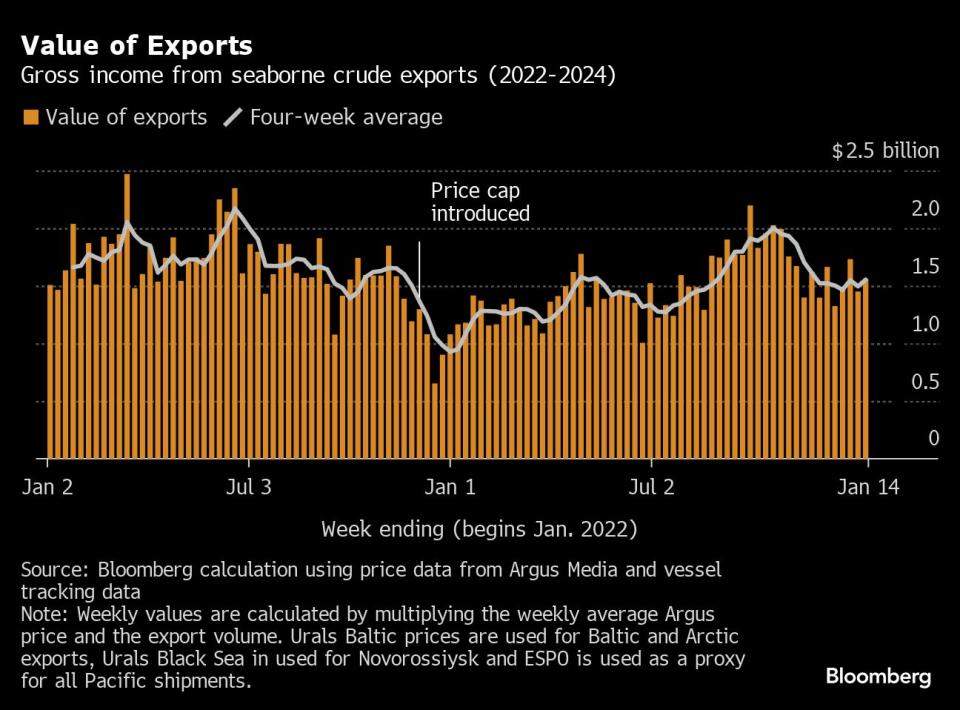

Export Value

Following the abolition of export duty on Russian crude, we have begun to track the gross value of seaborne crude exports, using Argus Media price data and our own tanker tracking.

The gross value of Russia’s crude exports rose to $1.56 billion in the seven days to Jan. 14 from $1.45 billion the previous week. Meanwhile four-week average income also increased, up by $58 million to $1.55 billion a week, the highest in seven weeks. The four-week average peaked at $2.17 billion a week in the period to June 19, 2022. The highest it reached last year was $2 billion a week in the period to Oct. 22.

During the first four weeks after the Group of Seven nations’ price cap on Russian crude exports came into effect in early December 2022, the value of seaborne flows fell to a low of $930 million a week, but soon recovered.

The chart above shows a gross value of Russia’s seaborne oil exports on a weekly and four-week average basis. The value is calculated by multiplying the average weekly crude price from Argus Media Group by the weekly export flow from each port. For shipments from the Baltic and Arctic ports we use the Urals FOB Primorsk dated, London close, midpoint price. For shipments from the Black Sea we use the Urals Med Aframax FOB Novorossiysk dated, London close, midpoint price. For Pacific shipments we use the ESPO blend FOB Kozmino prompt, Singapore close, midpoint price.

Export duty was abolished at the end of 2023 as part of Russia’s long-running tax reform plans.

Ships Leaving Russian Ports

The following table shows the number of ships leaving each export terminal.

A total of 32 tankers loaded 24.1 million barrels of Russian crude in the week to Jan. 14, vessel-tracking data and port agent reports show. That was up by about 1.2 million barrels from the previous week.

Storms in the eastern Black Sea continue to disrupt shipments from Novorssiysk.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. One cargo of KEBCO was loaded at Ust-Luga during the week.

NOTES

Note: This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the gross value of those flows. Weeks run from Monday to Sunday. The next update will be on Tuesday, Jan. 23.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

If you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

Japan’s Market Roars Back to Life—With Old-Timers Leading the Way

Patti LaBelle Moves From Stage to Stove With a Recipe for Success

©2024 Bloomberg L.P.