Russian Oil Flows Hold Fast Even as Kremlin Says Output Slashed

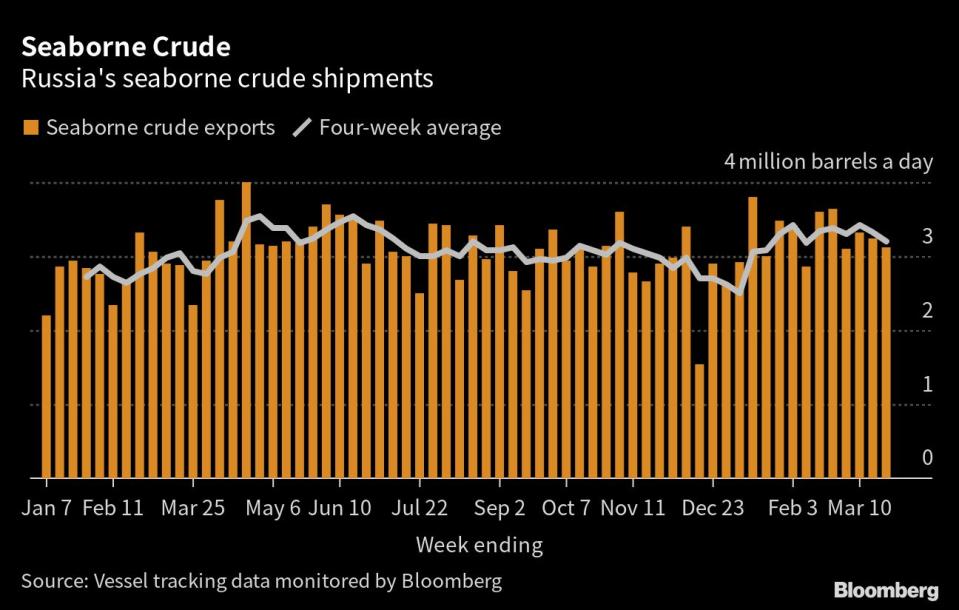

(Bloomberg) -- Russia’s seaborne crude flows are holding strong, meaning a pledge by the Kremlin to cut the nation's production sharply has yet to feed through into supplies to the international marketplace.

Most Read from Bloomberg

Schwab’s $7 Trillion Empire Built on Low Rates Is Showing Cracks

Binance and Its CEO Sued by CFTC Over US Regulatory Violations

Saudi National Bank Chair Resigns After Credit Suisse Remark

Banks in France Face More Than $1.1 Billion Fines After Raids

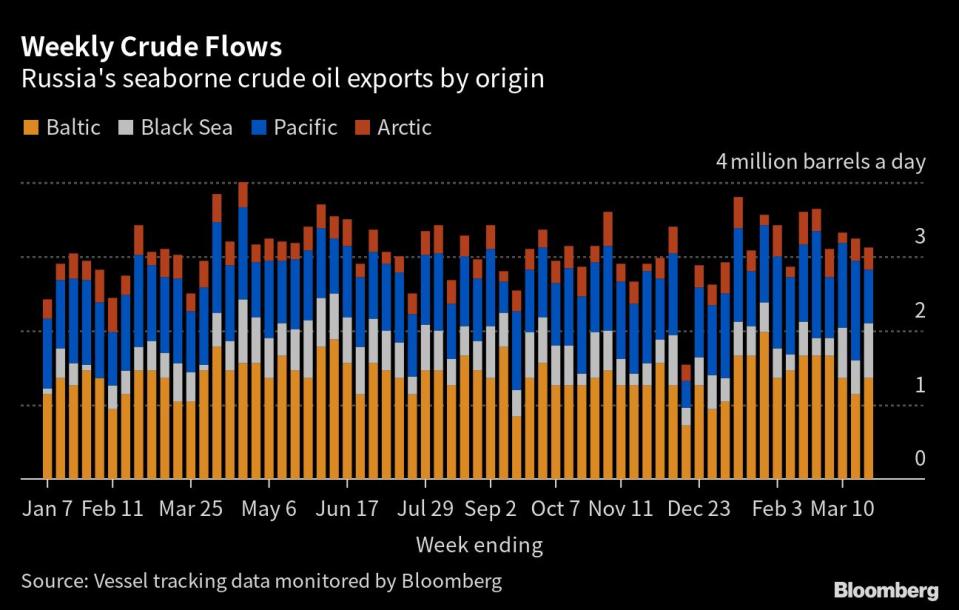

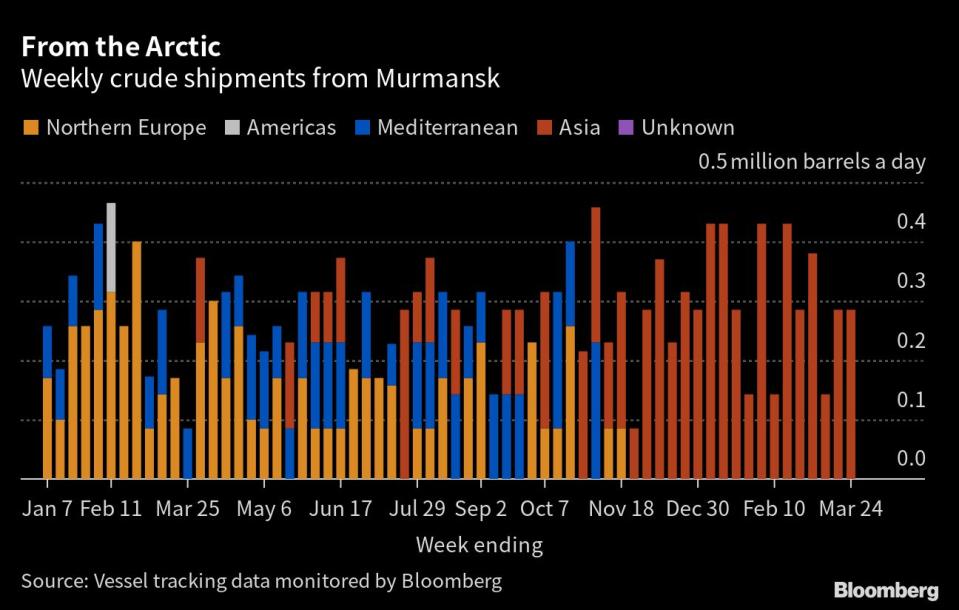

The nation’s shipments slid by 123,000 barrels a day to 3.11 million barrels a day in the seven days to March 24, according to tanker tracking by Bloomberg. The less-volatile four-week average dipped by a similar amount. It’s the sixth straight week they've held above 3 million a day.

Russia pledged to lower output by 500,000 barrels a day from this month through June in response to a Group of Seven price cap on the nation's crude sales. The planned cut has yet to show up in cargo data. Since the reduction was announced oil prices have fallen sharply, suggesting little trader anxiety about the threatened curtailment.

Any production drop will initially be offset by reduced demand from the nation’s refineries during a period of seasonal maintenance. Lost pipeline flows to Europe are also adding to the volumes available for export by sea.

The output reduction will be made from a baseline level of around 10 million barrels a day, Novak said. But the actual reduction may be smaller, with January and February output rates both assessed below that level by the International Energy Agency. With Brent crude currently trading near $75 a barrel and market forecasts showing a surplus in the first half of the year, Russia’s OPEC+ partners may welcome a unilateral output cut from the group’s second-largest producer.

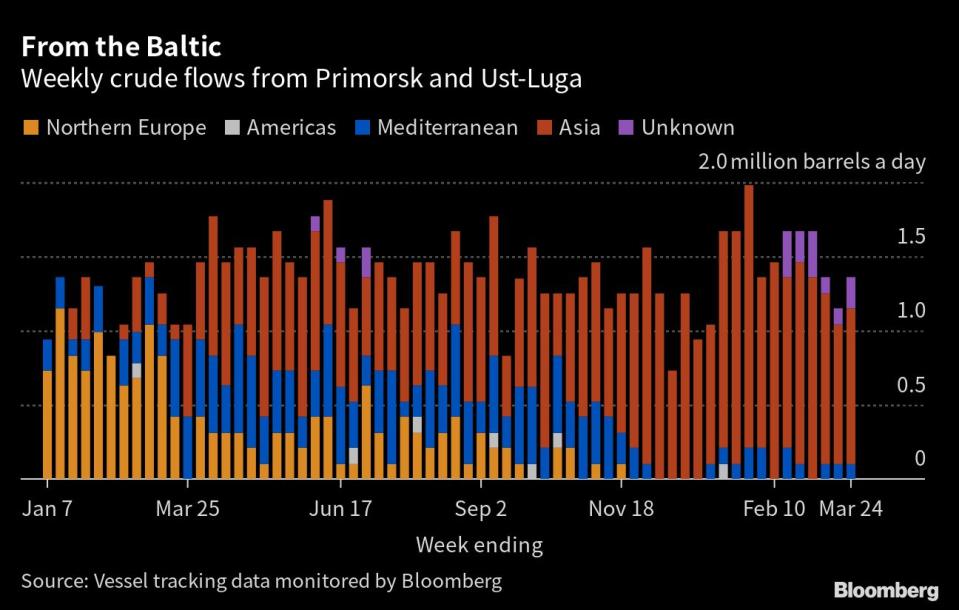

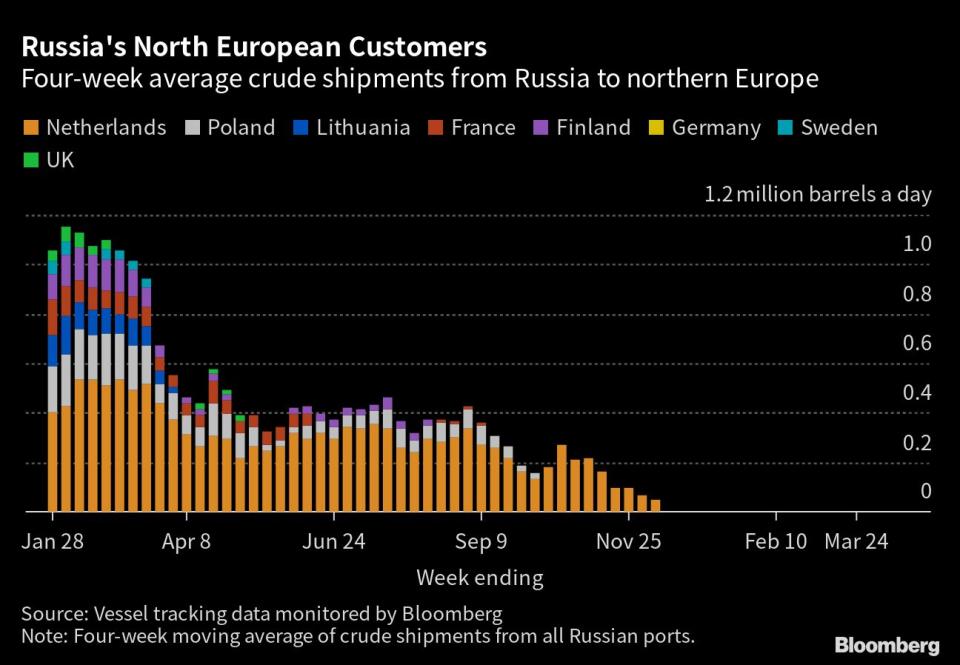

The increase in seaborne flows seen at the start of the year, which is most apparent in the four-week average data, probably reflects the diversion of crude previously delivered to Poland and Germany through the Druzhba pipeline. Flows to Germany halted at the end of 2022 and deliveries to Poland dropped to about 60,000 barrels a day under the country’s last remaining supply contract with a Russian company.The loss of those pipeline markets means an additional 500,000 barrels a day of Russian crude is now being exported through the country’s ports, despite the European Union ban on imports of almost all of Moscow’s crude and refined fuels and a G7 price cap that together prompted Moscow’s threat to cut output.

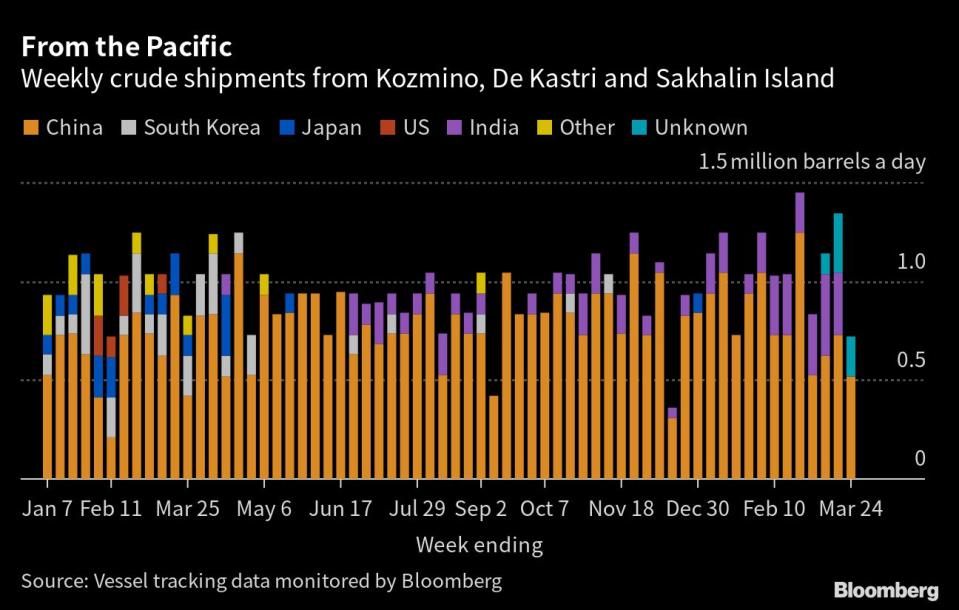

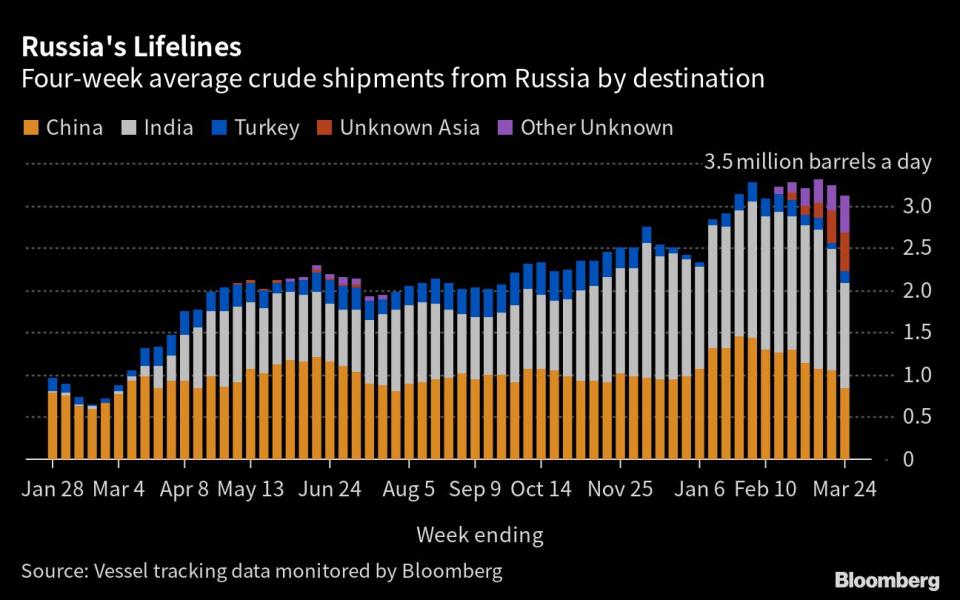

The combined volume of crude on vessels heading to China and India plus smaller flows to Turkey and quantities on ships that haven’t yet shown a final destination slipped back in the latest four-week period, to an average 3.1 million barrels a day, dropping to their lowest in six weeks.

As the ultimate destinations of cargoes loading in late January became apparent, flows to China rose to new post-invasion highs, though those levels haven’t been maintained with February-loading cargoes. Historical patterns suggest that most of the vessels currently identified as “Unknown Asia” destinations and heading for the Suez Canal will end up in India.

Ship-to-ship transfers of cargoes in the Mediterranean continue apace. This has been most visible off the Spanish north African city of Ceuta and off the Greek coast near Kalamata. At least 55 cargoes have been transferred between ships in those two locations since the start of the year. The volume transferred off the coast of Greece, mostly in the Bay of Lakonikos, soared in February, rising to more than 10 million barrels, equivalent to 360,000 barrels a day. That compares with 4.4 million barrels, equivalent to 156,000 barrels a day transferred off Ceuta.

A tanker carrying a cargo of Russian crude remains anchored off the Ghanaian port of Tema more than a month after it arrived at the west African country. The National Petroleum Authority granted a delivery period for the cargo to be unloaded, but national security considerations have held up the process, according to people familiar with the matter.

Crude Flows by Destination

Crude flows in the week to March 24 slipped by 123,000 barrels a day from the previous week. On a four-week average basis, overall seaborne exports dropped by the same amount to 3.32 million barrels a day.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through the Baltic ports of Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from European Union sanctions.

Asia

Most Read from Bloomberg

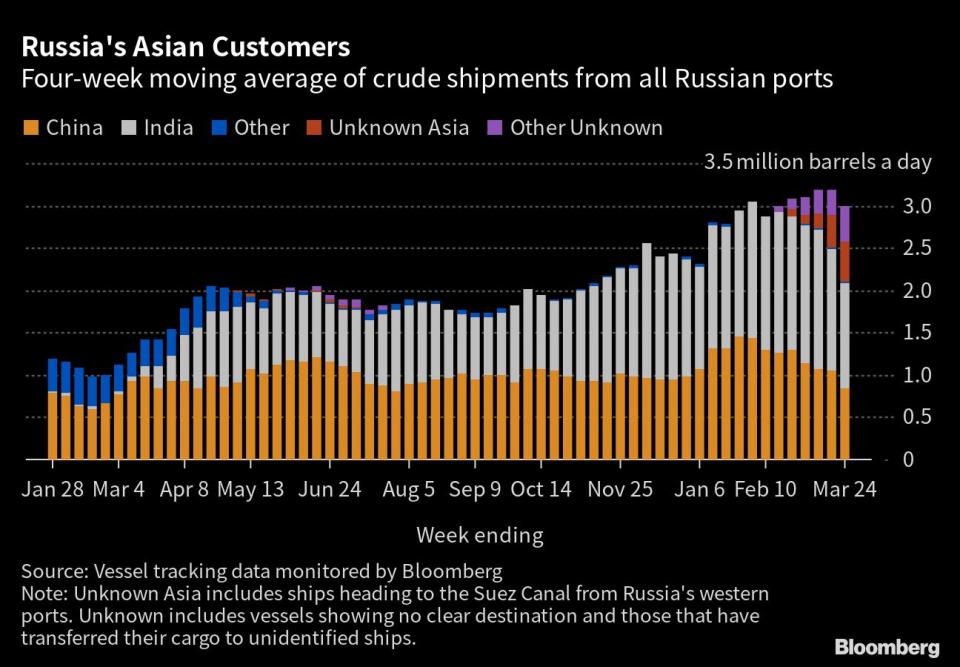

Four-week average shipments to Russia’s Asian customers, plus those on vessels showing no final destination, fell below 3 million barrels a day for the first time in five weeks. Shipments dropped to 2.99 million barrels a day in the period to March 24, compared with 3.18 million barrels a day previously.

While the volumes heading to China and India appear to have declined, history shows that most of the cargoes on ships without an initial destination eventually end up in one or other of those countries.

The equivalent of 467,000 barrels a day was on vessels showing destinations as either Port Said or Suez in Egypt, or which already have been or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at 426,000 barrels a day in the four weeks to March 24, are those on tankers showing a destination of Ceuta, Kalamata or no destination at all. Most of those cargoes go on to transit the Suez Canal, but some could end up in Turkey. An increasing number are being transferred from one vessel to another in the Mediterranean for onward journeys to Asia.

Europe

Most Read from Bloomberg

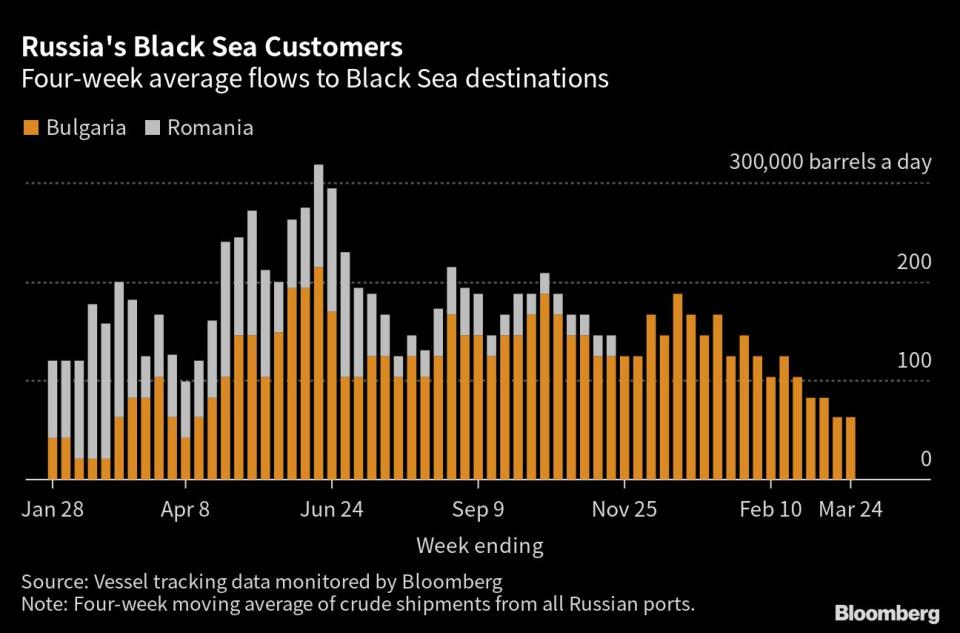

Russia’s seaborne crude exports to European countries remained at a low of 63,000 barrels a day in the 28 days to March 24, with Bulgaria the sole destination. These figures do not include shipments to Turkey.

A market that consumed more than 1.5 million barrels a day of short-haul crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

No Russian crude was shipped to northern European countries in the four weeks to March 24.

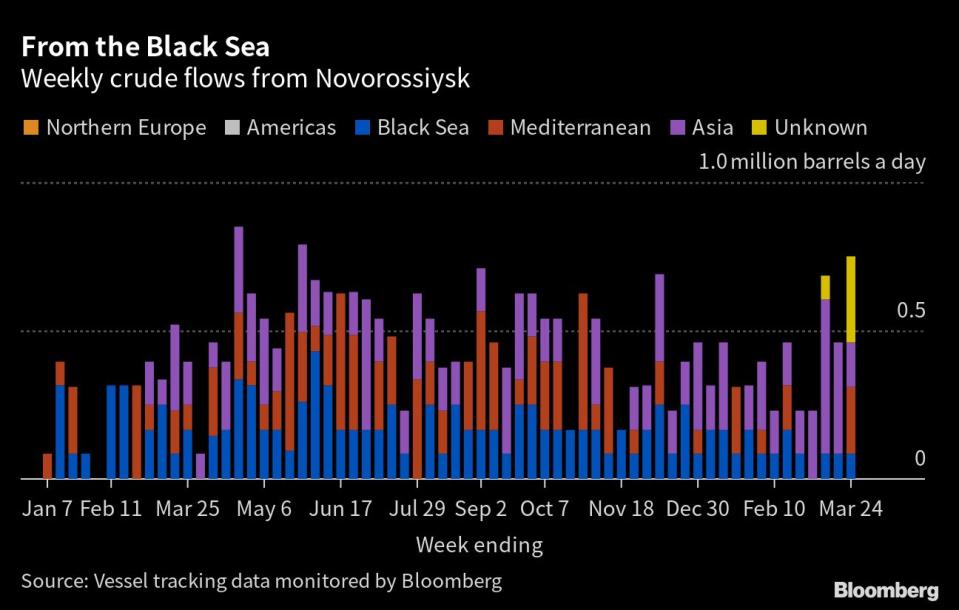

Exports to Turkey, Russia’s only remaining Mediterranean customer, recovered most of the previous week’s loss, rising to an average of 136,000 barrels a day in the four weeks to March 24. Flows there are less than one-fifth of the high they reached in September.

Despite not being a part of European sanctions on Russian crude exports, Turkey’s role as a lifeline for Moscow since the EU import ban came into effect on Dec. 5 has dwindled. The Star refinery near Aliaga, owned by Azerbaijan’s Socar, is cutting down purchases of Russian crude, with flows to the plant averaging about 50,000 barrels a day in January and February, compared with about 180,000 barrels a day from August to October. Just two cargoes of Russian crude have been delivered to the Star refinery so far in March, with two more heading to the port of Aliaga, where the refinery is located alongside another belonging to Turkey’s Turkiye Petrol Rafinerileri AS, known as Tupras. Those cargoes could go to either plant.

Flows to Bulgaria, now Russia’s only Black Sea market for crude, remained at 63,000 barrels a day for a second week. Despite Bulgaria securing a partial exemption from the EU’s import ban, the use of Russian crude has fallen to one-third of what it was in October, with Lukoil PJSC switching back to using non-Russian crude in its refinery at Burgas. Flows of Russian crude to Bulgaria remain the lowest since April.

Flows by Export Location

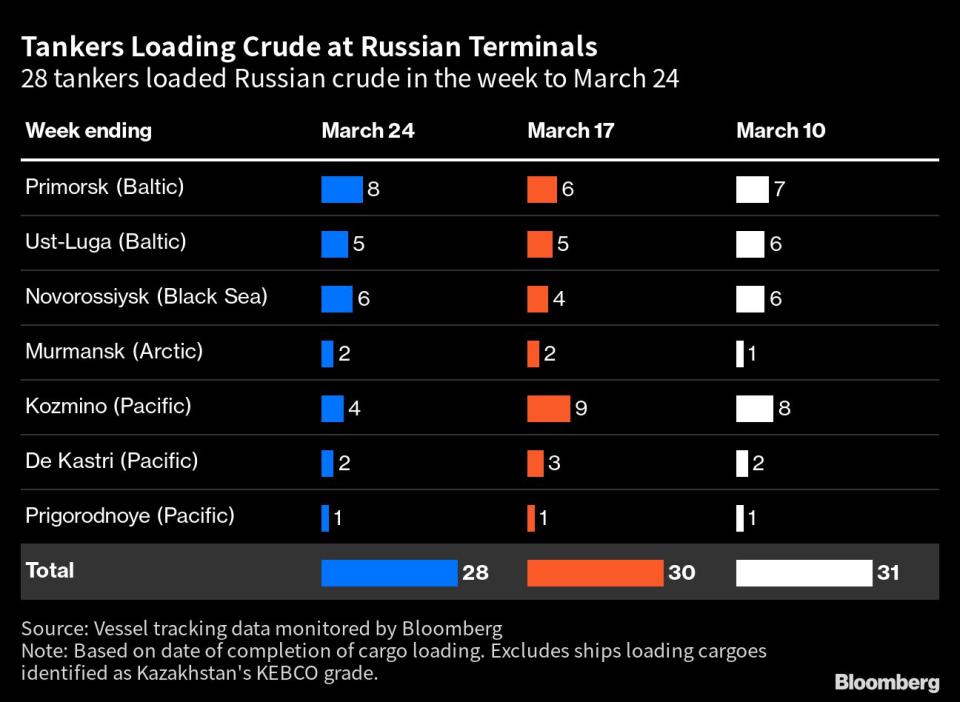

Aggregate flows of Russian crude edged lower to 3.11 million barrels a day in the week to March 24. A slump in exports from the Pacific was only partly offset by higher shipments from the other three regions.

Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

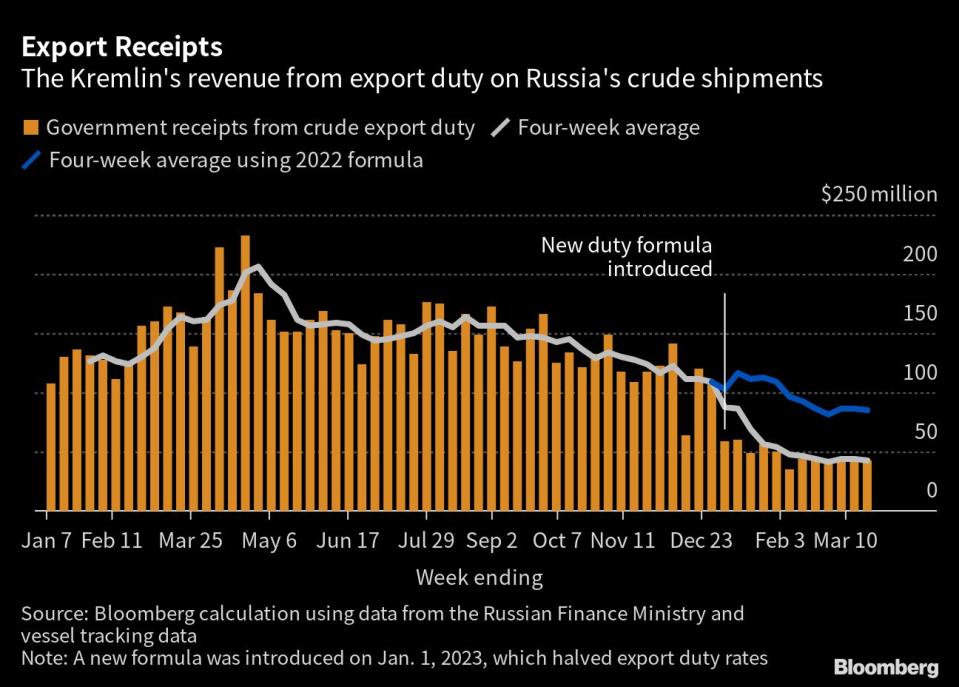

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty edged lower by $2 million to $42 million in the seven days to March 24, while four-week average income was unchanged at $43 million.

President Vladimir Putin has signed into law amendments to the way Russia’s oil price is assessed for tax purposes. From April, rates of mineral extraction tax and profit-based tax on oil companies will be calculated using a decreasing discount to prevailing Brent prices, rather than assessments of Urals crude. Export duty, which will be phased out at the end of 2023, will not be affected by the change.

The duty rate for March was set at $1.94 a barrel, the first increase since December, based on a Urals price of $50.51 a barrel during the assessment period that ran from Jan. 15 to Feb. 14. April will remain virtually unchanged, with export duty on crude set at $1.95 a barrel. That’s based on an average Urals price of $50.80 a barrel, more than $34 below the average Brent price during the assessment period of Feb. 15 to March 14.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

A total of 28 tankers loaded 21.8 million barrels of Russian crude in the week to March 24, vessel-tracking data and port agent reports show. That’s down by 850,000 barrels, or 4%, from the previous week. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

The total volume on ships loading Russian crude from Baltic terminals rebounded from the previous week’s drop to average 1.36 million barrels a day.

Shipments from Novorossiysk in the Black Sea jumped to their highest since May, with flows hitting 750,000 barrels a day. Shipping crude from the Black Sea, rather than the Baltic, can cut the journey time to India by more than a week, as long as tankers don’t suffer long delays transiting the Turkish Straits that connect the Black Sea to the Mediterranean.

Arctic shipments were unchanged, with two Suezmax tankers loading in the week to March 24.

Flows from the Pacific slumped to their lowest in more than three months. Seven tankers loaded at the region’s three export terminals in the week to March 24, down from 13 the previous week. There was an apparent gap in activity at the Kozmino export terminal between Tuesday morning and Friday afternoon, which restricted departures from the port to just four vessels.

India is continuing to take an significant volume of ESPO crude, accounting for six out of 24 cargoes loading so far this month, compared with two out of a total 30 shipments in February.

The volumes heading to unknown destinations are all Sokol cargoes that have recently been transferred to other vessels at Yeosu, or are currently being shuttled to an area off the South Korean port from the loading terminal at De Kastri. Most of these are also ending up in India.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

Note: Data on crude flows can also be found at {DSET CRUDEJ }. The numbers, which are generated by a bot, may differ from those in this story.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

China Lent Heavily to Developing Nations. Now It’s Helping Them Manage Their Debt

Sorry, Short Sellers, Hong Kong’s Dollar Is Stronger Than It Looks

Smart Ways to Repay Your Pandemic Small Business Disaster Loan

A Polluting Coal Miner Cuts Emissions by Using Methane for Power

©2023 Bloomberg L.P.