Seasonality Says Buy the Dip on This Blue Chip

The S&P 500 Index (SPX) is on pace to end March with a modest 0.4% gain, which would mark the index's third straight month in the black. Looking ahead, April tends to bode well for Wall Street, with the SPDR S&P 500 ETF Trust (SPY) -- an exchange-traded fund (ETF) that mimics the S&P 500 -- ending the month higher nine of the past 10 years. Below, we take a look at individual stocks that tend to shine in April, including blue chip American Express Company (NYSE:AXP), which is down today on FAANG competition fears.

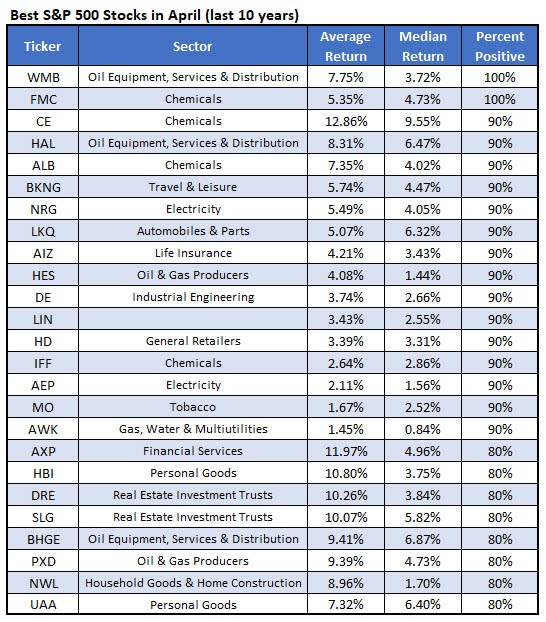

Here are the 25 top SPX stocks to own in April, looking back 10 years. To make the list -- cultivated by Schaeffer's Senior Quantitative Analyst Rocky White -- stocks had to have at least eight years' worth of returns.

American Express stock has averaged an April gain of nearly 12% in the past decade -- the second-highest average return on the list above. Further, AXP has ended the month higher 80% of the time.

Today, the Dow stock is down 0.9% at $108.51, after Apple (AAPL) unveiled a new credit card. The security just last week peaked at $114.25 -- within a point of its Dec. 3 all-time high of $114.55. Even with the recent pullback, AXP has added more than 21% in the past three months. Another 12% April rally from current levels would put the credit card concern around $121.53 -- well into uncharted territory.

Should American Express once again outperform next month, a round of upbeat analyst attention could add fuel to the security's fire. Despite its stellar 2019 performance thus far, the majority of analysts following AXP maintain tepid "hold" ratings. Further, the consensus 12-month price target of $117.70 represents expected upside of just 8.4% to the stock's current perch, leaving the door open for potential price-target hikes to lure more buyers to the table.