Do Schwälbchen Molkerei Jakob Berz's (FRA:SMB) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Schwälbchen Molkerei Jakob Berz (FRA:SMB). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Schwälbchen Molkerei Jakob Berz

Schwälbchen Molkerei Jakob Berz's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a falcon taking flight, Schwälbchen Molkerei Jakob Berz's EPS soared from €1.88 to €2.42, over the last year. That's a impressive gain of 29%.

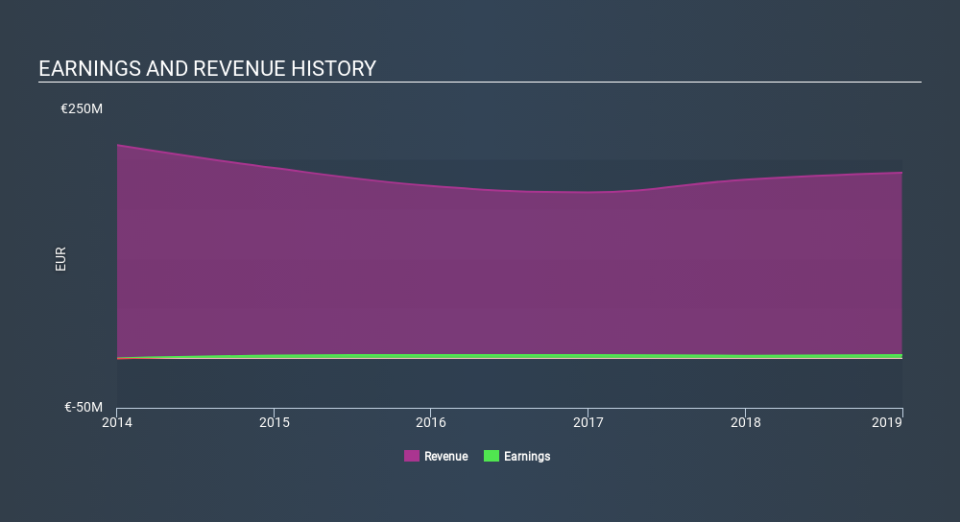

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Schwälbchen Molkerei Jakob Berz's EBIT margins were flat over the last year, revenue grew by a solid 3.8% to €186m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Schwälbchen Molkerei Jakob Berz is no giant, with a market capitalization of €56m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Schwälbchen Molkerei Jakob Berz Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that Schwälbchen Molkerei Jakob Berz insiders own a meaningful share of the business. In fact, they own 84% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about €47m riding on the stock, at current prices. That's nothing to sneeze at!

Should You Add Schwälbchen Molkerei Jakob Berz To Your Watchlist?

You can't deny that Schwälbchen Molkerei Jakob Berz has grown its earnings per share at a very impressive rate. That's attractive. I think that EPS growth is something to boast of, and it doesn't surprise me that insiders are holding on to a considerable chunk of shares. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. Of course, just because Schwälbchen Molkerei Jakob Berz is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Although Schwälbchen Molkerei Jakob Berz certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.