Sectors Contrarians Should be Targeting Right Now

This week I’m doing a quick-and-dirty sector analysis using our contrarian philosophy. I occasionally do these sector glances in this column but I haven’t done one since the depths of the coronavirus crash, so I believe it’s a good time to see how it looks.

For those unfamiliar with our contrarian philosophy, we don’t automatically go against what the crowd believes. We consider the sentiment toward a stock in context of how that stock is performing. If a stock is down sharply then a certain amount of pessimism is expected and can be disregarded. An ideal set up for us is when a stock is trending higher but despite that, the crowd continues to despise it. That pessimism is an indication of a lot of sideline money, and if all those naysayers capitulate at once as the stock is climbing, then it can propel the stock even higher in a short amount of time. The opposite is also true. A downward trending stock that the public loves is vulnerable to more declines.

Below, I list the best and worst performing sectors and gauge their sentiment. Then I show some individual stocks to buy or avoid based on the analysis.

Bullish Sector & Stocks

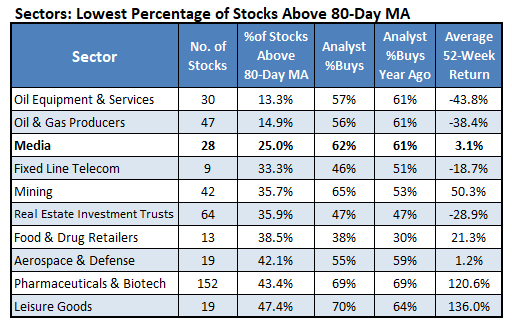

We have about 1,200 stocks grouped into 35 different sectors. To measure how their stocks are performing, the table below shows which sectors have the highest percentage of stocks trading above their 80-day moving average. To assess the sentiment toward the sectors, I aggregate the buy/sell/hold data we get from Zacks to see the percentage of analysts that rate the stocks within the sector a buy. I also show this percentage a year ago to see if analysts are becoming more bullish or bearish on the stocks in the sectors. Finally, I have the average 52-week return for the stocks in each sector.

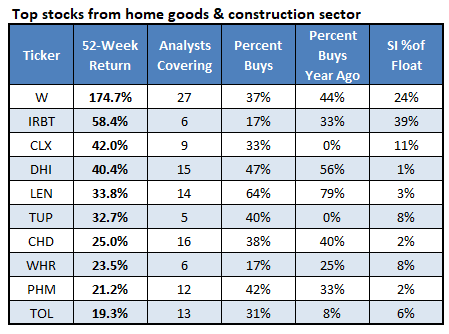

The very first sector on the list, Home Goods and Construction, is interesting. It has the highest percentage of stocks above their 80-day moving average but only 44% of analysts have a buy rating on the stocks. Analysts have not gotten more bullish on this sector from a year ago despite the outstanding returns.

Here are some of my favorite stocks from the home goods and construction sector. Most of these stocks are huge outperformers. For reference, the S&P 500 Index (SPX) is up about 15% over the past 52 weeks. The first one on the list is Wayfair (W). Despite its 175% return over the past year, only 37% of analysts rate the stock a buy. That is lower than a year ago when 44% rated it a buy. This, along with the fact it’s highly shorted, makes it an interesting stock to consider for a long play.

Bearish Sectors & Stocks

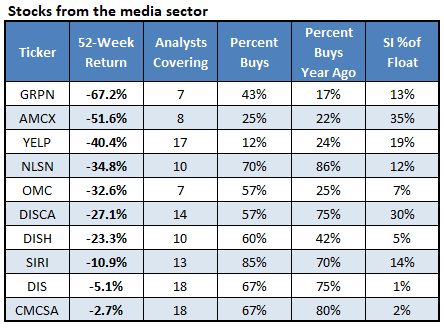

Now for the contrarian bearish setups. The table below shows the sectors that have the smallest percentage of their stocks above the 80-day moving average. Oil has performed horribly and a significant number of analysts still like those stocks. I’m going to focus, however, on the media sector stocks. Only a quarter of those stocks are trading above their 80-day moving average but 62% of analysts have a buy rating on those stocks. Furthermore, the percentage of buys now is slightly higher than a year ago.

Below are some poor performing stocks from the media sector. Disney (DIS) is interesting. Even though it’s down 5% over the past year, two-thirds of analyst rate it a buy. That’s an example of a stock which has underperformed yet analysts are still bullish.