School meals, community college, immigrant tuition: Mass. lawmakers approve overdue budget

BOSTON - Massachusetts legislators approved a $56.2 billion spending plan Monday with a 39-0 yes vote in the Senate and 156-2 vote in the House. Just in time for the traditional August recess.

Legislative leaders announced Friday that they had agreed on an overall spending plan for fiscal 2024 and worked through the weekend to iron out details before filing the final version Sunday.

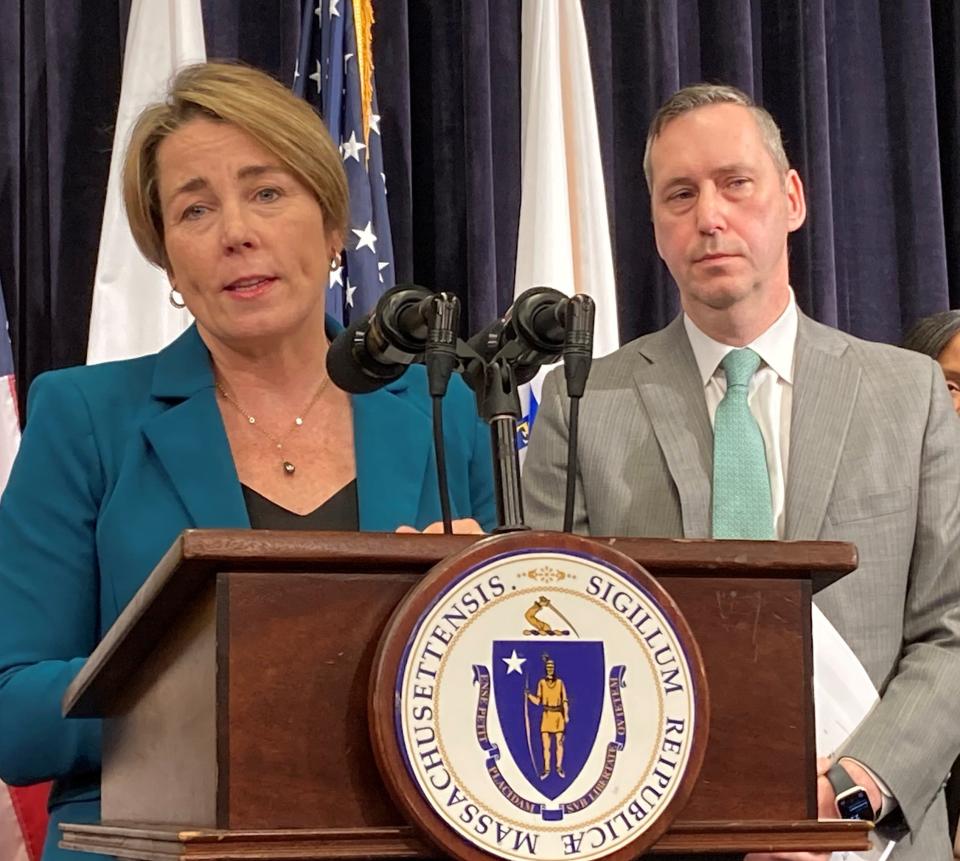

After the votes Monday, the measure goes to Gov. Maura Healey, who has 10 days to review and revise the document and make her own spending suggestions.

Included in the budget:

Direct school aid in the form of Chapter 70 funding comes in at $6.59 billion; an increase of over $600 million from the previous fiscal year with increases to the per-pupil amount from $30 to $60.

$172 million for universal school meals for all 900,000-plus students attending public school in Massachusetts.

Unrestricted aid to cities and towns will be funded at $1.27 billion; up almost $40 million from the previous fiscal year.

Almost $1.5 billion for early childhood care and education, with $475 million for grants in the Commonwealth Cares for Children program.

Money from the voter-approved surcharge on incomes over $1 million will be split between education ($523 million) and transportation ($477 million). Anything over the projected $1 billion will be held in reserve and dedicated to future education and transportation needs.

Included in the "Millionaire’s Tax" disbursement is $100 million for the Massachusetts School Building Authority, to aid districts facing higher-than-anticipated costs for approved projects due to inflation. Limits on grant approvals increased to $1.2 billion.

$50 million to fund free community college: $38 million for students over 25 and those pursuing nursing degrees starting in the fall of 2023, and the rest to fund free community college for all starting in fall 2024.

Immigrant students, regardless of legal U.S. status, will be allowed to pay in-state tuition rates and fees at Massachusetts public colleges if they attended high school for three years or earned their GED in the state. (The measure appears to have been one of the sticking points between the two houses and was further singled out for debate by Rep. Paul K. Frost, R-Auburn, in the minutes before the final vote on the budget bill. While his motion to suspend the rules to discuss the measure garnered 25 votes, it lacked the two-thirds majority necessary.)

$50 million for capital improvements for higher education institutions.

$90 million for regional transit.

Supports changes in the state nursing programs that would allow experienced and degreed professionals to teach clinical labs.

No-cost calls for inmates incarcerated in state and county facilities.

Eviction protections.

New standards for instruction of best practices for treatment and care residents with intellectual and developmental disabilities.

Expansion of eligibility for affordable health insurance, opening subsidies for people with annual income levels up to $73,000.

Starting insurance coverage for state employees on the first day of work.

Stroke treatment and prevention protocols.

Requiring insurance carriers to cover preventive medicine without cost sharing.

Bonding bill also passed includes funding for roads, bridges

In addition to the overall spending bill, state lawmakers passed a $375 million bonding bill Thursday that includes $200 million in Chapter 90 funds dedicated to transportation improvements (EV infrastructure, regional transit, the MBTA) and money to fix some of the state’s roads and bridges.

While legislators have set aside funding in the budget to bring tax relief to the tune of almost $600 million, lawmakers have not reached an agreement on the specifics of the proposals. Sticking points have included proposed changes in the capital gains tax and the proposed implementation of changes to the earned income tax credit and child tax credit.

Reaction mixed among advocacy groups

The Massachusetts Teachers Association, the union representing the bulk of state educators, declared that students “won big” with the budget deal.

The organization's statement highlighted the funding for free community college and universal free school meals for all students attending public schools. With the state shouldering the cost of breakfast and lunch, proponents believe families could save as much as $1,200 per student every year.

“These are all important investments,” according to the organization's release, “to build upon for the long-term prosperity of families living in the commonwealth.”

Other organizations praising the budget included Project Bread, which advocated for free universal school meals.

Others criticized the budgetary process.

The conservative-leaning organization Mass Fiscal Alliance charged that the Legislature missed the mark on transparency as well as tax relief.

“Speaker Ron Mariano and Senate President Karen Spilka once again demonstrated that the Massachusetts legislature is not open to transparency or tax relief,” said Paul D. Craney, a spokesman for the alliance.

Craney despaired that the conference committee tasked with reconciling the budgets released the document after 8 p.m. Sunday, and required members to vote on the $56.2 billion budget less than 24 hours later.

“The Massachusetts Legislature failed to provide any tax tangible relief in their budget,” said Craney in a written statement.

Andrew Farnitano, a spokesman for Raise Up Massachusetts, which advocated last year for the tax surcharge on high earners, praised Massachusetts residents for “choosing a fairer tax system and guaranteeing that the richest 1 percent will pay more to fund our schools, colleges, roads, bridges, and public transit.

“These major new investments will deliver real improvements to the infrastructure that drives our state’s competitiveness, from a functioning statewide transportation system to the public schools and colleges that produce our in-demand, educated workforce,” Farnitano said.

He urged lawmakers to protect the surcharge proceeds from "high-income tax avoidance" in the future.

This article originally appeared on Telegram & Gazette: Mass. lawmakers approve budget deal free school meals included