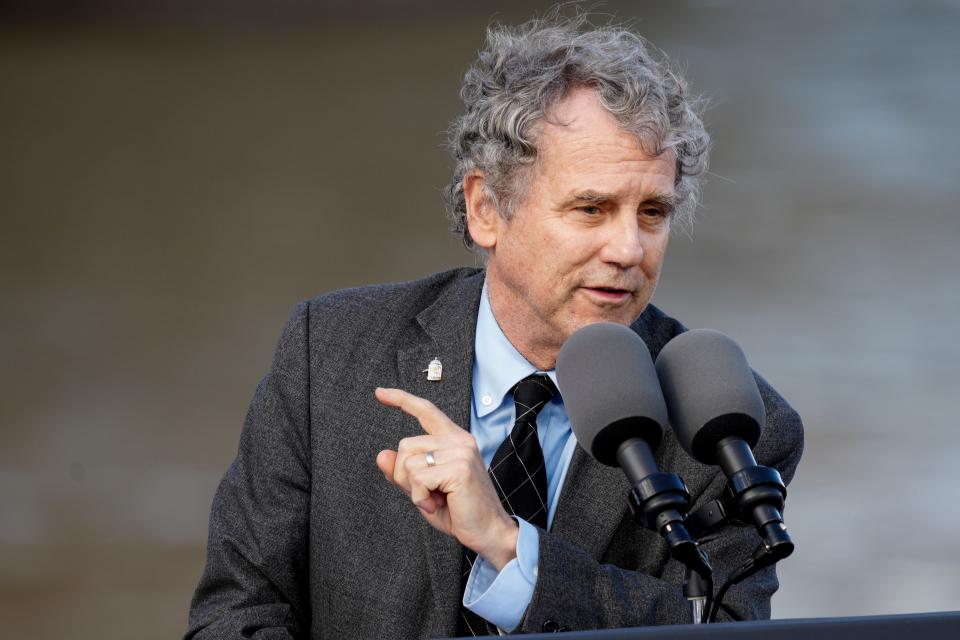

Sen. Sherrod Brown's bill aims to make corporate house buyers less profitable

- Oops!Something went wrong.Please try again later.

If you've been looking to buy a house, you may have cursed outside investors who have gobbled up much of the housing inventory in Greater Cincinnati and elsewhere.

Now, U.S. Sen. Sherrod Brown, a Cleveland Democrat, plans to introduce new legislation Tuesday that would eliminate some of the tax incentives for investors buying up large swaths of single-family homes and turning them into rentals.

The Stop Predatory Investing Act would prohibit investors buying 50 or more single-family rentals from deducting mortgage and other interest payments or depreciation on those properties from their taxes, reducing their tax savings by thousands of dollars.

The legislation is aimed at corporations backed by private equity firms that have been buying up large chunks of single-family homes across the nation and in Cincinnati.

Late last year, Brown held a press conference to discuss a letter he wrote to VineBrook Homes Trust, Inc., a real estate investment trust that owns thousands of homes in Cincinnati and has been accused of neglectful ownership practices as reported in The Enquirer.

The legislation, which is being co-sponsored by Sens. Ron Wyden, an Oregon Democrat, and Elizabeth Warren, a Massachusetts Democrat, among others, would apply to properties purchased by companies such as VineBrook.

Nationally, real estate investors purchased 48.6% fewer homes in the first quarter of 2023 than they did in the same period a year earlier as rising interest rates and home prices cut into potential profits, according to Redfin, a national real estate brokerage.

But investors continue to take a big share of housing stock off the market in many cities, including Cincinnati, contributing to severe housing shortages, skyrocketing home prices and rising rents.

“In too many communities in Ohio, big investors funded by Wall Street buy up homes that could have gone to first-time homebuyers, then jack up rent, neglect repairs, and threaten families with eviction,” Brown said in a statement.

In the Cincinnati metro area, investors bought just over 20% of the homes sold in the first three months of the year, ranking the Queen City No. 10 on the list of cities that saw the greatest share of investor purchases.

Fair housing advocates such as The Port, which has pushed back against investors snatching up homes from first-time homebuyers in recent years, applauded the proposed legislation.

"Curbing predatory practices by large institutional investors requires change at the local, state, and federal levels. The Port has worked closely with Senator Brown on this issue, and we are thankful for his unwavering commitment to tackling the challenges facing renters and incentivizing the construction of new housing supply in communities that need it the most,'' The Port's CEO Laura Brunner said in a statement.

It's hard to gauge the potential impact of the bill, at least in part because many corporate investors pay cash for the properties they buy, thereby eliminating mortgage interest payments.

However, investors also frequently take out non-mortgage loans to cover renovations and other expenses, and the interest on those loans also could not be deducted under the Stop Predatory Investing Act.

This article originally appeared on Cincinnati Enquirer: New bill would end deductions for some single-family rental properties