Russia's Oil Exports Collapsed Since G-7 Sanctions Began

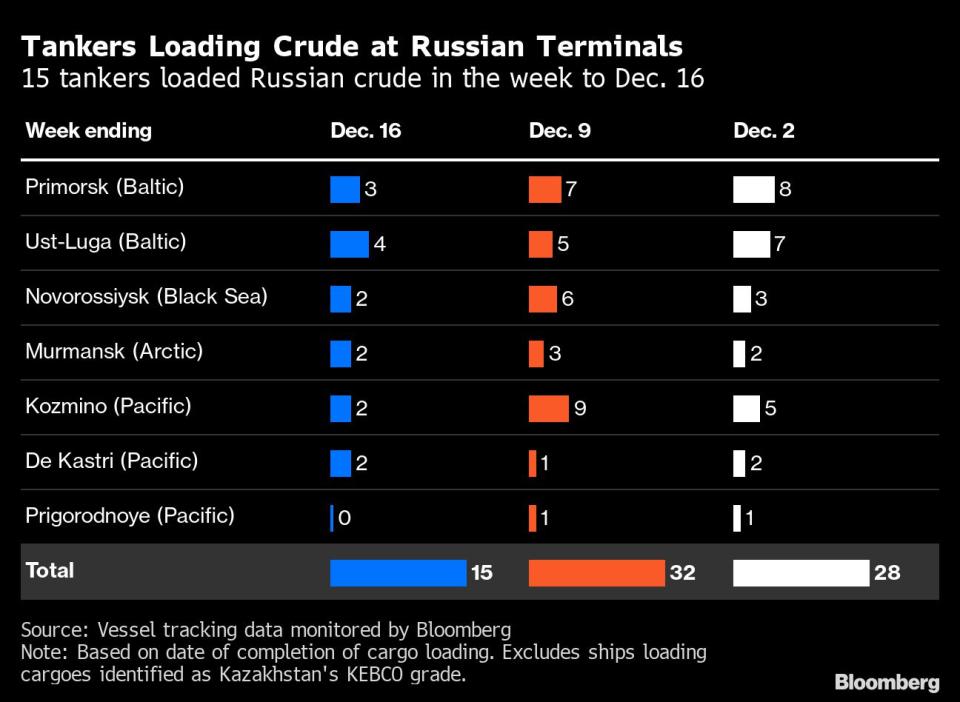

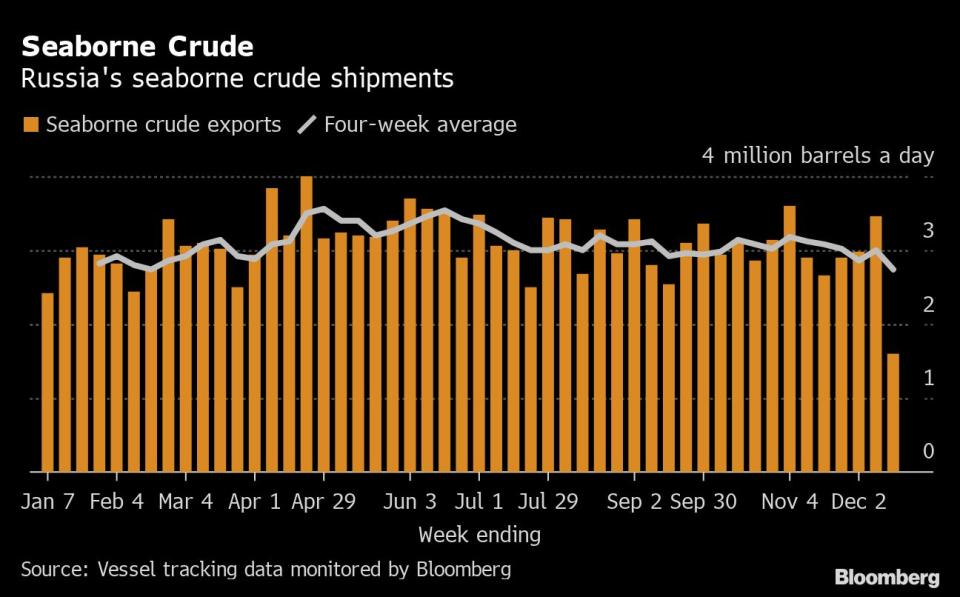

(Bloomberg) -- Russia’s seaborne crude shipments collapsed in the first full week of Group of Seven sanctions targeting Moscow’s petroleum revenues, a potential source of alarm for governments around the world seeking to avoid disruption to the nation’s giant export program.Some of the plunge was exaggerated by work at a port in the Baltic that’s now finished, but there also appeared to be a shortage of ship owners willing to carry key cargoes from an export facility in Asia. Several other ports also showed week-on-week declines. The data must be treated carefully, because weekly flows are at the mercy of the timing of cargo scheduling, the weather, and even the quality of signals that the vessels themselves transmit.

Most Read from Bloomberg

Messi Evacuated by Helicopter After Crowds Swarm World Cup Winners

Private Jet Costs, Sketchy Deductions Among Red Flags in Trump Taxes

European Union sanctions that began on Dec. 5 are designed to curb Russia’s revenue from oil. On one hand, the bloc stopped buying but it also barred the provision of key services to enable the oil to be moved. The US, alarmed at the severity of the measures, pushed for the measures to be softened with the implementation of a price cap, keeping those things — especially insurance — available for buyers elsewhere in the world when traders paid $60 a barrel or less for Russian oil.

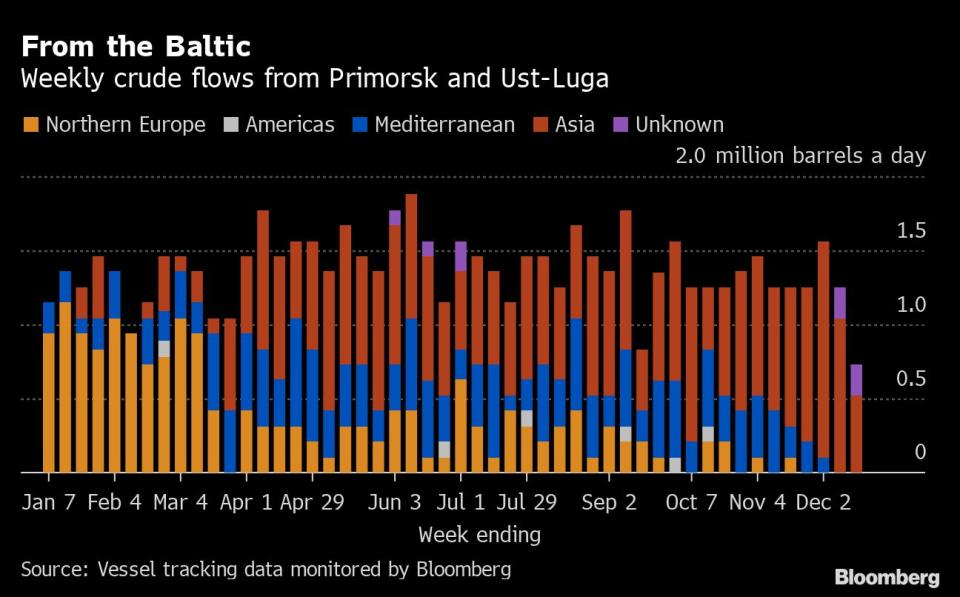

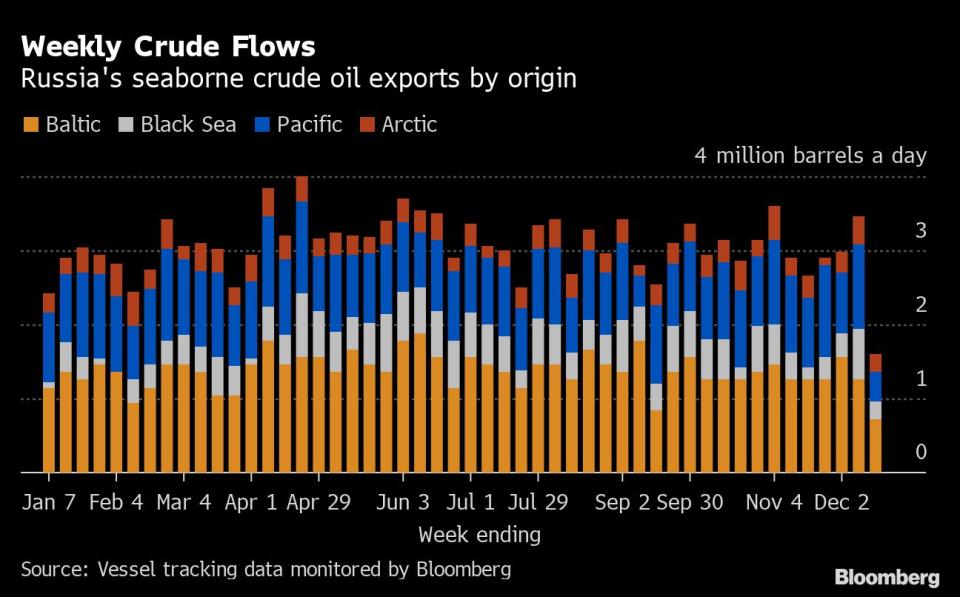

But in the first full week after the EU ban on seaborne Russian crude imports came into effect, total volumes shipped from the nation dropped by 1.86 million barrels a day, or 54%, to 1.6 million. A less volatile four-week average also plunged, setting a new low for the year. Baltic Sea volumes should recover with work now ended, but the issues in the East may take longer to solve.

Maintenance at the key port of Primorsk cut shipments there to just three cargoes in the week to Dec. 16, down from a more normal weekly loading rate of about eight.

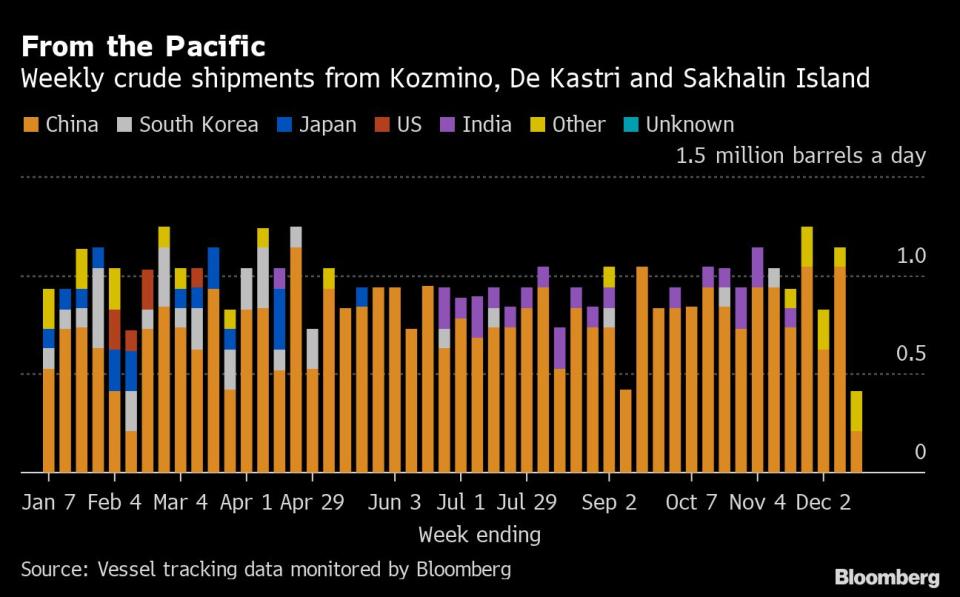

In the Pacific, though, flows of ESPO crude — named after a pipeline bringing the oil from Siberia — from the port of Kozmino appear to have plunged, with just two tankers loading in the week to Dec. 16. That’s down from an average of eight a week over the past three months. At least two major tanker owners have withdrawn their ships from the route, with ESPO crude selling at prices above the $60 a barrel cap set by the G7. Carrying cargoes that were bought above the cap would deprive the vessels of internationally-recognized insurance. The flow from Kozmino will recover, at least partially, in the week to Dec. 23, with three ships already loaded and two more berthed half way through the period. But, with a smaller fleet of ships available, volumes could remain erratic.The EU’s ban on imports of Russian crude by sea that came into force on Dec. 5 closed off Moscow’s closest oil market, which took roughly half the country’s supplies at the start of the year. With the exception of a small volume delivered to Bulgaria, seaborne flows of Russian crude to the bloc halted in full, as planned.

READ: What We’ve Learned Three Days Into the Russian Oil Price Cap

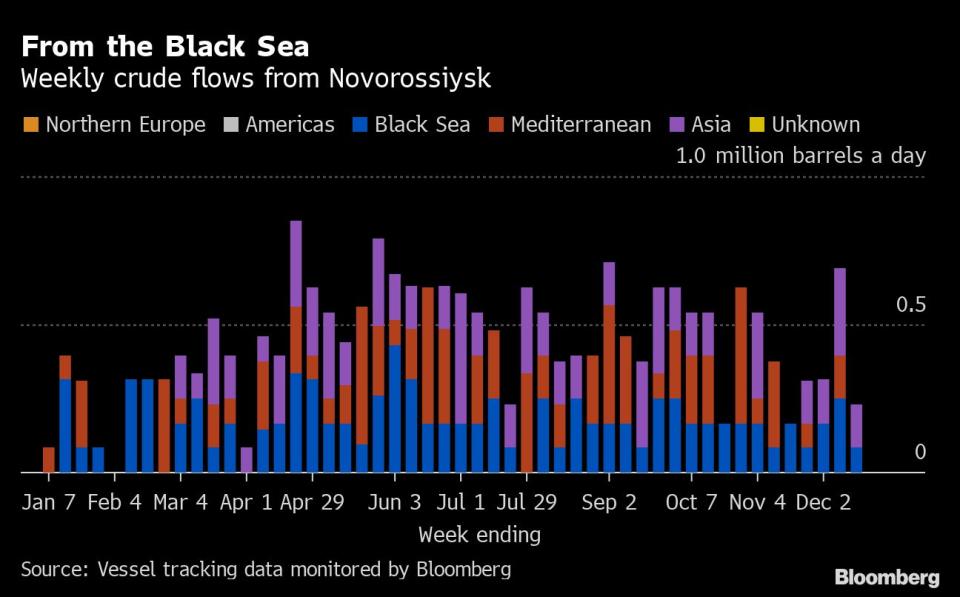

The ban, along with the associated price cap, created difficulties for shippers seeking to move crude from the Black Sea to the Mediterranean, with Turkey demanding specific confirmation of insurance before allowing ships to transit the Bosphorus and Dardanelles.

Insurers were initially reluctant to provide the letters requested by Ankara, leading to long delays for ships seeking to enter the Turkish Straits, which also caught up tankers carrying Kazakhstan’s crude, including CPC Blend, which is explicitly exempt from sanctions. The backlog of ships began to clear after a standoff between insurers and the Turkish authorities appeared to be resolved.

There have also been complications between how Russian oil trades in the real world and the practicalities of the price cap, making some traders wary. The distances involved in transporting oil to Asia from Russia’s western ports drove up freight costs, forcing prices of the nation’s flagship Urals grade to slump below the cap.

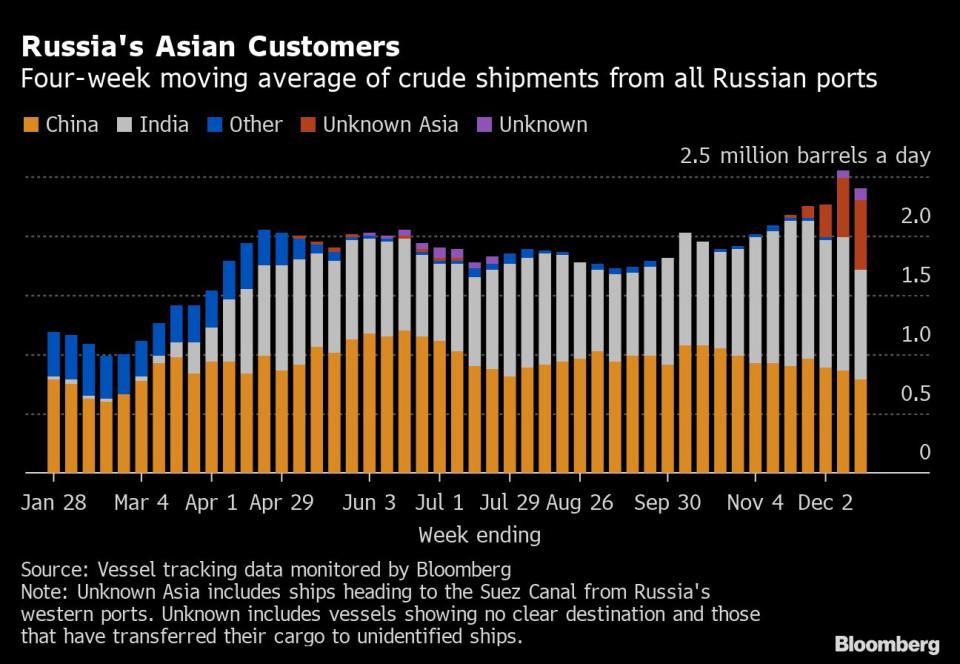

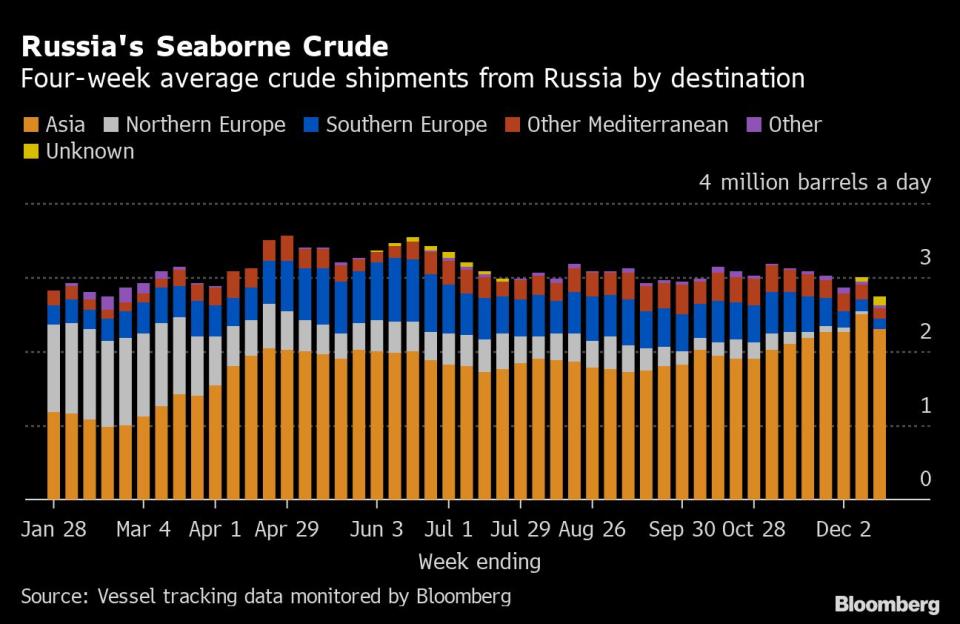

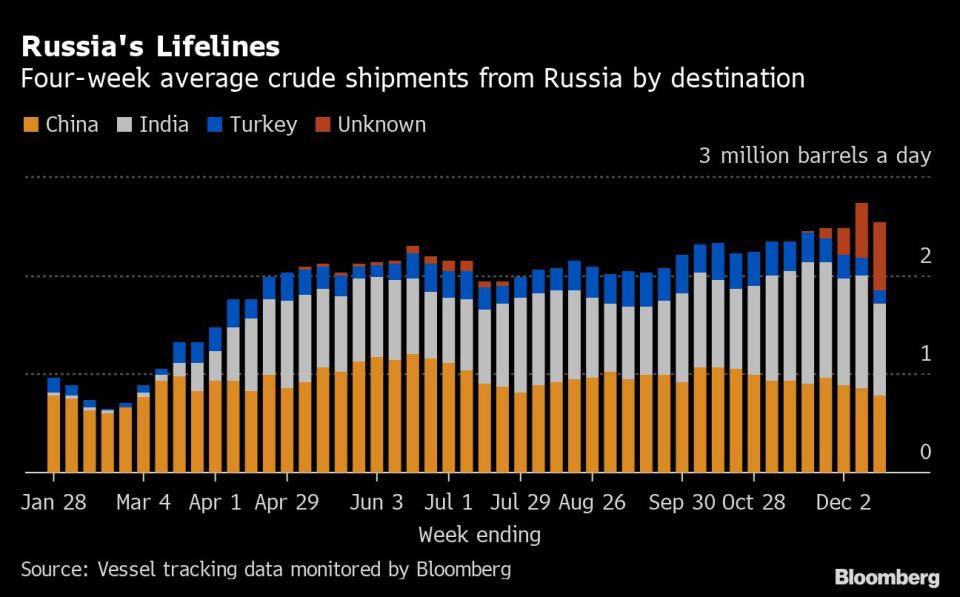

The volume of crude on vessels heading to China, India and Turkey, the three countries that have emerged as the only significant buyers of displaced Russian supplies, plus the quantities on ships that are yet to show a final destination, fell in the four weeks to Dec. 16 to average 2.53 million barrels a day. While that’s more than four times as high as the volume shipped in the four weeks immediately prior to Russia’s invasion of Ukraine in late February, it is the first time in five weeks that the amount has fallen. Inflows to the Kremlin's war chest also slumped.

Tankers hauling Russian crude are becoming more cagey about their final destinations. The volume of crude on vessels leaving the Baltic and showing their next destination as Egypt’s Port Said or the Suez Canal jumped to 686,000 barrels a day on a four-week average basis. It remains likely that many will begin to signal Indian ports once they pass through the waterway, while shipments to the United Arab Emirates are becoming more common.

Crude Flows by Destination:

On a four-week average basis, overall seaborne exports fell by 266,000 barrels a day. Shipments to Europe have dried up almost completely, while those to Asia also slipped.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. These are shipments made by KazTransoil JSC that transit Russia for export through Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since the invasion of Ukraine by Russia, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from the EU sanctions.

Europe

Most Read from Bloomberg

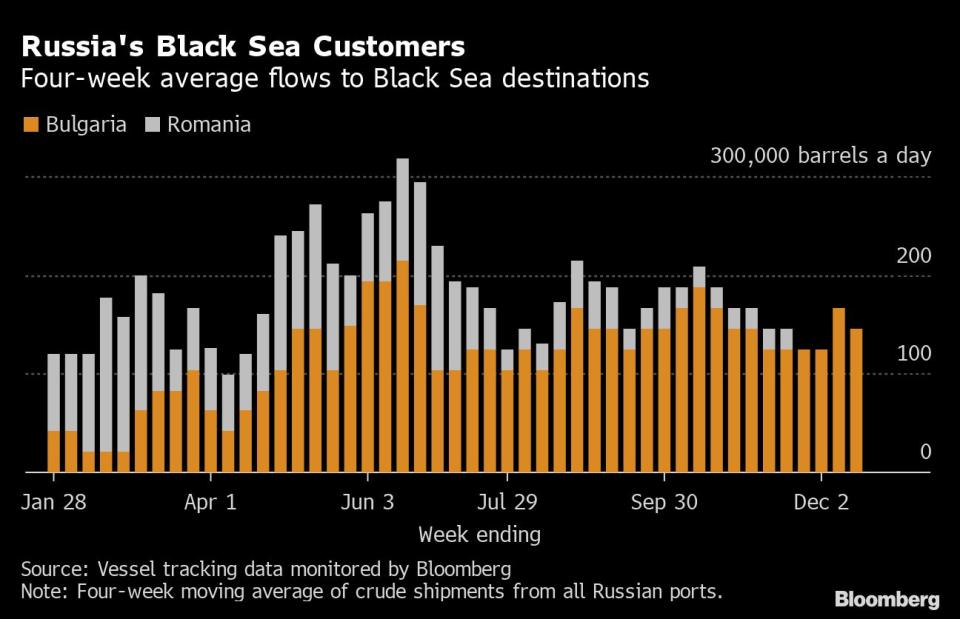

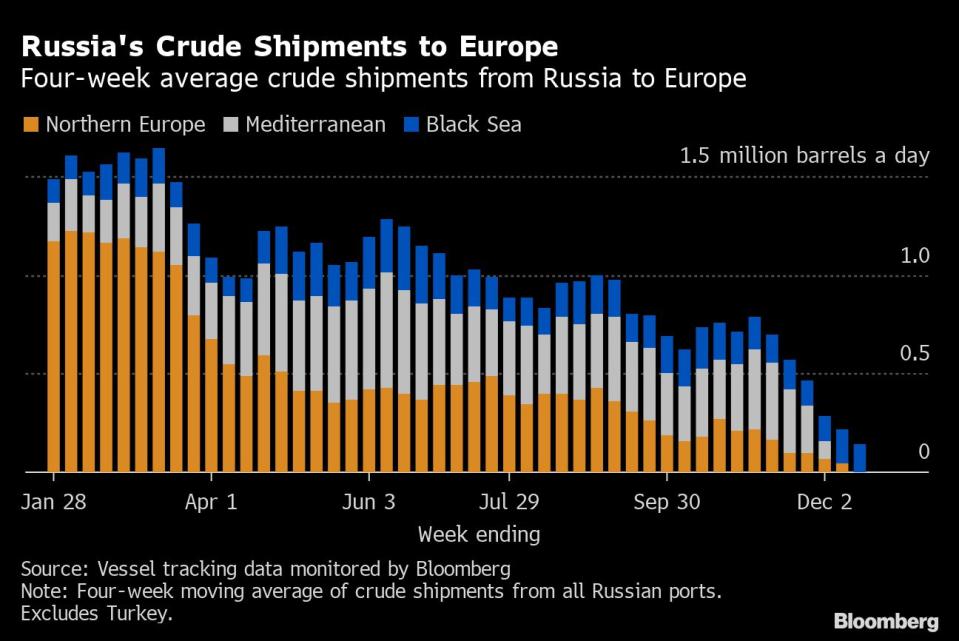

Russia’s seaborne crude exports to European countries fell to 146,000 barrels a day in the 28 days to Dec. 16, with Bulgaria the sole European destination. These figures do not include shipments to Turkey.

A market that consumed more than 1.5 million barrels a day of short-haul crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

No Russian crude was shipped to northern European countries in the four weeks to Dec. 16.

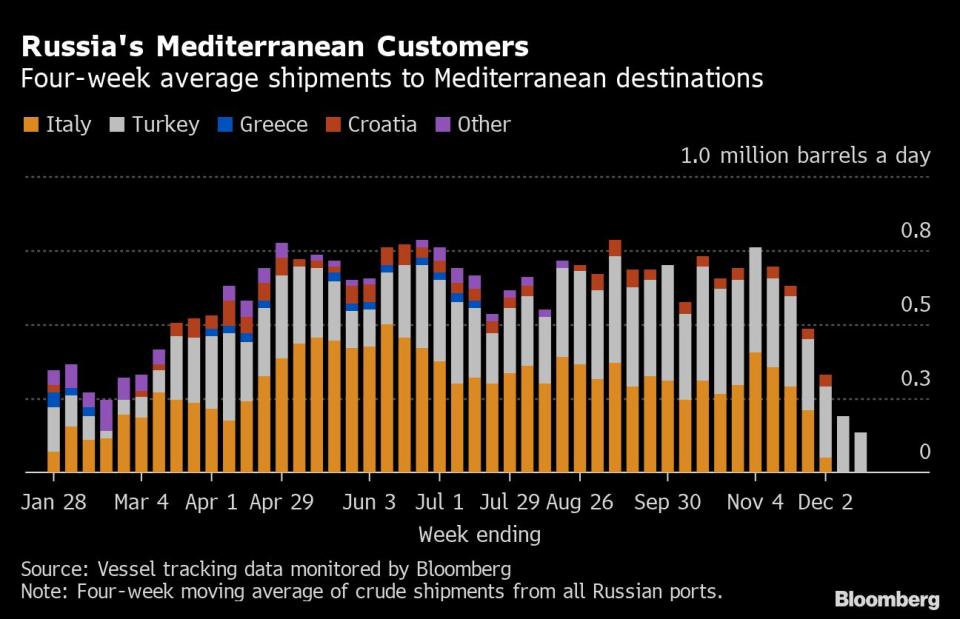

Exports to Mediterranean countries continued to fall, slipping to 136,000 barrels a day on average in the four weeks to Dec. 16 and setting another low for the year so far. Flows to the region fell for a sixth week.

Turkey was the only destination for Russian seaborne crude into the Mediterranean, but flows there also fell, dropping to the lowest since June on a four-week average basis. Shipments to the country in the four weeks to Dec. 16 were half the levels seen at the start of November; however, the country is expected to continue to be an important destination for Russian crude going forward.

Flows to Bulgaria, now Russia’s only Black Sea market for crude, slipped back from a seven-week high to 146,000 barrels a day. Bulgaria secured a partial exemption from the EU ban, which should support inflows now that the embargo has come into force.

Asia

Most Read from Bloomberg

Four-week average shipments to Russia’s Asian customers, plus those on vessels showing no final destination, which typically end up in either India or China, fell back from the previous week’s high, but remained close to 2.3 million barrels a day.

The equivalent of more than 580,000 barrels a day was on vessels showing destinations as either Port Said or Suez, or which have already been or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India and show up in the chart below as “Unknown Asia.”

The “Unknown” volumes, running at 104,000 barrels a day in the four weeks to Dec. 16, are those on tankers showing a destination of Gibraltar, Malta or no destination at all. Most of those cargoes go on to transit the Suez Canal, but some could end up in Turkey.

Cargoes heading for Asia that were bought at a price above $60 a barrel at the point of loading will have to be delivered before Jan. 19, if they are to retain their International Club insurance. Alternative insurance arrangements will need to be made for any cargoes that are discharged after that date.

Flows by Export Location

Aggregate flows of Russian crude dropped sharply, falling by 1.86 million barrels a day, or 54%, in the seven days to Dec. 16 to their lowest for the year. Shipments were lower from ports in all four regions, the Baltic, Black Sea, Arctic and the Pacific. Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty slumped by $77 million, or 54%, to $66 million in the seven days to Dec. 16, while the four-week average income fell by $11 million to $112 million. Export duty revenues were the lowest for the year by either measure.

The December duty rate is $5.91 a barrel, according to figures released by the Russian Ministry of Finance, based on an average Urals price of $71.1 a barrel, according to figures from the Russian Ministry of Finance. The duty rate for January will fall by 61% to $2.28 a barrel, its lowest since June 2020, when oil prices were hit by the Covid-19 crisis.

However, the drop is due in part to a change in the formula used to calculate duty rates for 2023, with the country moving away from taxing exports and shifting the burden to production as part of its multi-year tax maneuver. The plan sees export duty phased out entirely by the start of 2024.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

Just 15 tankers loaded 11.2 million barrels of Russian crude in the week to Dec. 16, vessel-tracking data and port agent reports show. That’s down by 13 million barrels, or 54%, from the previous week. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

The total volume on ships loading Russian crude from Baltic terminals fell by 42%, to its lowest for any week this year.

Flows from Primorsk slumped, with just three tankers taking on cargoes. A gap in the port’s loading program, which matches similar ones in previous years, suggests maintenance at the export terminal may be responsible for the drop.

Shipments from Novorossiysk in the Black Sea slumped to a 4-week low after the previous week’s surge. Just two tankers loaded Russian crude cargoes at the port in the week to Dec. 16.

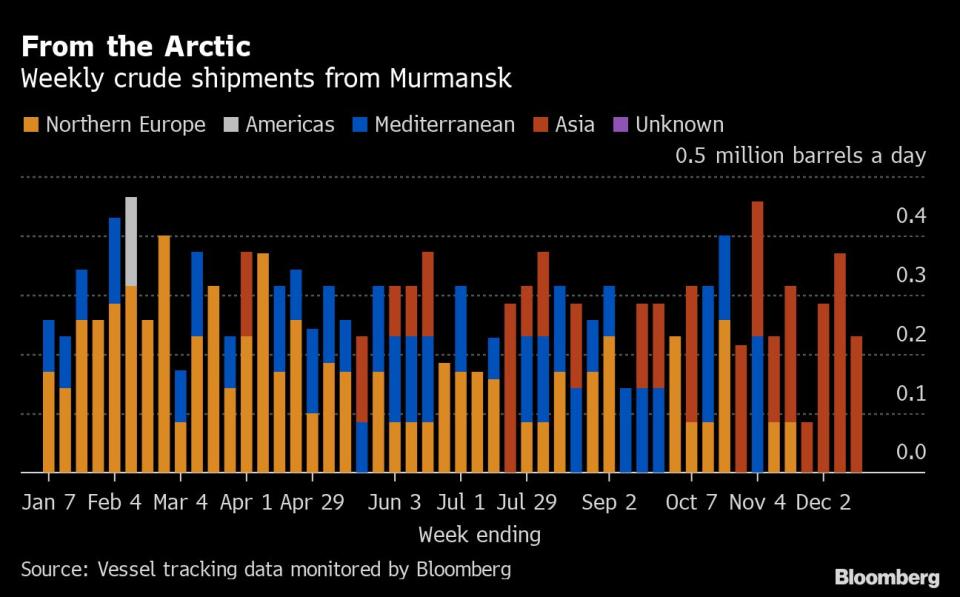

Arctic shipments slipped back from a five-week high in the seven days to Dec. 16 with two vessels leaving from Murmansk during the week. Both ships are heading to Asia via the Suez Canal.

Shipments from the Pacific slumped to equal their lowest level for the year. Shippers appear to be struggling to find vessels willing to carry cargoes that are selling at prices above the $60-a-barrel cap imposed by the G7 countries. Just four tankers loaded at Russia’s Pacific terminals, with only two loading ESPO crude at Kozmino, down from a more normal level of eight or nine ships a week leaving the port.

All of the cargoes heading for unknown destinations ((TK)) are on ships going to Yeosu in South Korea, where it’s likely that they will conduct ship-to-ship transfers outside the port, as previous tankers have done, or on vessels that have already taken cargoes in this way.

All cargoes of Sokol crude loaded since shipments restarted in October have been moved in this way. Initially, the receiving vessel carried them onward to ports in India and China. More recently, they have remained anchored off the port, or moved south to Johor in Malaysia to sit at anchor there. The area is a popular transshipment area for crude cargoes.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government. The next version of this story will be published on Tuesday Jan. 3

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

Note: Data on crude flows can also be found at {DSET CRUDE }. The numbers, which are generated by a bot, may differ from those in this story.

Note: Aggregate weekly seaborne flows from Russian ports in the Baltic, Black Sea, Arctic and Pacific can be found on the Bloomberg terminal by typing {ALLX CUR1 }.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

Apple Investors’ Loyalty Is Rewarded With a $454 Billion Gift

China’s Hasty Reopening Is a Risky Bet That Beijing Can Control the Narrative

Child Care Faces $24 Billion Fiscal Cliff as Pandemic Aid Ends

How a Cocaine-Smuggling Cartel Infiltrated the World’s Biggest Shipping Company

How to Make Cars Safer for Women? Use Crash-Test Dummies That Resemble Them

©2022 Bloomberg L.P.