Sales tax information provided as election draws near

By this time, Pontiac residents should have all the information available to them regarding the proposed 1 percent sales tax referendum on Tuesday's Primary Election ballot. But if they have questions, the series of town hall meetings the city provided are now over.

The last of the seven gatherings took place Thursday afternoon at the Eagle Theater. On hand from the city to explain the referendum and answer questions were City Administrator Jim Woolford and alderpersons Kelly Eckhoff and Don Hicks.

Where there were approximately 20 residents who collectively attended the previous six meetings, there were none at the final one. That didn't prevent the city government officials from explaining one last time what the sales tax is, why it is and how the money generated from it will be used.

It was the same information that has been made public before, including where the money is expected to be generated from and what the city plans to do with it to better the community.

The primary reason for the sales tax is to raise money to fix the streets. Woolford explained that the money the city has available annually at this time is simply not enough to get the job done.

He said that a primary question asked by property owners is why is this needed since they pay property taxes each year. Woolford broke down where that property tax money goes, per state requirements. Of the taxes collected, 65 percent goes to school districts. In Pontiac, that means PTHS Dist. 90, PGS Dist. 429 and Heartland Community College.

He pointed out that, based on a property value of $150,000, about $770 dollars reaches the city's General Fund account for operations. Of that, 90 percent of the General Fund goes to pension funds (police and fire as required by the state), liability insurance and the library. The insurance and library money is quite minor, Woolford noted.

The other 10 percent is discretionary money, which covers administration, cemetery, public works, fire, police, recreation and ambulance services.

There is another revenue that comes in that is directed to streets. That's the motor fuel tax. Woolford said that if there was no gasoline sold in Pontiac, the city would still receive $470,000 from the state. If Pontiac sold all the gasoline in the state, it would still receive $470,000 from the state.

The Federal Aid Urban money received is $190,000, which gives the city $660,000 a year to do street repair.

The cost of street repair ranges from $50,000 to $150,000 (depending on what work is being done) per block.

This means that the city will not have the money to fix the streets in any kind of a timely manner without having to get them repaired again. As an example, South Division Street, from Lincoln to Torrance, could be repaired, but it will need repaired again before the rest of the city streets can be repaired and a vicious cycle has been created.

Hence, the need for the sales tax to generate enough money to get the street work done more quickly and more efficiently.

“As most communities in Illinois, that money we get that can be used for streets isn't enough, which is why Pontiac, like many other communities, is struggling to repair streets,” Woolford said. “That's where the 1 percent Non-Home Rule sales tax idea comes in, to spend on street funding.”

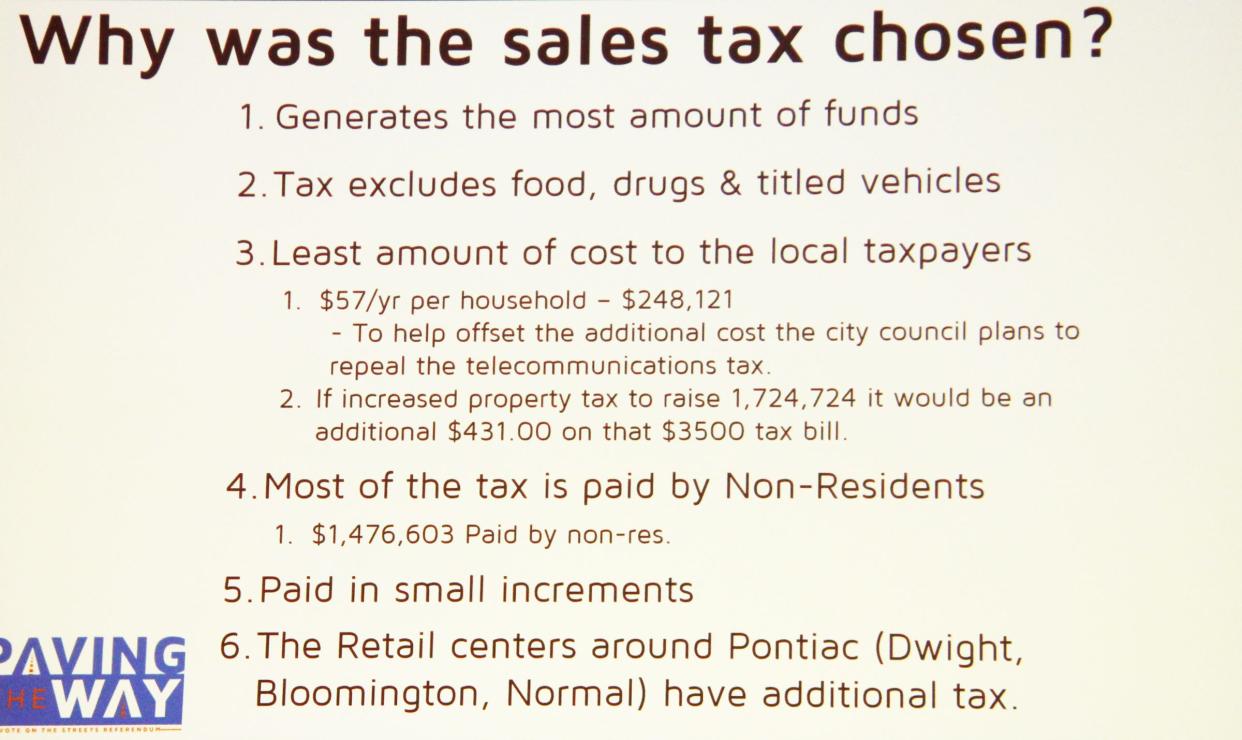

The sales tax will cover the purchase of retail items, such as clothing and gasoline among other things.

What it will NOT cover are groceries, prescription drugs and titled vehicles.

“Your groceries that you buy and take home are excluded,” Woolford said. “There's a list of like 10 things that state has that is included (in the tax). If you go to a restaurant, the food there is included.

An illustration shown indicated that Pontiac residents would spend about $4.75 a month, or $57 a year, on this tax. Obviously, spending habits will change given the month and what is available.

The money expected to come from the households in Pontiac would be $248,121 in collected taxes. An illustration showed that this tax would have generated $1,724,724 in 2021. This means that $1,476,603 would be generated by non-residents.

“The council felt that that was the fairest method because, when you're talking about street repair, residents are using our streets and non-residents are using our streets,” Woolford said.

Dwight has this tax already in place. Bloomington and Normal are home-ruled communities and have higher tax rates than Pontiac.

“We've heard, 'if you're going to raise taxes here in town, then why wouldn't I just go to Bloomington?'” Woolford said. “You would spend more in Bloomington on taxes there and that city would get the tax rather than here and they would use that money for whatever they designate it. For here, it would be used for our streets.”

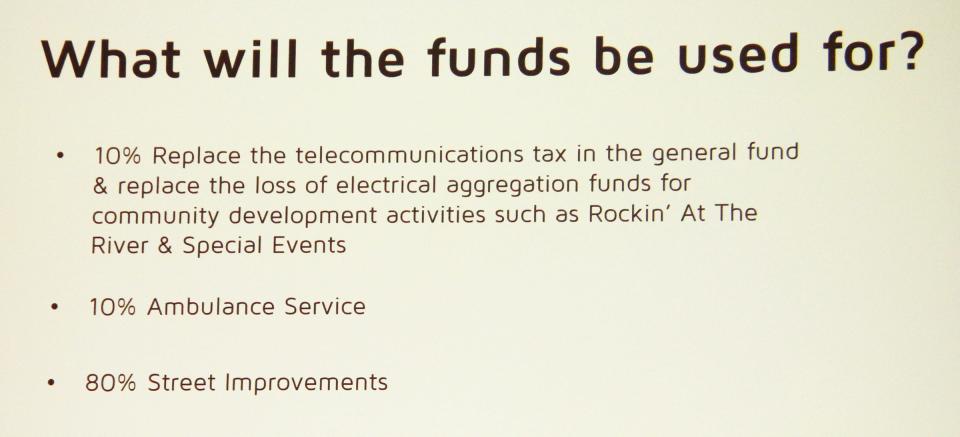

So where does the money this tax will generate actually go? Woolford said it is broken into three categories. The main focus is street repair and 80 percent of the money will go to there.

Ten percent will go to the ambulance service, which the city inherited when Duffy Ambulance ceased operations.

“We were very fortunate to be able to utilize American Recovery Plan money to help get that operation going,” Woolford said.

The other 10 percent will go to repeal the telecommunications tax in the General Fund and replace the loss of electrical aggregation funds and be used for community development, Woolford said. The telecommunications tax is a surcharge on the phone and cellphone bills, which helps fund the 9-1-1 center.

Earlier this year, the city council said, if the sales tax passes, it would execute a $7 million bond to cover repair costs up front and repay the creditors by use of the sales tax. Woolford said that once the debt is created, the city is locked in and minds cannot be changed.

This is the third try in three years for this measure, but it is the first time where other factors are involved. The city is hoping that residents understand that it isn't a big cost to them but rather to those who come to the city for whatever reason and make purchases.

This article originally appeared on Pontiac Daily Leader: 1 percent sales tax information provided as election draws near