Seattle Genetics Options Volume Skyrockets as Shares Soar

While drug distributors like McKesson (MCK) and Cardinal Health (CAH) are swimming in red ink amid reports of eleventh-hour legal settlements over the opioid crisis, the shares of Seattle Genetics, Inc. (NASDAQ:SGEN) are near the top of the Nasdaq today. The biotech stock is pacing for its best day since July -- and just notched an all-time high -- after the company reported encouraging data from its breast cancer drug trial. As such, analysts and options traders are betting bullishly on SGEN shares today.

Seattle Genetics said its experimental drug tucatinib -- combined with a pair of other drugs -- successfully delayed the advancement of a certain breast cancer, and was generally well tolerated. In addition, patients' survival rate increased 34% compared to those taking the other two drugs alone. Meanwhile, patients with brain metastases saw a their risk of disease progression or death decrease by 52%. The pharmaceutical concern expects to file for Food & Drug Administration (FDA) approval in the second quarter of next year.

As a result, analysts at SVB Leerink expect tucatinib to generate $427 million in global sales among those afflicted with breast cancer. Needham, meanwhile, hiked its price target on SGEN stock by nearly 50%, to $121 from $81 -- in uncharted territory for the shares.

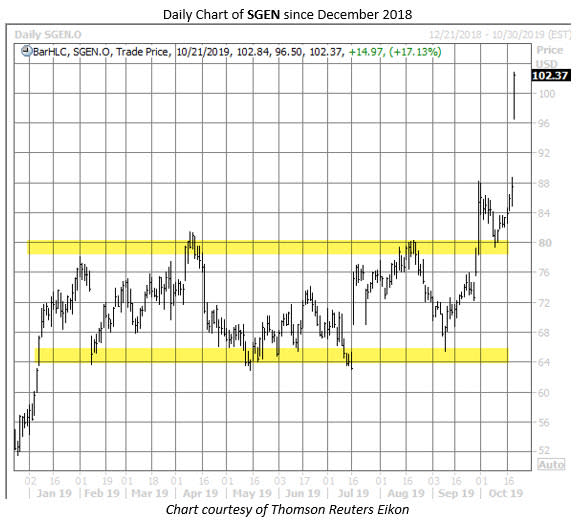

The security was last seen 17.1% higher at $102.37, fresh off a record high of $102.84. SGEN spent most of 2019 range-bound, bouncing between support in the $64-$65 area and resistance in the $80 region. However, the stock broke north of this range in late September, thanks to encouraging data on the company's bladder cancer treatment, and is pacing for its seventh gain in eight sessions.

As alluded to earlier, options traders are rushing to Seattle Genetics today, especially on the call side. Roughly 6,300 calls have changed hands -- nearly nine times the stock's average daily call volume. On the flip side, just over 1,000 SGEN puts have traded -- two times the norm.

Garnering the most attention is the December 120 call, where nearly 1,400 contracts have traded. With new positions being opened at the out-of-the-money strike, the call buyers are hoping SGEN shares extend their journey north and topple $120 by the time the options expire on Friday, Dec. 20.

On the other hand, the buyers could be Seattle Genetics short sellers seeking an options hedge. Short interest accounts for roughly 6.8 million SGEN shares, representing nearly seven sessions' worth of pent-up buying demand, at the equity's average daily trading volume. By purchasing out-of-the-money calls, shorts can limit losses in the event of an extended rally heading into 2020.