Schlumberger Delivers Growth Where It Matters

Based on Schlumberger's (NYSE: SLB) share-price performance heading into the fourth quarter, investors weren't expecting much from the world's largest oil services company. The company's stock had tumbled to its lowest price-to-book valuation since the 1980s. Oil prices were on the decline throughout the quarter and most North American exploration and production companies had previously signaled that they weren't going to be completing wells at the end of the year. This all pointed to a miserable quarter for Schlumberger.

Overall, though, the quarter wasn't as bad as some predicted, as the company beat earnings expectations. More importantly, management's comments about 2019 were enough to make even the most skeptical investor modestly hopeful about the upcoming year. Let's take a look at Schlumberger's most recent quarter and determine if the stock is poised for a great year.

Image source: Getty Images.

By the numbers

Metric | Q4 2018 | Q3 2018 | Q4 2017 |

|---|---|---|---|

Revenue | $8.2 billion | $8.5 billion | $8.2 billion |

Pre-tax income | $648 million | $787 million | ($2.2 billion) |

Diluted EPS | $0.39 | $0.46 | ($1.63) |

Free cash flow | $1.41 billion | $961 million | $456 million |

Data source: Schlumberger earnings release. EPS = earnings per share.

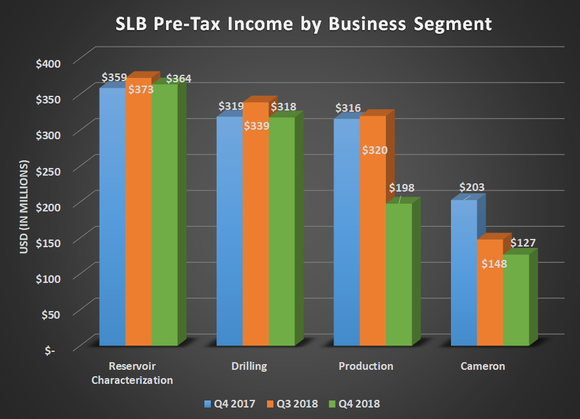

Even though the company reported slightly lower revenue compared to the prior quarter, what really mattered was where those declines came from. Its production and Cameron segments bore the brunt of the decrease because of the abrupt slowdown in North American shale activity. Shale is an incredibly volatile business that can react quickly to changes in oil prices. One thing that stood out in these results is that Schlumberger reported an increase in drilling activity revenue for North America, but its production segment -- which does services like hydraulic fracturing and well completions -- declined.

This data point lines up with statistics from the U.S. Energy Information Administration, which say that the inventory of drilled but uncompleted wells stood at a record of 8,723. Management expects production and Cameron revenue to pick back up again as producers go back to complete these wells in 2019.

What's more important for Schlumberger is that business activity outside North America continued to increase modestly throughout the quarter. Capital spending on new production outside North America has been incredibly slow following the price crash several years ago, but it appears that this part of the industry is on the upswing again.

Data source: Schlumberger. Chart by author.

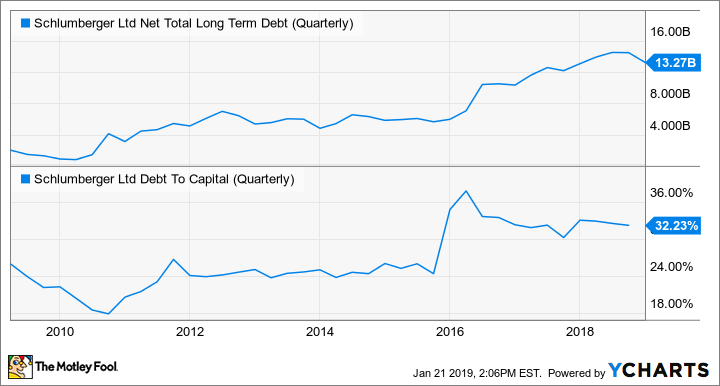

Another thing that was encouraging about this past quarter was that Schlumberger was able to generate enough free cash flow for the year to almost cover its dividend payment. After falling woefully short of covering its dividend in 2017, there were some concerns that its payout would get cut. The cash it generated for the year and the expectations for a better 2019 should allow the company to get back to covering its payment without issue and hopefully start to trim its debt load. Over the past three years, it has doubled its net debt load to just over $13 billion and has pushed its debt-to-capital ratio to abnormally high levels for Schlumberger.

SLB Net Total Long Term Debt (Quarterly) data by YCharts.

What management had to say

CEO Paal Kibsgaard has been one of the more optimistic voices in the oil industry over the past year. He has been saying for some time that the lack of capital spending and resource development was going to catch up to the industry eventually. Even though we saw a sharp decline in drilling activity and prices at the end of the year, he still sees this longer-term trend playing out over the coming years:

Not surprisingly, the recent oil price volatility has introduced less visibility and more uncertainty around the E&P spend outlook for 2019, with customers generally taking a more conservative approach to the start of the year, again delaying the broad-based recovery in E&P spend that we expected only three months ago. However, from our customer discussions, we are seeing clear signs of E&P investment sentiments starting to normalize in the various parts of the world and heading toward a more sustainable financial stewardship of the global resource base.

(You can read a full transcript of Schlumberger's conference call here.)

Schlumberger's business is growing in the right places

Schlumberger's results over the past several years are a testament to the profound impact shale drilling has had on the oil industry. It has been a little over five years since shale oil really took off, and oil prices have been on a roller-coaster ride ever since. While Schlumberger has been able to capture some of this business and has become the No. 2 player in North American shale, its business is set up to serve the international markets.

Seeing its international activity steadily increase in the face of this recent oil price crash is an encouraging sign for Schlumberger. It should help significantly boost margins across all its segments and generate more cash. For 2019, investors should keep a close eye on the company's ability to capture international business. If it can do that, then its cash issues will likely be solved and management can start to trim the debt load it built up during this weak period. With shares of Schlumberger still trading at historically low prices and boasting a dividend yield of 4.8%, investors should keep this stock on their radar.

More From The Motley Fool

Tyler Crowe has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.