Schools in four Ohio counties have money issues on the Nov. 8 ballot

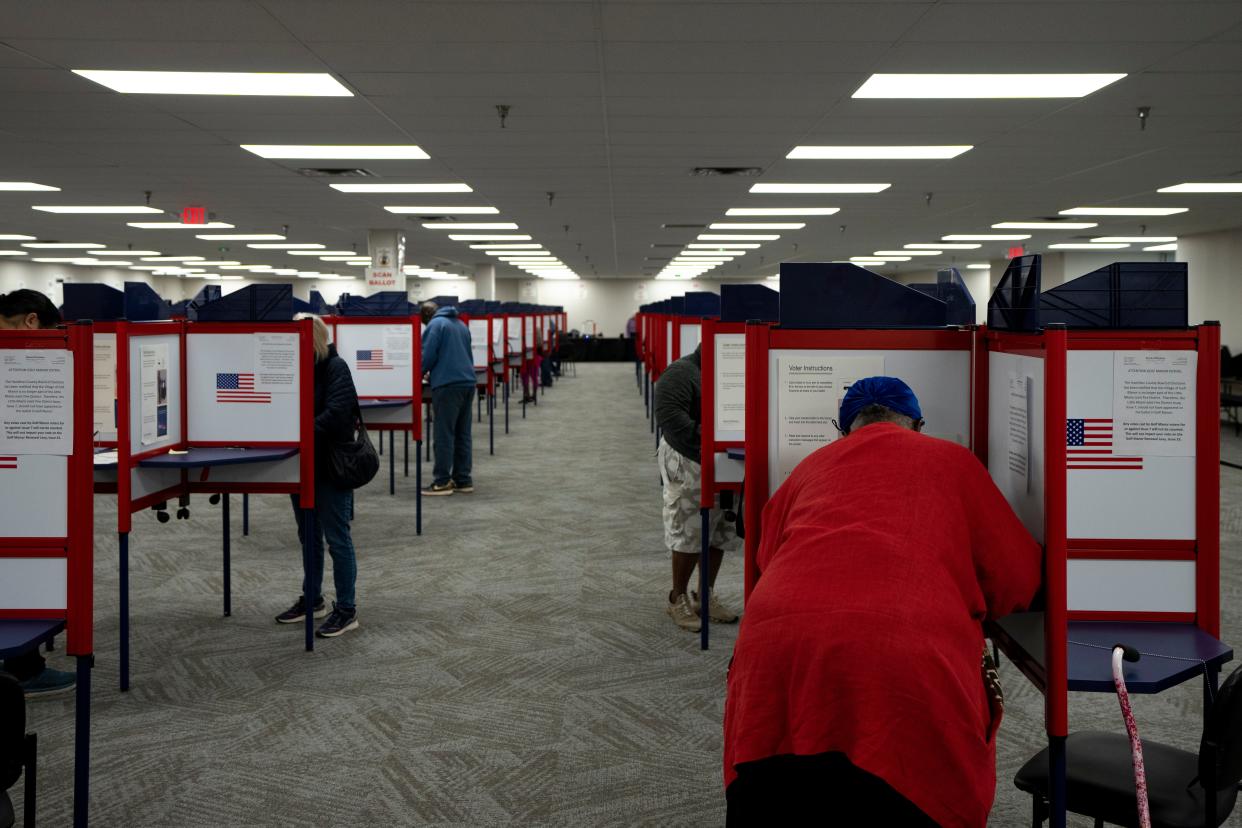

Voters in 12 southwest Ohio school districts will be asked to approve money issues when they go to the polls Nov. 8.

'Nibbled to death':Hamilton County voters passed four tax hikes in recent years. Will they approve a fifth?

'Big mistake':Whoops: Boosters of a county levy sent a mailer wrongly telling voters a yes vote would mean a huge tax hike

Does my school district have a levy on the ballot?

Six districts ‒ Felicity-Franklin, Kings, Loveland, Ross, Talawanda and Winton Woods – are asking for new property tax levies. Franklin and Lebanon are asking for replacement levies that won’t increase taxes.

Goshen and Northwest are districts asking for the passage of bond issues that will pay to construct new schools or improve existing ones.

Cincinnati Public Schools is asking voters to renew a property tax levy.

Here's the rundown: by county.

Butler County

Ross Local Schools: A 7.99-mill five-year levy would raise $3.7 million each of the next five years beginning in January if passed. Taxes on a $100,000 house would increase by $280. The annual increase would begin in January.

Talawanda School District: A 5.7-mill continuing levy would raise $4.8 million annually beginning in January. The owner of a $100,000 house would pay an additional $199.50 annually.

Clermont County

Blanchester Local School District: A 1.25% income tax on earned income for six years, beginning in January is expected to raise $2.1 million each of the next six years beginning in January if passed by voters.

Felicity-Franklin Local School District: An additional 8.9-mill 5-year emergency levy for day-to-day operations; would raise $890,000 each of the next five years with collections beginning in January. Taxes would increase about $311 annually on a $100,000 house.

Goshen Local School District: A 7.2-mill bond issue; would raise $49.9 million to pay for a new 93,239-square-foot school for students in grades 4-6, The levy would also pay for classroom additions totaling 19,400 square feet at the high school, and renovations to the district’s other three buildings. Taxes on a $100,000 house would increase by $252 for the next 38 years beginning in January.

Hamilton County

Cincinnati Public Schools: A renewal levy of 6.8 mills for 10 years would not increase taxes.

Loveland City School District: An additional 4.9 mill continuing levy will raise $4.7 million annually. Taxes would increase $171.48 on a $100,000 house beginning in January

Northwest Local School District: 4.98-mill bond issue; would raise $8.7 million annually to pay off bonds for a $175.8 million project that combines three middle schools into two new buildings – Colerain Middle School and Pleasant Run Middle School. The plan also would build a new Colerain Elementary School and Houston Early Learning Center and renovate Monfort Heights Elementary School. Taxes on a $100,000 home would be increased by $174.30 for the next 38 years.

Winton Woods City School District: A 5.4-mill emergency levy would raise $3 million each of the next five years. Taxes on a $100,000 home would increase by $189 with collections beginning in January.

Warren County

Franklin City Schools: A substitute 13.39-mill levy for five years would raise $7.75 million each of the next five years beginning in January; would not increase taxes.

Kings Local School District: A continuing additional 6.4 mill levy would raise $7.5 million annually. The cost to the owner of a $100,000 house is an additional $224 annually.

Lebanon City Schools: A substitute 9.6-mill for 10 years would combine three existing levies from 2005, 2011 and 2019, into one. The levies would continue to raise $12.2 million annually and would not raise taxes.

This article originally appeared on Cincinnati Enquirer: Ohio election 2022: What school levies are on the ballot