Will Segmental Performance Hurt L3Harris (LHX) Q4 Earnings?

L3Harris Technologies, Inc. LHX is slated to report fourth-quarter 2021 results on Jan 31, 2022, before the market opens.

L3Harris Technologies has a four-quarter earnings surprise of 3.90%, on average. Its fourth-quarter results might have been impacted by factors like business divestiture and supply-chain challenges, such as shortages of electronics and other components. However, integration benefits and pension adjustments can be projected to have contributed favorably.

Integrated Mission Systems’ ISR Order to Boost Growth

A follow-on Intelligence, Surveillance, Reconnaissanceaircraft award timing from the NATO customer for which revenues had been booked in October 2021, is expected to have contributed favorably to revenues of L3Harris’ Integrated Mission Systems in the fourth quarter. Also, higher revenues from maritime business growth can be projected to have boosted this segment’s top line.

The Zacks Consensus Estimate for the Integrated Mission Systems segment’s fourth-quarter revenues, pegged at $1,649 million, suggests an improvement of 12.6% from the year-ago quarter’s reported figure.

Space and Airborne Systems – a Revenue Contributor

Space and Airborne Systems is likely to reflect a favorable outcome from an increase in missile defense and other responsive programs. However, this might have been partially offset by lower revenues in Mission Avionics, Electronic Warfare and Intel and Cyber.

The Zacks Consensus Estimate for the Space and Airborne Systems segment’s fourth-quarter revenues, pegged at $1,455 million, suggests an improvement of 15.8% from the year-ago quarter’s reported figure.

Communication Systems’ Component Shortage – a Drag on Revenues

The communication segment is expected to reflect the impact of the global electronic component shortage that might have had a negative impact on its product and electronics-focused businesses in particular and tactical communications, resulting in a delay in the fulfillment of orders. This might have weighed down on the communication systems unit’s revenues in the soon-to-be-reported quarter.

Aviation Systems Remains Gloomy

Revenues from the Aviation Systems business unit are expected to reflect the impact of divestitures of the military training and CPS businesses. This, in turn, must have weighed down the segment’s revenues in the soon-to-be-reported quarter. However, the recovery in commercial aerospace might have contributed favorably to this segment’s revenues, thus mitigating the downside effect on its revenues to some extent in the fourth quarter.

The Zacks Consensus Estimate for the Space and Airborne Systems segment’s fourth-quarter revenues, pegged at $648 million, suggests a decline of 23.3% from the year-ago quarter’s reported figure.

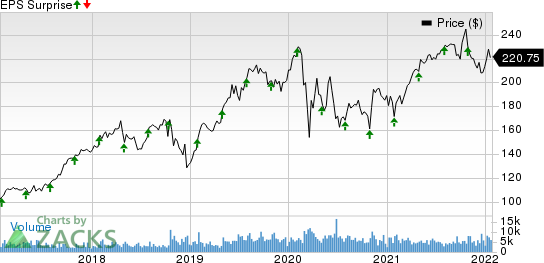

L3Harris Technologies Inc Price and EPS Surprise

L3Harris Technologies Inc price-eps-surprise | L3Harris Technologies Inc Quote

Fourth-Quarter Estimates

With the majority of L3Harris Technologies’ segments anticipated to report lower sales, one can remain skeptical about the company’s top line in the soon-to-be-reported quarter. The impact from business divestiture and supply-chain challenges, such as shortages of electronics and other components are some of the factors that might have had an adverse impact on the company’s overall fourth-quarter top line.

The Zacks Consensus Estimate for fourth-quarter sales is pegged at $4.47 billion, indicating a decrease of 4.1% from the prior-year reported figure.

L3Harris Technologies might reflect a favorable impact from cost management and integration benefits as well as increased pension income, which might have added impetus to its bottom line in the soon-to-be-reported quarter. The Zacks Consensus Estimate for fourth-quarter earningsis pegged at $3.25 per share, indicating an increase of 3.5% from the prior-year reported figure.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for LHX this time. The combination of a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that is not the case here.

L3Harris Technologies has an Earnings ESP of -2.00% and a Zacks Rank. You can uncover the best stocks to buy or sell, before they’re reported, with our Earnings ESP Filter.

Stocks to Consider

Here are three defense players you may want to consider as they have the right combination of elements to post an earnings beat this season:

Aerojet Rocketdyne HoldingsAJRD has an Earnings ESP of +2.00% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Aerojet has a four-quarter average negative earnings surprise of 2.17%. The Zacks Consensus Estimate for AJRD’s fourth-quarter sales and earnings is pegged at $578.5 million and 50 cents per share, respectively.

Virgin Galactic Holdings, Inc. SPCE has an Earnings ESP of +26.12% and a Zacks Rank #2. Virgin Galactic has a four-quarter average negative earnings surprise of 33.86%.

The Zacks Consensus Estimate for SPCE’s fourth-quarter earnings is pegged at a loss of 39 cents per share, indicating a decline of 25.8% from the prior-year quarter’s reported figure. Its 2021 sales estimate, pegged at $3.12 million, suggests a huge improvement when compared to $0.24 million reported in the year-ago quarter.

Triumph Group TGI has an Earnings ESP of +1.01% and a Zacks Rank #3. Triumph Group delivered a four-quarter average earnings surprise of 101.89%.

The Zacks Consensus Estimate for TGI’s fourth-quarter sales and earnings is pegged at $368.8 million and 20 cents per share, respectively. Triumph Group boasts a long-term earnings growth rate of 2.6%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Triumph Group, Inc. (TGI) : Free Stock Analysis Report

Aerojet Rocketdyne Holdings, Inc. (AJRD) : Free Stock Analysis Report

L3Harris Technologies Inc (LHX) : Free Stock Analysis Report

Virgin Galactic Holdings, Inc. (SPCE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research