Russia's Crude Flows Surge as Black Sea Port Rebounds From Storm

(Bloomberg) -- Russia’s seaborne crude exports climbed on a four-week average basis, driven by a big jump in weekly flows after storms that disrupted Black Sea shipments finally abated. Loadings soared at the port of Novorossiysk, with a full week of uninterrupted activity.

Most Read from Bloomberg

JPMorgan Is in a Fight Over Its Client’s Lost $50 Million Fortune

Goldman Trader Paid $100 Million Since 2020 Is Stepping Down

Argentina’s Milei Devalues Peso by 54% in First Batch of Shock Measures

Netflix Posts Viewer Data on Every Show, Film for First Time

Raimondo Vows ‘Strongest Possible’ Action on Huawei’s Chip Breakthrough

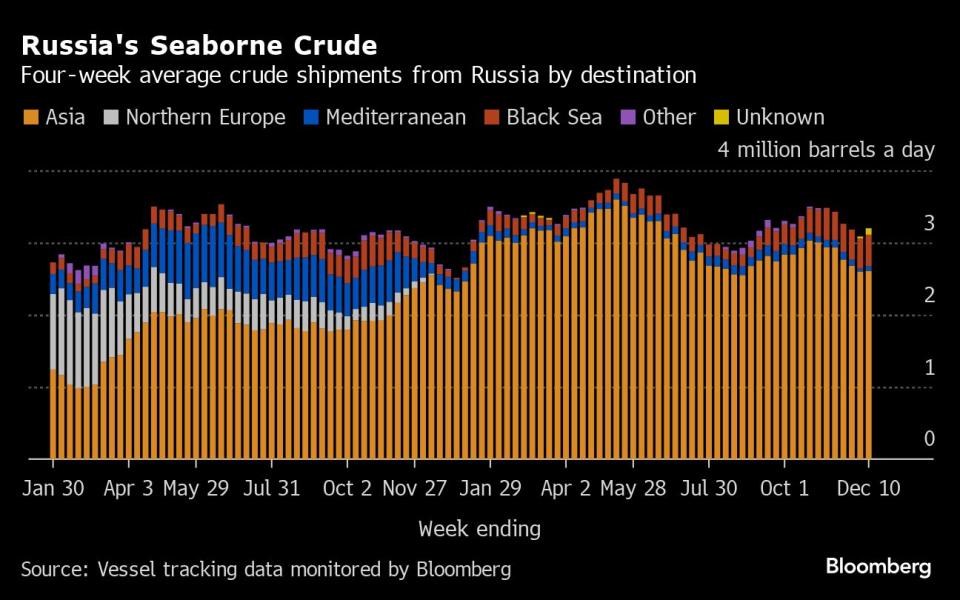

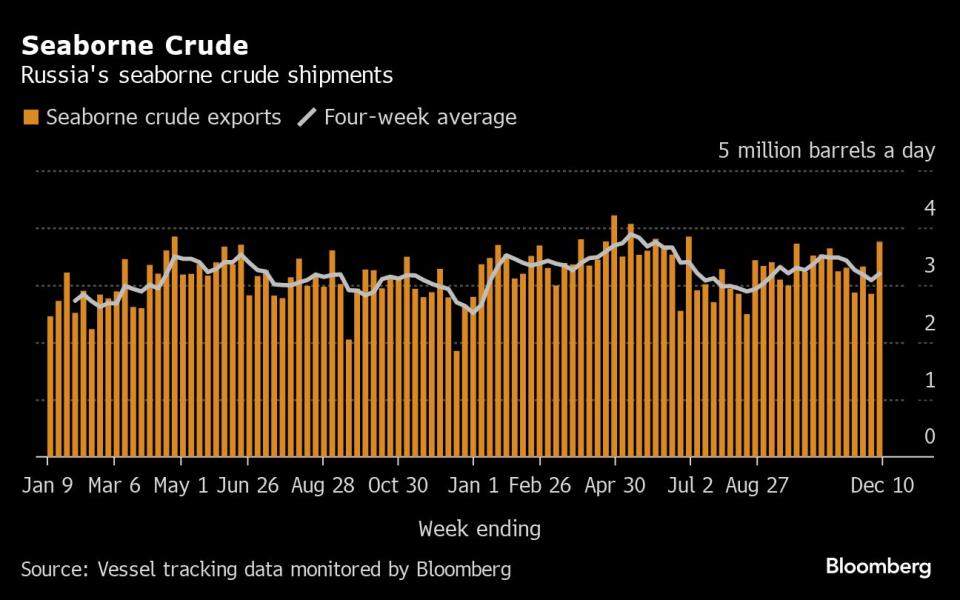

About 3.2 million barrels a day of crude were shipped from Russian ports in the four weeks to Dec. 10, tanker-tracking data monitored by Bloomberg show. That was up by 114,000 barrels a day from the revised figure for the period to Dec. 3. The more volatile weekly average leaped to the highest since early July.

While still depressed by the very low flows seen from the Black Sea during the recent storms, four-week average crude shipments were about 385,000 barrels a day below their May-June level — the baseline used by Moscow for the export reduction it has pledged to its partners in the OPEC+ group.

Russia will deepen its oil export cuts to 500,000 barrels a day below the May-June average during the first quarter of next year, after Saudi Arabia said it would prolong its unilateral one-million-barrel-a-day supply reduction and several other members of the group agreed to make further output cuts.

The Russian cut will be shared between crude shipments, which will be reduced by 300,000 barrels a day, and refined products, according to Deputy Prime Minister Alexander Novak. For the rest of 2023, the reduction is set at 300,000 barrels a day, spread across both crude and refined products in undefined proportions. That complicates assessments of whether Russia is meeting its commitment to its OPEC+ partners.

The figure for weekly flows rose sharply. Using this measure, shipments soared to 3.76 million barrels a day, up by about 910,000 barrels a day from the revised figure for the period to Dec. 3. Weekly shipments were the highest in more than five months.

Russia’s oil processing fell to a seven-week low in the first days of December as logistical constraints weighed on refineries. The recent storms in the Black Sea, a key route for fuel exports, hampered shipments from the plants, forcing them to cut runs.

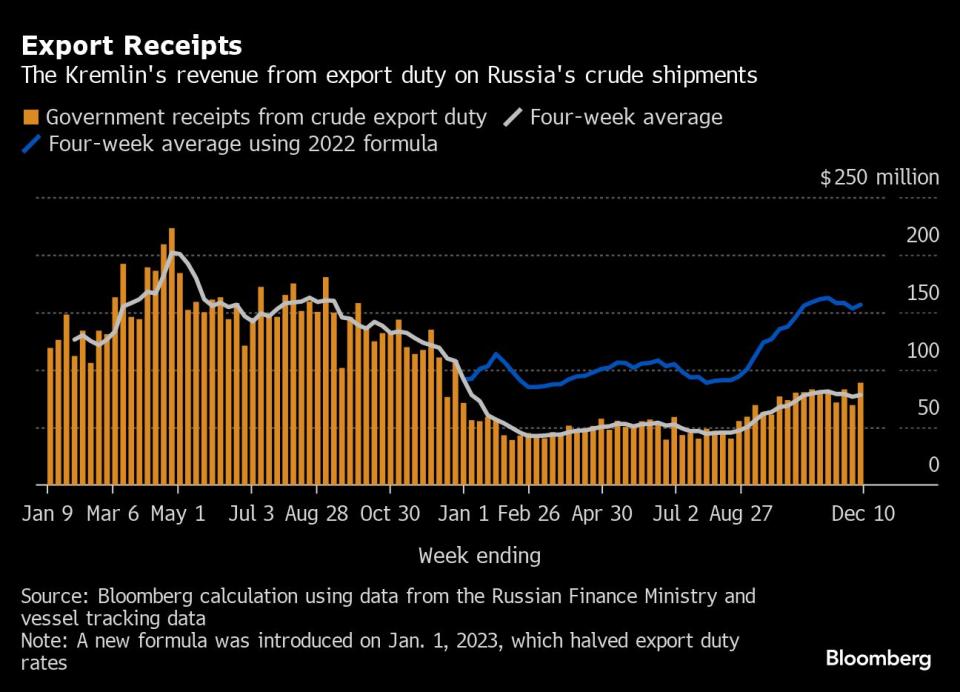

The Kremlin’s weekly revenues from oil export duties jumped to the highest level for the year, driven by the surge in shipments. From January, Russia’s oil producers are set to pay a higher output tax to fund increased downstream subsidies, which were reinstated in October after being halved the previous month.

Flows by Destination

Russia’s seaborne crude flows in the four weeks to Dec. 10 rose to 3.2 million barrels a day. That was up from a revised 3.08 million barrels a day in the period to Dec. 3. Shipments were about 385,000 barrels a day below the average seen in volumes in May and June.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and the Baltic port of Ust-Luga and are not subject to European Union sanctions or a price cap.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Asia

Most Read from Bloomberg

JPMorgan Is in a Fight Over Its Client’s Lost $50 Million Fortune

Goldman Trader Paid $100 Million Since 2020 Is Stepping Down

Argentina’s Milei Devalues Peso by 54% in First Batch of Shock Measures

Netflix Posts Viewer Data on Every Show, Film for First Time

Raimondo Vows ‘Strongest Possible’ Action on Huawei’s Chip Breakthrough

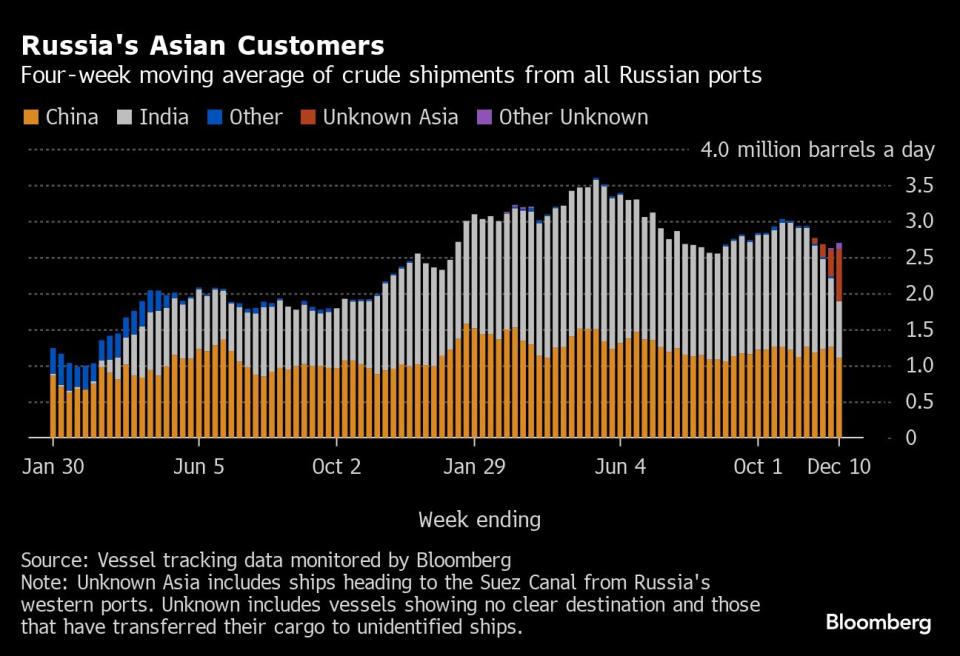

Observed shipments to Russia’s Asian customers, including those showing no final destination, rose to 2.7 million barrels a day in the four weeks to Dec. 10, up from a revised 2.63 million barrels a day in the period to Dec. 3.

About 1.11 million barrels a day of crude was loaded onto tankers heading to China in the four weeks to Dec. 10. China’s seaborne imports are supplemented by about 800,000 barrels a day of crude delivered directly from Russia by pipeline, either directly, or via Kazakhstan.

Flows on ships signaling destinations in India averaged about 780,000 barrels a day in the four weeks to Dec. 10.

Both the Chinese and Indian figures will rise as the discharge ports become clear for vessels that are not currently showing final destinations.

The equivalent of about 720,000 barrels a day was on vessels signaling Port Said or Suez in Egypt, or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 90,000 barrels a day in the four weeks to Dec. 10, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others could be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, off the coast of Greece.

Europe and Turkey

Most Read from Bloomberg

JPMorgan Is in a Fight Over Its Client’s Lost $50 Million Fortune

Goldman Trader Paid $100 Million Since 2020 Is Stepping Down

Argentina’s Milei Devalues Peso by 54% in First Batch of Shock Measures

Netflix Posts Viewer Data on Every Show, Film for First Time

Raimondo Vows ‘Strongest Possible’ Action on Huawei’s Chip Breakthrough

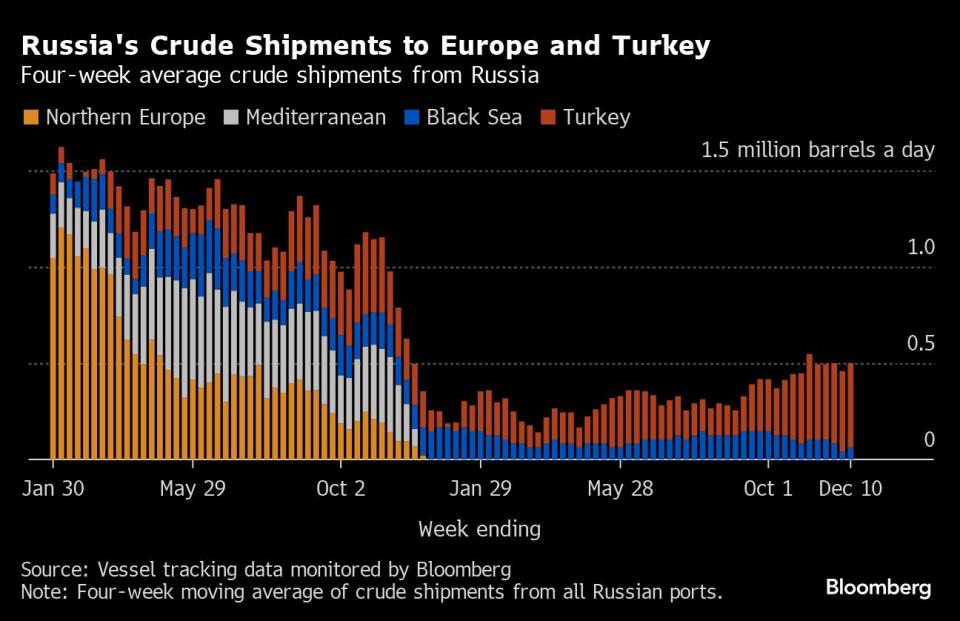

Russia’s seaborne crude exports to European countries have collapsed since Moscow’s troops invaded Ukraine in February 2022. A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

Combined flows to Turkey and Bulgaria, Russia’s only two remaining buyers close to its western ports, have stabilized at about 500,000 barrels a day, tanker tracking data show.

Exports to Turkey were also up, rising to about 440,000 barrels a day in the four weeks to Dec. 10. They are now more than three times as high as the lows they hit in July and August.

Flows to Bulgaria, now Russia’s only European market for crude, rose to about 63,000 barrels a day in the most recent four-week period. Flows are recovering from the disruption at Novorossiysk, though the halt to shipments from the port continues to affect the average.

No Russian crude was shipped to northern European countries, or those in the Mediterranean in the four weeks to Dec. 10.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty rebounded to $89 million in the seven days to Dec. 10. That’s the highest weekly figure for this year. Meanwhile four-week average income also rose, increasing by $2 million to $78 million.

The rate for December is $3.37 a barrel, based on an average Urals price of $79.23 during the calculation period between Oct. 15 and Nov. 14. That was about $9.39 a barrel below Brent over the same period.

Export duty is set to be abolished at the end of this year as part of Russia’s long-running tax reform plans.

Origin-to-Location Flows

The following table shows the number of ships leaving each export terminal.

A total of 34 tankers loaded 26.3 million barrels of Russian crude in the week to Dec. 10, vessel-tracking data and port agent reports show. That’s up by about 6.4 million barrels from the revised figure for the previous week.

There were six shipments from Novorossiysk, with storms that had hampered activity at the port finally abating to allow a full week of uninterrupted operations at the port.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Two cargoes of KEBCO were loaded at Novorossiysk during the week.

NOTES

Note: This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government. Weeks run from Monday to Sunday. The next update will be on Tuesday, Dec. 19.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

If you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

SBF’s Lawyer Says His Client Was the ‘Worst’ Ever Under Cross Examination

Rate-Cut Pivot Can’t Come Soon Enough for Debt-Strapped Companies

How the Biggest Boutique Fitness Company Turned Suburban Moms Into Bankrupt Franchisees

Hottest Job in US Pays $80,000 a Year, No College Degree Needed

©2023 Bloomberg L.P.