See the 10 types of new US Navy warships plagued by shipbuilding delays

The US Navy's highly-anticipated shipbuilding projects are years behind schedule, a review found.

The Navy attributed the delays to pandemic-related supply chain issues.

The delayed warships include submarines, guided missile destroyers, and a new aircraft carrier.

All of the US Navy's highly anticipated shipbuilding projects face yearslong delays, the service said earlier this month.

The delayed ships include a new fleet of Virginia-class attack submarines, guided-missile destroyers, and a new Gerald R. Ford-class aircraft carrier.

The announcement came after a 45-day review ordered by Secretary of the Navy Carlos Del Toro in January. The review identified the "shortfalls" that caused the delays, including labor shortages and supply chain issues.

Speaking at the Navy League's Sea Air Space conference on April 9, Del Toro said the review found that "too many of our industry partners are behind schedule and over budget on our highest priority programs."

Del Toro also said the Navy's Office of Strategic Assessment will perform a "deep dive" to find solutions to address the delays, including advanced material procurement and multi-ship buys.

"I think there's a lot of promise about being able to reduce those timelines into the future," he said.

The major delays come amid concerns that China is outpacing American shipbuilding and increasing its naval capabilities. The US Department of Defense said China now has "the largest navy in the world with a battle force of over 370 platforms," and it is only expected to grow — with up to 435 ships by the end of the decade.

But China isn't the only shipbuilding superpower in the Indo-Pacific. The Navy secretary said he and his team were "floored" by US ally South Korea's shipbuilding capabilities.

In a February statement, the Navy recognized Korean and Japanese shipbuilding as an asset to the US as "China continues to aggressively pursue worldwide shipbuilding dominance."

A new Ford-class aircraft carrier

Last month, the Navy announced that the future aircraft carrier Enterprise (CVN 80), the third Gerald R. Ford-class carrier, is set to deliver a year and a half behind schedule.

Contracted to Huntington Ingalls Industries' Newport News Shipbuilding — the US's only aircraft carrier builder — the Enterprise was initially scheduled to deliver by March 2028. However, the Navy's shipbuilding review found that it will now deliver in September 2029 from the earliest to May 2030 at the latest.

In August 2022, Olympians Simone Biles and Katie Ledecky commemorated the keel-laying of the Enterprise in a ceremony in Virginia, chalking their initials on the ship's steel plates.

Production delays have plagued all of the Ford-class carriers. The second-in-class John F. Kennedy was set to deliver in June 2024 but was delayed a year so the Navy could perform more work to prepare it for deployment in the Indo-Pacific.

The first-in-class USS Gerald R. Ford also faced its fair share of delays, deploying in May 2023 — a few months before the 10-year anniversary of its 2013 launch. Then-Chief of Naval Operations Adm. Michael Gilday said it was the supercarrier's new, untested technologies that contributed to cost overruns and its yearslong delay.

"We had 23 new technologies on that ship, which quite frankly increased the risk … of delivery on time and cost right from the get-go," Gilday said during Navy League's symposium in 2021.

"We really shouldn't introduce more than maybe one or two new technologies on any complex platform like that in order to make sure that we keep risk at a manageable level," Gilday continued.

Guided-missile frigates

The first-in-class PCU Constellation, a guided-missile frigate, has been under construction since August 2022.

It was the first time a new frigate had been built since the 1980s, when USS Ingraham, the last Oliver Hazard Perry-class frigate, was built.

Italian shipbuilding company Fincantieri Marinette Marine was awarded the contract for the first-in-class warship in 2020, as well as sister ships, Chesapeake and Congress. The company also has contract options for seven additional ships.

The next-generation small surface combatant is designed for multi-mission capabilities, including air, surface, and underwater warfare. The versatile frigate features an advanced 3D air surveillance radar, sonar, a Mk 41 vertical launch system, and an upgraded version of the Aegis Combat System, which operates aboard Arleigh Burke-class guided-missile destroyers.

But the Constellation also faces significant delays, with its delivery pushed back by three years from its original 2026 date, according to the Navy's shipbuilding review. Last Friday, the Navy held a keel-laying ceremony for the Constellation at the Wisconsin shipyard.

"I'm not here to put blame on mistakes that were made in the past either by Fincantieri or the Navy," Del Toro said. "I want to move this forward more aggressively to a better place. And so we're going to work as a team, with industry, with the government, to get us there quicker. And that's what we're doing."

Ballistic missile submarines

With the US Navy's submarine fleet carrying about 70% of the deployed US nuclear arsenal, the service's highest priority shipbuilding program is a new fleet of "boomers" to carry them.

In June 2022, the Navy laid the keel for the future District of Columbia, the lead ship of the upcoming class of nuclear-powered ballistic missile subs that will replace the 14 existing Ohio-class submarines.

The Columbia-class submarines will be the largest submarines ever built by the US, measuring 560 feet long and 43 feet wide. The Columbia is designed to carry Mk 48 Advanced Capability torpedoes and 16 Trident II D5 nuclear ballistic missiles. It will also feature "superior acoustic performance and state-of-the-art sensors to make it the most capable and quiet submarine ever built," according to the Navy.

Construction on the first-in-class submarine began in 2021, designed in collaboration between General Dynamics' Electric Boat and HII's Newport News. The stern of the boat was delivered to a facility in Rhode Island in January 2024.

The Navy plans to build 12 Columbia-class boats in a $136 billion contract, with the District of Columbia and future Wisconsin being the only two ordered so far.

However, the Navy's review found that the lead ship's delivery could be pushed back at least 12 to 16 months. The District of Columbia was scheduled to deliver in October 2027, the same year the first Ohio-class submarine, USS Henry M. Jackson, is set to decommission. The delays, brought on by ballooning costs, workforce shortages, and late supply deliveries, could prompt the Navy to keep its aging Ohio-class submarines a while longer.

"A delay of that length would make it more likely for the Navy to implement its backup plan to extend the service lives of up to five Ohio-class by a little bit," Ronald O'Rourke, a naval analyst for the Congressional Research Service, told Bloomberg. "There would be some cost for doing those service life extensions."

Virginia Block IV submarines

Pandemic-related supply chain issues and workforce shortages also impacted the upcoming Block IV Virginia-class fast-attack submarines, putting the program three years behind schedule.

These attack submarines are contracted to Electric Boat and Newport News, the same shipbuilders and suppliers as the higher-priority Columbia-class boats.

Virginia Block IV submarines differ from Block III in that the design is focused on reducing procurement costs and maintenance periods through smaller-scale design changes. Block IV boats will still have the same armament as Block III, carrying Mk 48 torpedos and Tomahawk cruise missiles.

Four of the 10 submarines in Block IV are in service: USS Vermont, Oregon, Montana, and Hyman G. Rickover. Three Block IV vessels have yet to be commissioned — PCUs New Jersey, Iowa, and Massachusetts — and three are still under construction — PCUs Idaho, Arkansas, and Utah.

Virginia Block V submarines

Ten Virginia-class Block V attack submarines are also under construction in a $24.1 billion contract awarded to Electric Boat and Newport News in December 2019, the Navy's largest-ever shipbuilding contract.

According to a report from the Congressional Research Service, the design of Block V boats differs from that of Block IV boats by about 20%, including acoustic superiority, additional payload tubes, and a high-resolution photonic mast.

The Block V submarine is designed to be 461 feet and displace 10,200 tons, making it the second-largest US submarine behind the Ohio class.

The additional length comes from the Virginia Payload Module, an 84-foot-long extension that expands the sub's missile capacity. With the VPM, Block V boats increase the number of Tomahawk missiles they can carry from 12 to 40. The VPM can also be used to store and deploy additional payloads, such as missiles, seabed sensors, or sea drones.

While the Virginia-class boats are not as well-armed as the Seawolf-class fast-attack submarines, the Block V boats will be equipped with a larger launcher that can deploy advanced hypersonic missile technology as it becomes available, including a new version of the anti-ship Maritime Strike Tomahawk.

Three boats have been laid down so far, PCUs Oklahoma, Arizona, and Tang, with another seven ordered that have yet to begin construction.

However, the Block V submarines have faced problems since they were ordered in 2019, with insufficient staffing and workforce efficiency potentially pushing back their projected delivery by an average of two years.

Ocean surveillance ships

In response to China and Russia continuing to modernize their naval capabilities, including submarine activity, the US Navy is looking to procure a new fleet of ocean surveillance ships, designated TAGOS-25.

The unarmed naval surveillance vessels are designed to operate surveillance patrols for submarines and are maintained by civilian contractors for the Military Sealift Command.

In 2022, the Navy initially procured the first vessel of the planned TAGOS-25 class at a cost of $434.4 million from Alabama-based shipbuilder Austal USA.

But two years later, the cost skyrocketed to $789.6 million in the Navy's 2024 budget submission — an 81.8% increase — due to factors like "direct material inflation, supply chain challenges, and increased nonrecurring engineering costs," according to the Congressional Research Service.

As a result, the Navy proposed to defer the procurement of a second TAGOS-25-class ship from 2025 to 2026 to cover the additional costs. Nonetheless, Austal USA was also awarded a contract to design and construct seven more TAGOS-25-class vessels.

The future TAGOS-25 ships will succeed four Victorious-class vessels and USNS Impeccable, which entered service more than two decades ago.

The ships will be about 359 feet long and feature a catamaran-like Small Waterplane Area Twin Hull (SWATH) design. Powered by three diesel generators and a gas turbine, the vessel will travel at speeds of up to 22 knots with a range of 960 miles, making it the largest and fastest TAGOS ship operated by the US Navy.

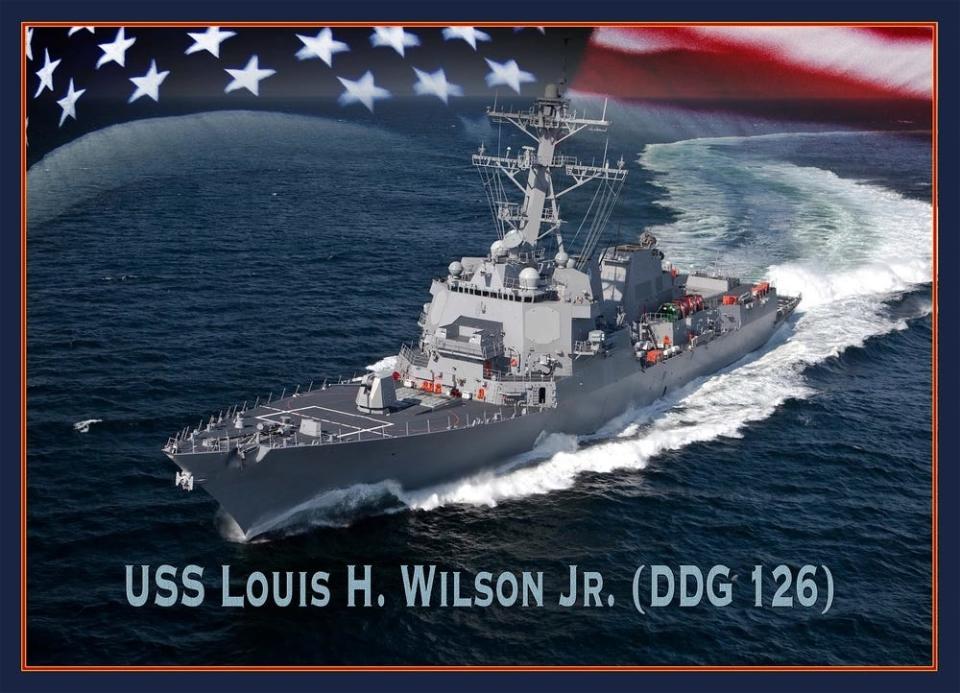

Guided-missile destroyers

The Arleigh Burke-class destroyer program is one of the Navy's longest-running shipbuilding programs. Since the first-in-class USS Arleigh Burke was commissioned on July 4, 1991, more than 70 destroyers have been added to the Navy's fleet, with dozens more still on deck for delivery.

The Navy is modernizing its existing warship fleet with an updated Flight III variant of the Aegis destroyers. The Flight III design includes an upgraded Aegis Weapons System and a new SPY-6 radar, enhancing its air defense operations.

The Flight III contract was awarded to General Dynamics/Bath Iron Works and Huntington Ingalls Industries/Ingalls Shipbuilding, costing about $2.5 billion per vessel. While the program schedule is still stable despite late delivery dates, the limited capacity of the shipbuilding industry reduced the procurement rate of DDG-51s a year despite Congress pushing for more.

"I'm not hating on DDGs — my only point was that last year Congress added a third, and the reason we didn't budget for three is, again, we don't see the yards being able to produce three a year," Mike McCord, the Pentagon's top budget officer, told USNI News at a 2023 conference. "We don't see them being able to produce two a year. And that's just data. It's not what we wish to be true."

"Everybody's struggling with skilled labor. Everybody's struggling with supply chain," McCord added. "So it's not getting better very fast from the data that I've seen — whether with submarines or DDGs. So two a year seems to be a reasonable place."

Helicopter-carrying assault ships

Built by Huntington Ingalls Industries/Ingalls Shipbuilding, the Navy is currently procuring large-deck amphibious helicopter-carrying assault ships, designated LHA. These "big deck" ships carry Marine aviators and landing craft.

The Navy's 2024 budget submission estimates the procurement cost for the fourth America-class ship, PCU Fallujah, at $3.8 billion, which has been incrementally funded by Congress over the last few years.

The Fallujah will feature a similar design to USS America, but the new vessel will have a larger deck configuration to accommodate F-35B Joint Strike Fighter and MV-22 Osprey aircraft, as well as a well deck that floods to launch landing craft.

The Fallujah's predecessor, PCU Bougainville, was delayed by over a year due to engine defects and staff shortages, now expected to be delivered in 2025. The Navy also plans to buy the next America-class ship, LHA-10, nearly a decade after the Fallujah will be potentially procured, which could lead to cost increases and impacts on the shipbuilding industrial base.

"Between LHA-9 and LHA-10, there's an 11-year gap, depending on when you decide it was appropriated," Lt. Gen. Karsten Heckl, deputy commandant of the Marine Corps, said in a 2022 congressional hearing. "We're returning to well decks with the flight deck; it's a very capable platform, very important to what we're doing, very important to the nation's crisis response force."

Amphibious transport dock ships

Designed and constructed by Ingalls Shipbuilding, the forthcoming variant of San Antonio-class amphibious transport dock ships was planned to replace the Navy's existing class of dock landing ships (LSDs), which were set for early retirement after the Defense Department found them to be in "poor material condition."

The three Flight II San Antonio-class vessels, the first of which is the future Harrisburg, will feature an advanced air surveillance radar and a new steel mast. Overall, they will equal the capabilities of the Flight I ship with lower production costs.

Last year, the Navy halted plans to buy any more future San Antonio-class ships to reassess their worth compared to the Flight I design, especially amid growing costs and delays in the shipyard.

The pause on shipbuilding, in conjunction with the early retirement of the LSDs, could reduce the amphibious fleet to below 31 ships, potentially violating the legally required minimum in the 2023 National Defense Authorization Act.

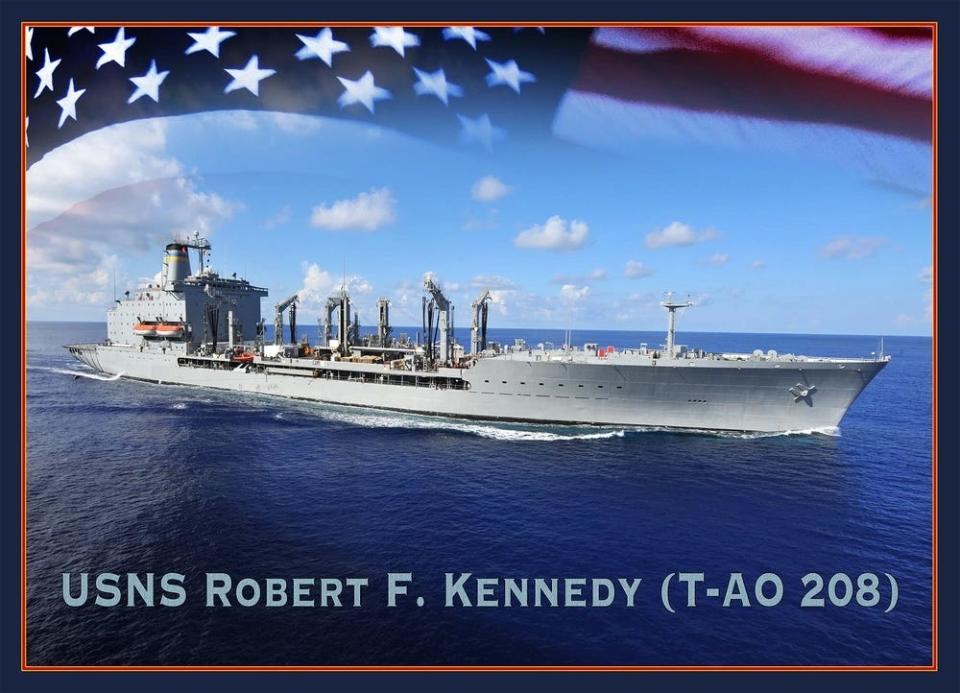

Fleet replenishment oil tankers

Shipyard delays and ballooning costs aren't just impacting the Navy's warships and submarines but also its newest class of replenishment oil tankers.

Since the first-in-class John Lewis-class oiler was procured in 2016, the Navy plans to buy a total of 20 ships in a contract with General Dynamics National Steel and Shipbuilding (NASSCO). The ships are expected to cost about $650 million each.

While transporting fuel for ships and aircraft during replenishments-at-sea is one of the vessel's primary missions, it can also supply dry cargo, fresh water, and ammunition at sea. The tanker can also be armed with a close-in weapon system or anti-ship missile defense system to detect and engage cruise missiles. It is also fitted with a defense system to counter torpedo attacks and fast-attack craft.

The lead ship, PCU John Lewis, was originally scheduled to deliver in August 2020, but it was ultimately delivered almost two years later in July 2022, also pushing back subsequent ship deliveries by 12 to 15 months.

According to a report from the Congressional Research Service, several factors contributed to the Lewis' delay, including late delivery of materials, a need to rework parts of the ship, and the shipbuilder's dry dock flooding in 2018.

Read the original article on Business Insider