School property taxes are likely to rise significantly. Why that is and what to expect.

CORRECTION: Those qualified to receive an income sensitivity tax credit pay a base rate of 2% of their annual income before other factors are applied. The section about income sensitivity has been modified for clarity. Also, a line about how renters pay property tax has been removed for clarity because the processes are different from what the bulk of this article addresses.

Vermonters could see their school property taxes rise by as much as 20% this year, and school districts and Montpelier are blaming each other for the hit to household budgets. The statewide school tax is calculated using a complex formula that even tax and education officials – the experts – find difficult to explain.

The back-and-forth leaves the average taxpayer, who wants transparency about how their money is being spent and if the increases are justified, ill-equipped to understand education finance, even when presented in cartoon form.

The Legislature and school districts each control some of the factors that contribute to the fluctuation in the tax rate. However, experts analyzing the same numbers are coming away with conflicting conclusions about what is the biggest driver for higher taxes.

In less than a month, voters will make their voices heard on school spending on Town Meeting Day.

Here’s a breakdown on how Chittenden County towns are likely to be impacted and a closer look at one community: South Burlington.

Property tax 101

Property tax is divided into two parts: what goes to the state for the Education Fund – to pay for schools – and what is owed to the town to pay for municipal services like fire, police, libraries, parks, roads and bridges and town offices and personnel. Each portion is itemized in the tax bill you receive from your town and each has its own tax rate. Typically, the education portion makes up the majority of property taxes owed – for some it may be 80% of their bill.

The tax rate usually changes each year due to a variety of factors − these factors are explained later in the article − and is multiplied by a property’s value at a base rate of $1 per $100 of property value. So, for a $100,000 home, the tax would be $1,000 before adjustments.

Around 60% of Vermont homeowners qualify for income sensitivity tax credit that calculates property taxes based on income rather than property value.

For 2023, households making less than $128,000 qualify for this tax credit. These households pay a base rate of 2% of their income, plus the rate of the school district's per pupil spending over the income yield. There are also limits on how much property value can be taxed depending upon whether the household make more or less than $90,000 per year in income.

Most Vermonters have the opportunity to vote whether or not to approve local school budgets for the 2024-25 school year during Town Meeting Day in March. The actual tax rate is set, often months later. Fiscal 2025 begins July 1 and bills are usually mailed by the towns to residents in mid-July. Towns can have between one and four property tax payment due dates throughout the year.

Breaking down the Education Fund

The education fund, which is the state-level pot that collects the money from towns and then distributes dollars back to school districts and supervisory unions, is made up of multiple funding sources. In fact, property tax from homeowners − the homestead tax − only made up 26% of the total needed to fund K-12 public education in Vermont during the 2019 fiscal year.

In addition to the money raised by individual districts and towns, the state provides financial assistance for some educational programs and funds the Agency of Education. About 41% of money in 2019 came from non-homestead property tax – think commercial property and retail, restaurants, etc. Unlike homestead property tax, non-homestead property tax is not allocated to a specific town and the tax rate is uniform for all. When Wal-Mart pays its property tax, for instance, the money goes into the pool of money to be used across the state and doesn’t benefit just Williston.

Non-property sources make up the remainder of the education fund, about 33% in 2019, and include other taxes like sales & use (total), meals & rooms (one-quarter of the total), purchase & use (one-third of the total), wind & solar plus money made from the lottery.

How school budgets become a mathematical formula

Each year school districts set their budgets and take note of how much will be offset by revenue sources such as federal funding. The amount leftover is what homeowners pay. This amount is represented by a figure that sets a per pupil rate – the cost of educating a single student.

Here it gets tricky. The per pupil rate could be higher in districts which have fewer resources, have a smaller number of homes to tax or have an outsized proportion of students with higher level of needs.

In 1997 Act 60 said every student had a right to equal access to education, so as a result, a school funding formula was created to ensure students in smaller or lower income communities didn't have less access to resources than richer ones with a greater tax base. This is one reason why property tax for schools goes into the state education fund first, before it is redistributed back to individual communities in the amount they had budgeted. If a year-over-year percentage spending increase exceeds what an Agency of Education committee deems is necessary, the district may have to rework its budget.

Five factors influencing your education property tax rate

To ensure some Vermonters aren’t paying a much higher proportion of their income on schools than others, the education funding formula takes into account a variety of factors to calculate tax rate. Some of these figures are based on a statewide average. So, your town’s deviation from the average is likely to cause taxes to go up or down accordingly.

School BudgetSchool budgets almost always increase from year to year. Often the increase can be in the 5% range. This year, however, the state is predicting, on average, schools are planning to spend 12% more than last year. Federal pandemic recovery funds coming to an end, increased cost of fuel for buses and other goods and services rates going up, healthcare benefit costs for employees and the cost of maintaining aging infrastructure or servicing debt on capital or renovation projects account for much of the increase in budget numbers this year, according to the Agency of Education.

Pupil Weight ChangesPer-pupil figures are based upon the idea there is a basic cost associated with educating one student - mathematically this is expressed by dividing the school budget by the number of students. However, not every student is the same. It may cost more to educate a high school student than one in elementary school or a student for whom English isn't their primary language because they have support from an English Language Learning teacher. So, "weights" were created are and added using the number of students in a school community with factors that could raise the cost to educate them.

This year Act 127 created even more pupil weights, which drive the total number of pupils up higher, thus reducing the spending per pupil. Because the per-pupil rate is lowered, this brings down the tax burden for that community. Sparsely populated communities and districts with a higher level of low-income students or percentage of English language learners have higher weights this year. Those communities will likely see some tax savings where as communities that don’t have as many of these students are likely to shoulder more tax.

YieldThe yield is the portion of the per-pupil amount of spending that is attributable to the base amount – the $1 per $100 of homestead value or 2% of annual income. The Legislature sets the per-pupil yield each year at the level necessary to fund school budgets. Spending more than the base rate increases the town's tax rate proportionally.

Common Level of AppraisalCommon Level of Appraisal (CLA) is a number that represents the difference between what your property has been appraised for tax purposes and what it would likely sell for in today’s market. The town's average difference is expressed as a deviation from the statewide average.

Townwide property re-appraisals are costly so they happen infrequently. Therefore sale prices from homes in the area over the past couple years help inform property value. In towns where there hasn’t been an appraisal for a while but have seen a significant increase in what homes are selling for are likely see their tax rates go up.

The Legislature sets the CLA for each town with 100 being the state average. A number lower than 100 means the assessed value of homes haven't kept up with market prices, therefore the taxable property value has been adjusted. A lower CLA increases the tax rate, and a CLA above 100 decreases the tax rate.

Many Chittenden County towns have seen a spike in property values the past few years due to pandemic migration and scarcity of housing stock, with many homes worth far more than their assessed value. That means these communities are likely to see a lower CLA value than other areas of the state.

CapsSpending limits are placed on specific factors affecting the tax rate and are designed to keep tax increases from becoming exorbitant year-over-year.

With the implementation of Act 127 which changes the pupil weight system and, therefore, a town’s tax capacity, the Legislature anticipated some communities would be affected more greatly than others. The Legislature put a 5% cap on a town’s tax rate increase each year for the next five years (fiscal years 2025-2029). However, the cap is applied before the CLA is factored in.

An increase in per-pupil spending exceeding 10% year-over-year triggers a “tax rate review.” Board members appointed by the Agency of Education will determine if the school district or supervisory union’s increase is beyond their control and justified, or if school spending needs to be reduced to bring down the per-pupil spending increase to 10%.

A sticking point for some communities is that the CLA has no limits placed upon it. Some towns have said the CLA is most responsible for driving up taxes, something that is out of their control. To bring down taxes without adjusting the CLA, school districts said they would have to slash their budget by millions of dollars.

South Burlington blames CLA for school tax increase

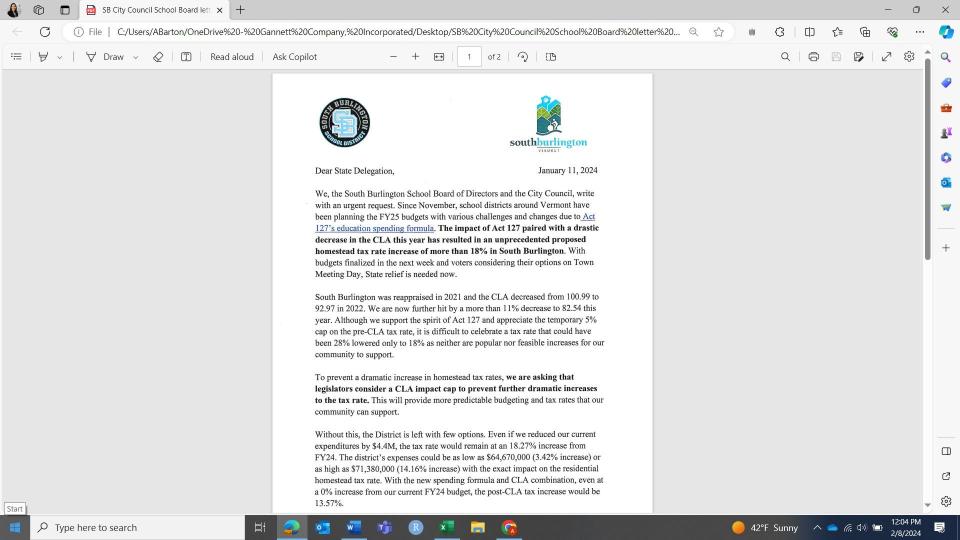

South Burlington is projecting school taxes will increase 18% this year. The City Council and School Board members jointly called on state delegates to adjust the homestead tax rate to prevent the “dramatic increase” that they said they were unsure taxpayers would support. The South Burlington community has voted down school district budgets before. In both 2020 and 2017, it took three rounds to approve the budget.

The City Council and School Board asked legislators to urgently consider implementing a CLA impact cap. “Without this, the District is left with few options,” the statement read. “With the new spending formula and CLA combination, even at a 0% increase from our current FY24 budget, the post-CLA tax increase would be 13.57%.” Essentially, South Burlington is saying of its 18.3% tax rate increase, about 13.5% is attributable to the CLA and pupil weight changes which are set by the Legislature, while the school budget accounts for just 4.7%.

The South Burlington School District said it could cut their school budget by $4.4 million and still the tax rate increase would remain higher than 18%. Further, the district said whether the school budget was increased by 3.42% or 14.16% this year have not impact on the tax rate.

Typically a town’s CLA drop has been fueled by a lag between townwide appraisals. However, South Burlington's last reappraisal was in 2021. The CLA stood at 100.99 then, and now it has fallen to 82.54.

South Burlington concluded the district would need to reduce spending by $6.6 million from this year's budget of about $62 million to make a considerable difference to the tax rate which would mean increasing class sizes; reducing transportation; reducing arts, language and AP course offerings; pause hiring literary specialists and instructional coaches as planned and put special education compliance in jeopardy.

South Burlington isn’t the only school district calling for immediate action to decrease the tax burden on their community. Burlington and the Champlain Valley School District – which serves the towns of Williston, Hinesburg, Shelburne, Charlotte and St. George – have also been vocal about the CLA’s outsized impact this year.

Tax Department: CLA not to blame for tax increase in South Burlington

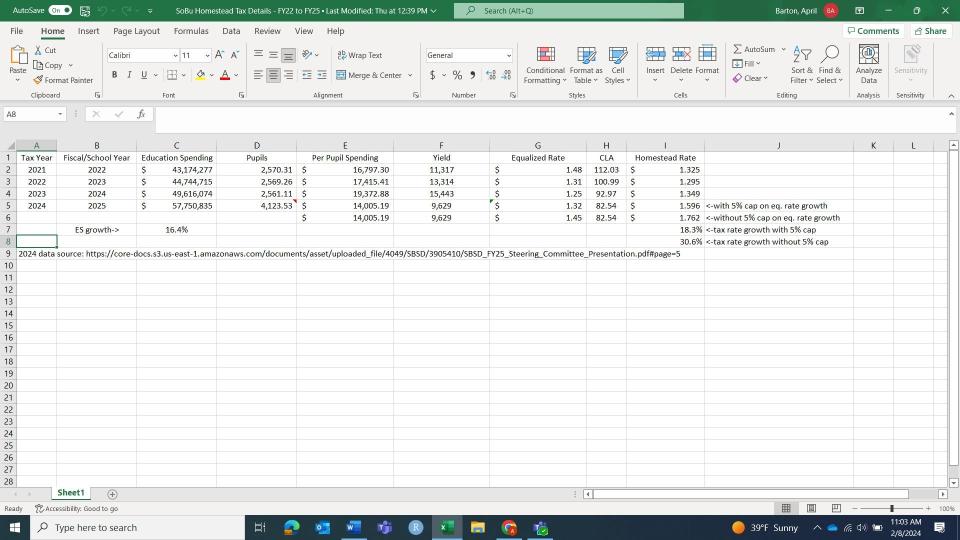

The Tax Department says the CLA has received undue blame for this year's tax increases. Using South Burlington as an example, Jake Feldman, a senior fiscal analyst for the tax commissioner’s office, analyzed data from the past few years.

An important distinction is that tax rates are based on education spending, not the total school budget, Feldman said. Education spending is the figure that homeowners pay – the school budget minus expected income sources like federal funding or education dollars paid to the district for students who live in another town. This number is what gets divided by the number of pupils to arrive at the per pupil spending.

Using data publicly provided by the South Burlington School District, Feldman showed in a spreadsheet that South Burlington’s education spending is going up by 16.4% this year.

“Some people are saying that the CLA is to blame for the expected tax rate increase in SoBu next year, but note that the CLA has dropped in SoBu by similar amounts each year since the town reappraised in 2021, but homestead tax rates were pretty stable over that period,” Feldman wrote in an email to explain how to interpret numbers in the spreadsheet he provided. He explained that when CLAs drop, which has been happening all across the state, the yield goes up.

“So after ruling out the CLA theory, that leaves the other factors in play for next year as the possible causes,” he said.

He added that the 5% cap on the tax rate increase added this year to help communities disadvantaged by the new pupil weight formula has made a significant difference in South Burlington. Without that cap, he said South Burlington would have been facing a 30.6% increase in property taxes.

Could there be changes before Town Meeting Day?

The time for taxpayers to vote is approaching quickly and there could still be changes. The Legislature is considering amending the education funding law with House Bill 850 that could possibly impact proposed school budgets, if passed. In some cases, towns may consider delaying the school budget vote until after Town Meeting Day. If that happens, it will be important to take note of town and school district communications because new community presentations may be offered to inform the public in advance of the vote.

If voters don't approve the school budget, the school district reworks the budget and another vote is scheduled. In the event a school budget doesn't pass by July 1, the start of the next fiscal year, the school board can borrow to 87% of the most recently approved budget. Taxpayers would be charged an interim tax rate of $1 per $100 (the base rate) adjusted for the CLA. If districts have not adopted a budget by 30 days before the date of payment, they would receive 25% of a base amount adjusted for inflation.

Contact reporter April Barton at abarton@freepressmedia.com or 802-660-1854. Follow her on X, formerly known as Twitter @aprildbarton.

This article originally appeared on Burlington Free Press: Vermont school taxes set for sharp increase. What to know