How to save money when your car insurance increases

"Seriously, my car insurance went up $500 this year," said Fabian Bitri, a 32-year-old resident of Doylestown.

"No accidents, no citations, no traffic violations, no claims, no notice," he said.

Bitri's dismay comes as Allstate, his insurance provider, added hundreds of dollars to his annual premium, causing his bill to skyrocket from $900 to $1,400.

"If it went up to $100 or $150, I would understand it. But a $500 jump in just a year is hard to accept," Bitri explained.

Bitri is not alone. A growing number of central Bucks County residents are grappling with soaring costs of insurance. Autoinsurance.com says one in four drivers is now expressing concerns about their ability to afford their premiums.

The result? Ten percent of drivers are trimming their coverage, the industry website reported.

Why has car insurance gone on the rise?

Over the past year, car insurance rates have surged by more than 17%, as reported by the U.S. Bureau of Labor Statistics, with the increases blamed on the impact of climate change, inflation, younger or less experienced drivers, electric vehicles, supply shortages, and reinsurance rate fluctuations.

Frank Palmer, Chief Insurance Officer at Root Insurance, says costly car repair fees, higher body shop wages, and pricier used cars are contributing to the problem.

“The entire industry has had to raise rates to keep up with these trends,” he said.

The average annual cost for full car insurance coverage has risen to $2,040, up 15% from 2022 in Pennsylvania, according to a recent report from Bankrate.

Car insurance rates are expected to increase by 8.4% across the U.S. in 2023, driven by the growing number of drivers returning to the road, according to consumer research and finance site ValuePenguin.

"I just got a car insurance bill that has gone up a lot," said Sophia Daniel, a 46-year-old resident of Hatboro.

She has her car insurance with GEICO. "I was paying $95 per month for full coverage last year, but now it has surged to $160 per month."

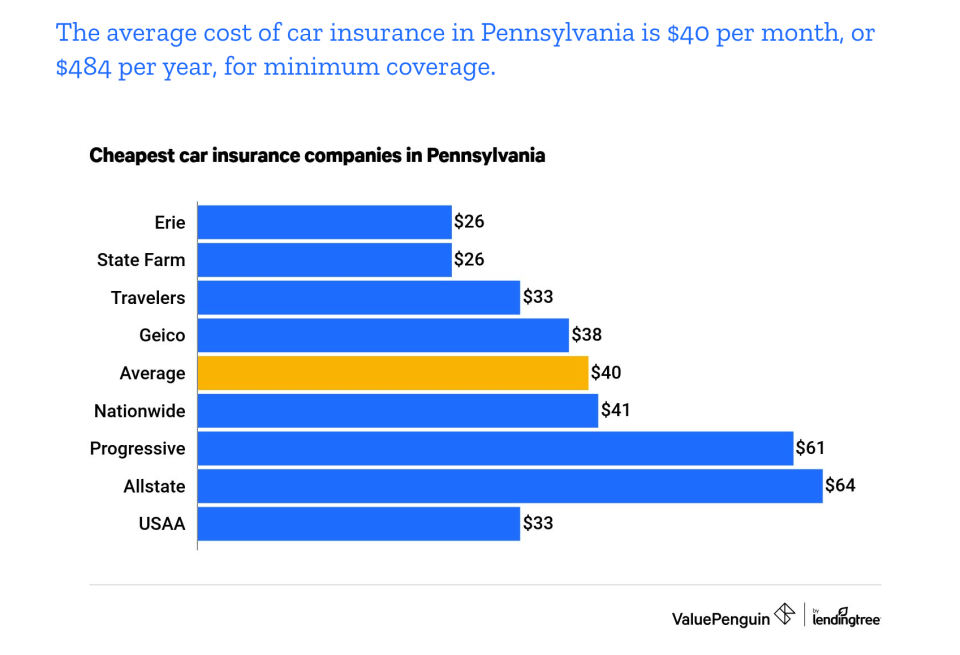

The resurgence of pre-pandemic driving patterns, with more employees returning to offices and families resuming their travel plans, is one of the primary factors behind these increases, as explained by Divya Sangam, an insurance spokesperson at LendingTree, the parent company of Value Penguin.

For families with young drivers, car insurance bills are even harder to stomach, just like Daniel's family.

Andrew Daniel drives to school and basketball practice, which helps his parents out. But he never thought that the car insurance would increase that much.

“It's astonishing, we definitely did not anticipate such a significant increase in premiums,” said his mom, Sophia Daniel.

How to save money on your car insurance?

Feeling the pain of insurance price hikes? Here are three strategies to find the best car insurance deal.

Shop around

To find the best deal, it's wise to collect at least three quotes from a variety of insurance companies and types of insurers, a spokeswoman for the Pennsylvania Insurance Department explains. Talk with neighbors and friends about what their insurance rates are and do some research.

Watch your credit score

Some insurers consider credit information when determining the pricing for auto insurance policies. Be sure to review your own credit report and verify it's accurate.

Trim your coverage on some cars

As a general guideline, if your older car is worth less than 10 times your insurance premium, it might not make sense and be cost-effective to maintain collision, and/or comprehensive coverage. You can easily find your car's value by using free resources available on websites such as Kelley Blue Book, the National Association of Auto Dealers (NADA), and TrueCar.

This article originally appeared on Bucks County Courier Times: How to save money on your car insurance?