Savers to lose £400 with inflation 20 times higher than interest rates

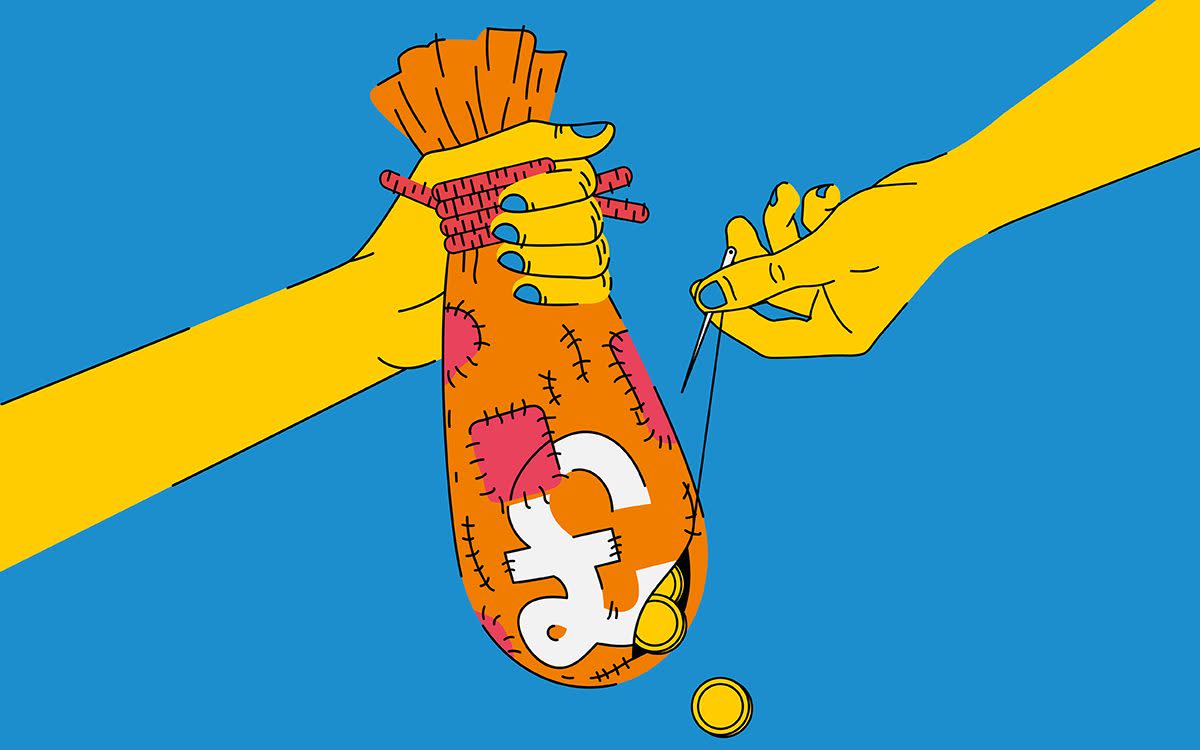

The average saver will lose nearly £400 this year as interest rates offered by banks failed to keep pace with rampant inflation.

No deals match the eroding power of the consumer prices index, which hit a 30-year high of 5.4pc last month. All cash savings pots will now reduce in real terms.

Households that have the majority of their savings in cash Isas would be hit hardest. Britons have an average of £8,100 in such accounts according to the Office for National Statistics.

Rates on these deals remain incredibly low despite the Bank of England hiking its rate in December for the first time in three years. The average easy-access cash Isa pays just 0.27pc and means an average saver will lose £394 this year.

Those who use traditional savings accounts have £5,000 saved on average but accounts pay around 0.2pc, earning just £10 over the year. Purchasing power will reduce by £247 after 12 months.

Even top-paying accounts with eye-catching short-term bonuses fail to come close. £20,000 with Family Building Society's Premier Saver, the best deal paying 0.72pc, will see the saver lose £888 over 12 months. Savvy savers who have traditionally moved their money between the best-paying accounts will see their spending power diminish.

Locking money away in fixed-rate bonds will slow the effects of inflation, but will not stop it. Even the top-paying five-year bonds, that would keep money tied up until 2027, offer just 1.34pc on average. £20,000 in the average five-year account would yield £268 in interest in the first year but, if inflation remained at 5.4pc for five years, the pot would be worth just £16,400 by the time it was withdrawn.

The best-paying five-year bond, from Charter Savings Bank, offers 2.1pc interest, some 3.1 percentage points below CPI.

Last month the Bank of England increased rates by 0.15 percentage points to 0.25pc in an attempt to tackle surging inflation. Banks have yet to pass on the rise to savers, however. Easy-access rates have increased by just 0.01 percentage point since December. The average one-year bond has fallen from 0.84pc to 0.82pc.