Screw it, I solved the student debt forgiveness debate

Some want the government to forgive specific amounts of student loans. Others argue that's not fair.

The government should reduce the interest rate on federal student loans, and forgive any that's accrued.

This helps the people who most need it while avoiding the moral hazard of paying off the principal.

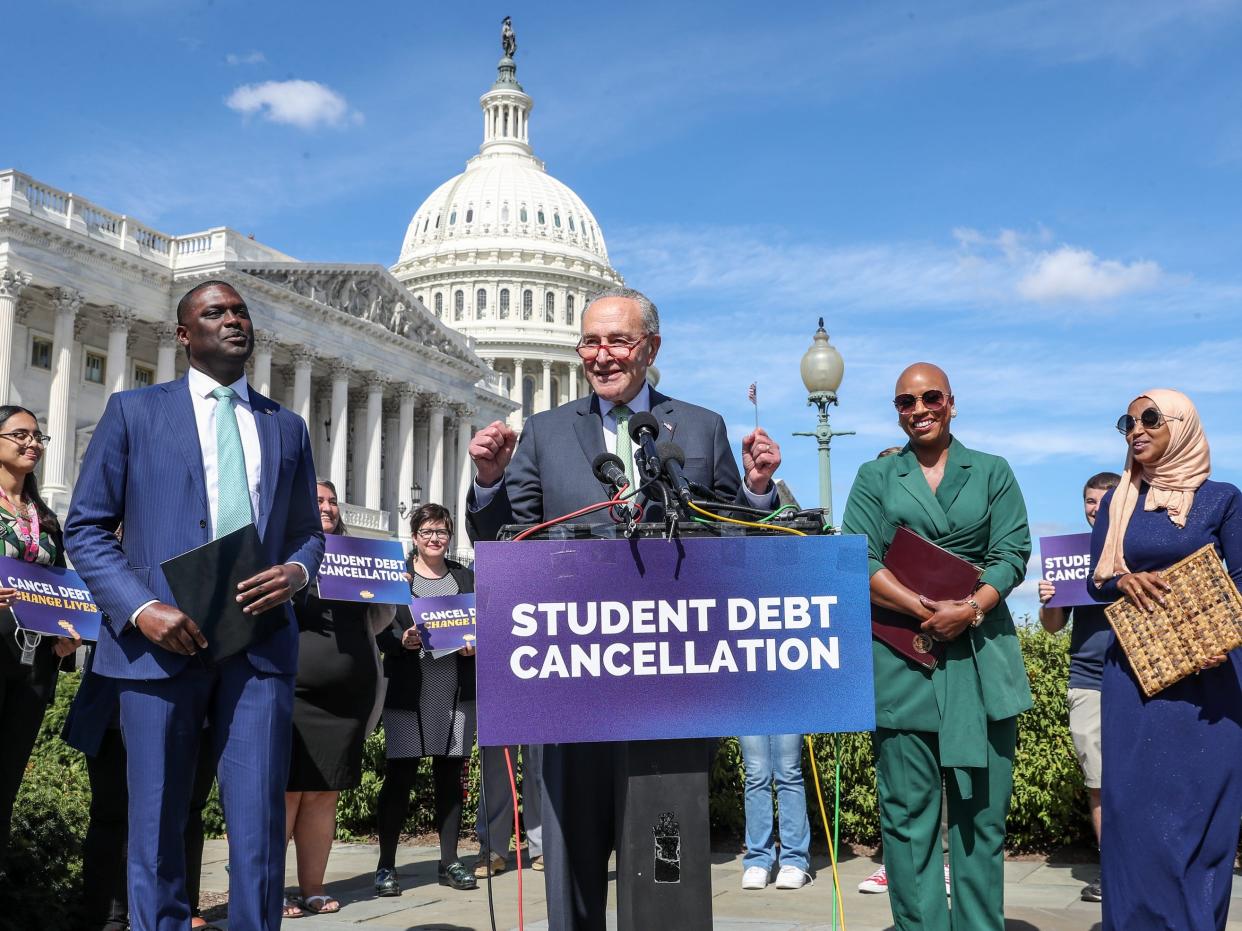

The debate over how or if to forgive student debt has split the country.

Half of Americans support forgiving up to $20,000 in federal student loan debt, a figure that soars to 83% among those who have student loans. Forgiving all student loan debt still maintains 39% support, a remarkably high figure for a fiscal policy that even a decade ago would have been an utter non-starter politically.

Advocates of forgiveness have a case. Americans owe just south of $1.6 trillion in student loan debt. It's a financial dead weight on the neck of an emerging generation. People with debt will delay critical life milestones — marriage, home ownership, having children — that would otherwise bolster the economy and country as a whole. It undermines the financial autonomy of millions of Americans, and the country would be better if Uncle Sam snapped his fingers and eliminated it.

Opponents of forgiveness have a case, too. The choice to go to college is one that not everyone makes, and why should someone who decided on a less financially onerous educational path subsidize the education of someone who did? Why should an electrician pay the tab of a liberal arts major? They knew what they were signing up for. There were other pathways — the military among them — that many took advantage of in order to avoid having debt. Why should the government hand over a fortune to the educated?

I personally favor forgiveness over the status quo — I paid off my student loans after ten years of monthly payments that neared $1,000, but I don't think that is a viable long-term strategy for developing an educated democracy of equal opportunity — but I am very sympathetic to the opponent's case as well.

There is a compromise here.

The problem is the interest.

Few people who graduate from college will have enough money to pay back their loans immediately. That would not be an issue, except for the fact that these are interest-bearing loans given out by the federal government.

The main argument for some manner of student loan forgiveness is the sheer number of Americans who have made payments for years, but currently owe more now than they did at the outset. These people are legion. Spending any amount of time reading their stories paints a picture of irrecoverable financial devastation. Take just one example from that Luke O'Neill blog:

By my reckoning I have paid out a total of $112,000 since 2008 on a $90,000 balance after graduation. Have refinanced/consolidated a few times to push interest rate down. Currently owe $69,000. I'm glad that it hasn't gone up but Jesus Christ people you've made your money.

This person should not owe student loans. They have paid back the full balance and then some, but are still a decade away from paying off that debt. This is a policy failure.

But, if the government were to immediately forgive principal, some argue that might open up the system to moral hazard. Universities probably should be charging less money, but if the government indicates that prices won't actually matter, there will be less incentive for students to discriminate based on price. That would be bad, and could lead to price gouging from many colleges and universities.

It's worth remembering why it is that the federal government bothers to offer student loans anyway. In a multi-polar world, an educated population means that the services- and innovation-based economy that has made the United States a superpower requires a great deal of investment. Offering capital to students to pursue higher ed is, arguably, a matter of national security.

Universities, besides their outward goal of educating kids after high school, also serve as a massive research and development investment laundered through that tuition money. That R&D goes on to foster companies and inventions that make America rich. It's good that the feds offer to front the money so that people who need it can go to college.

The government doesn't need the vig on student debt to make money. It makes money from the taxes on the companies and intellectual property and research and development that happens when you front the money for smart people to hang out together.

The problem is the interest. Clearly, the interest burden on student loans has in some cases spiraled out of control. People who have paid back their initial balance, sometimes multiple times, are still in the hole because they were unable to make that money fast enough.

As a result, an equitable solution is this: retroactively adjust the interest rate on federal student loans to be at or near zero. Based on the interest accrued over the life of the loan, forgive that amount. The remaining balance is the original principal minus the amount paid back over the course of the loan. If the loan has been paid off, the amount of excess interest paid is applied as a federal tax credit over the course of several years.

Why this works

This is not a giveaway -- it's an adjustment to the terms of interest.

The individual who decided to forgo college and pursue a trade is giving nothing to the individual who pursued a degree in higher ed. That college student is still on the hook for the principal amount of the loan they took out.

The individual who took out a loan and then paid it off in time was not a schmuck for doing so. Indeed, they can anticipate a small tax credit moving forward based on the information from their IRS Form 1098-E filings.

The individual who has paid back the principal of their loan but still finds themselves underwater is now free of the debt burden.

The person who is in the middle of paying off a loan is probably still in the middle of paying off that loan. They'll have a more direct manner in which to do that.

The government has successfully accomplished its real goal: Many people got to and will continue to get to go to college, improving the United States economy and starting companies and fueling research. It just no longer operates that program at a direct profit from the 18-year-olds who signed up to it, instead taking those profits in the form of taxes on the subsequent increased economic activity.

There's a bill that's trying to do this looking forward. But by applying it retroactively, the government can make a bad situation right.

Read the original article on Business Insider