Sarah Ketterer Exits General Electric, Trims Bank of America

Causeway Capital Management's chief executive officer, Sarah Ketterer (Trades, Portfolio), sold shares of the following stocks during the third quarter.

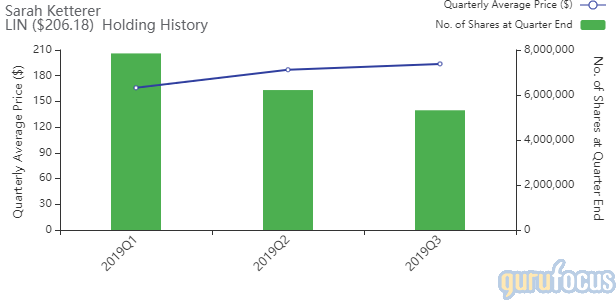

Linde

During the quarter, the guru trimmed the Linde PLC (NYSE:LIN) stake by 14.45%. The portfolio was impacted by -1.97%.

The industrial gases supplier has a market cap of $110.75 billion and an enterprise value of $125.27 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 11.39% and return on assets of 6.31% are outperforming 91% of companies in the chemicals industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.15 is below the industry median of 0.62.

The largest guru shareholder of the company is Pioneer Investments (Trades, Portfolio) with 1.38% of outstanding shares, followed by Dodge & Cox with 0.84% and First Eagle Investment (Trades, Portfolio) with 0.76%.

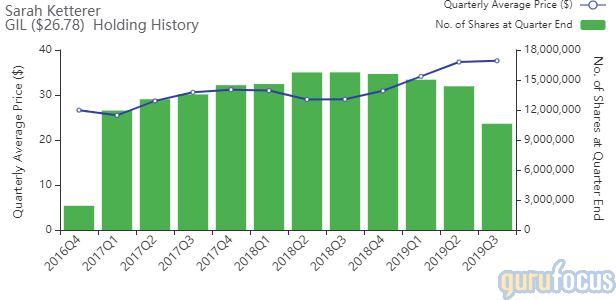

Gildan Activewear

The investor trimmed her Gildan Activewear Inc. (NYSE:GIL) position by 26.06%. The portfolio was impacted by -1.58%.

The company, which manufactures apparel like T-shirts, socks and underwear, has a market cap of $5.48 billion and an enterprise value of $6.41 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 14.91% and return on assets of 8.9% are underperforming 77% of companies in the manufacturing - apparel and accessories industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.06.

Other notable guru shareholders of the company include Richard Pzena (Trades, Portfolio) with 1.79%, PRIMECAP Management (Trades, Portfolio) with 0.59%, Mario Cibelli (Trades, Portfolio) with 0.20% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.20%.

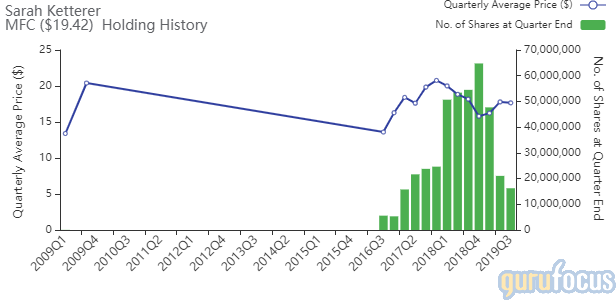

Manulife Financial

The Manulife Financial Corp. (NYSE:MFC) holding was reduced by 22.88%, impacting the portfolio by -0.96%.

The Canadian life insurer has a market cap of $37.96 billion and an enterprise value of $37.83 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. While the return on equity of 10.13% is outperforming the sector, the return on assets of 0.58% is underperforming 71% of companies in the insurance industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 1.41 is below the industry median of 2.34.

The largest guru shareholder of the company is Ketterer with 0.83% of outstanding shares, followed by Simons' firm with 0.33%, Pioneer Investments with 0.09% and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates with 0.03%.

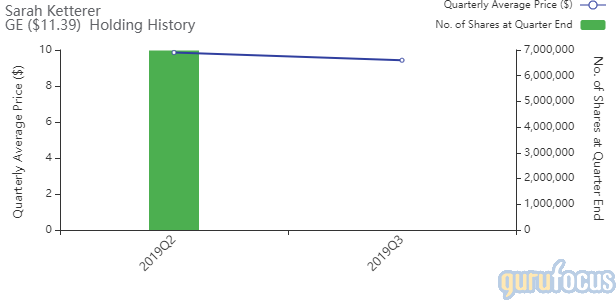

General Electric

Ketterer exited her General Electric Co. (NYSE:GE) stake. The trade had an impact of -0.80% on the portfolio.

The company has a market cap of $99.48 billion and an enterprise value of $121.08 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of -16.74% and return on assets of -1.64% are underperforming 83% of companies in the industrial products industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.79 is below the industry median of 0.89.

The largest guru shareholder of the company is Barrow, Hanley, Mewhinney & Strauss with 1.22% of outstanding shares, followed by Hotchkis & Wiley with 1.21% and Pzena with 0.73%.

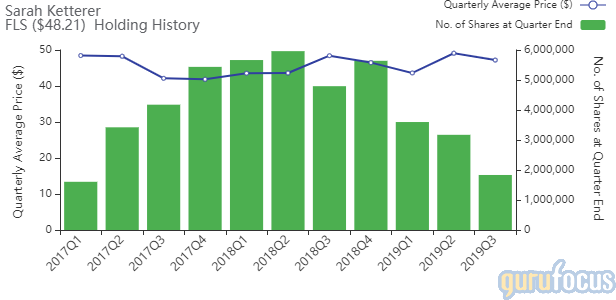

Flowserve

The guru trimmed the Flowserve Corp. (NYSE:FLS) position by 42.19%. The portfolio was impacted by -0.77%.

The company, which provides flow control systems, has a market cap of $6.31 billion and an enterprise value of $7.33 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 14.68% and return on assets of 5.22% are outperforming 63% of companies in the industrial products industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.36 is below the industry median of 0.89.

The largest guru shareholder of the company is First Eagle Investment with 9.22% of outstanding shares, followed by Mario Gabelli (Trades, Portfolio) with 1.79%.

Bank of America

The Bank of America Corp. (NYSE:BAC) holding was reduced by 57.48%. The portfolio was impacted by -0.65%.

The bank, which is one of the largest financial institutions in the U.S., has a market cap of $294.05 billion and an enterprise value of $427.09 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of 9.85% and return on assets of 1.17% are outperforming 54% of companies in the banks industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.6 is above the industry median of 1.14.

Warren Buffett (Trades, Portfolio) is the largest guru shareholder of the company with 10.31% of outstanding shares, followed by Dodge & Cox with 1.29%, PRIMECAP Management with 0.42% and Bill Nygren (Trades, Portfolio) with 0.20%.

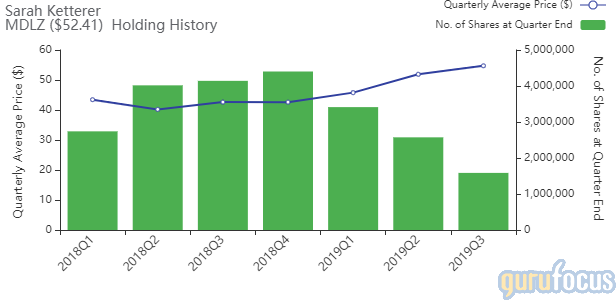

Mondelez International

The Mondelez International Inc. (NASDAQ:MDLZ) stake was reduced by 38.37%. The portfolio was impacted by -0.58%.

The confectionery company has a market cap of $75.46 billion and an enterprise value of $93.94 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 15.28% and return on assets of 6.23% are outperforming 70% of companies in the consumer packaged goods industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.08 is below the industry median of 0.40

The largest guru shareholder of the company is Simons' firm with 0.29% of outstanding shares, followed by Pioneer Investments with 0.25% and Hotchkis & Wiley with 0.20%.

Disclosure: I do not own any stocks mentioned.

Read more here:

7 Stocks John Rogers Continues to Buy

Glenn Greenberg Exits Facebook, Trims Alphabet

Robertson's Tiger Management Buys Adobe, Facebook

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.