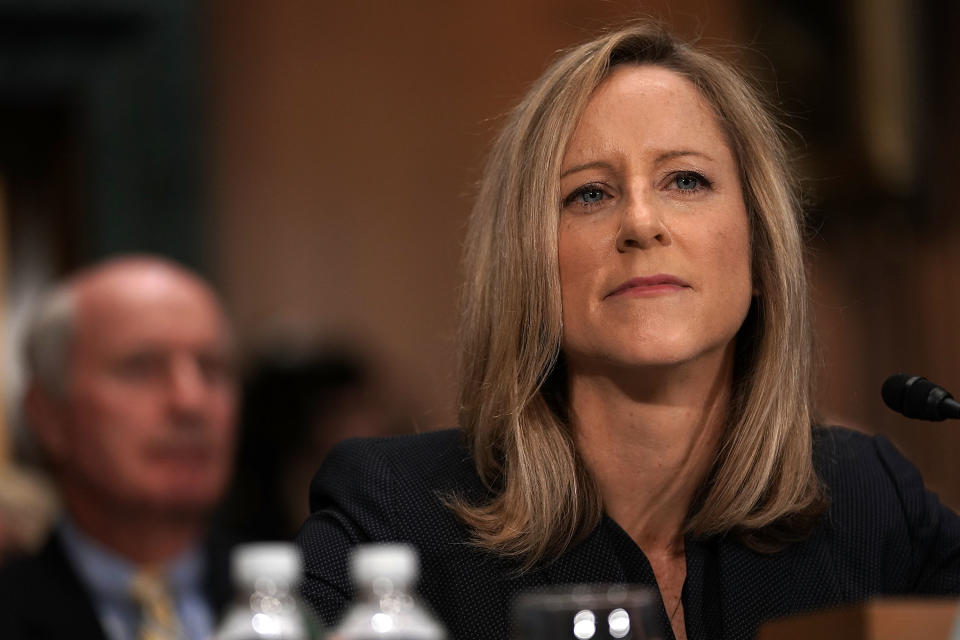

Democratic Senators tell CFPB’s Kraninger to ‘do your job’ in scathing letter

Lawmakers continue to berate Consumer Financial Protection Bureau (CFPB) Director Kathy Kraninger over failures related to the oversight of student loan servicers, blaming her for allowing the massive problems in the student loan system to “fester.”

In a new letter obtained exclusively by Yahoo Finance (embedded below), Senators Bob Menendez (D-NJ), Sherrod Brown (D-OH), Jack Reed (D-RI), Tina Smith (D-MN), Chris Van Hollen (D-MD), Catherine Cortez Masto (D-NV), Elizabeth Warren (D-MA) and Mark Warner (D-VA) chided Kraninger for her handling of federal student loans and student loan servicers, telling her that after two years of “widespread reports of mistakes and mismanagement by federal student loan servicers, it is time that you accept responsibility, stand up to Secretary DeVos, and do your job.”

Kraninger had previously indicated that she had tried to oversee the servicers but was stopped by the Department of Education (ED). On Tuesday, the senators pushed her to challenge Education Secretary Betsy DeVos on that decision.

“While you did not create this situation, you have allowed it to fester,” they wrote. “In the one year since you became Director, you have failed to confront the Department, seek a court order, or take any other measure to ensure the Bureau has access to the student loan information so that it can resume examinations of student loan servicers’ handling of federally owned loans.”

They asked her to take “immediate action to resume examinations of student loan servicers’ handling of loans owned by the federal government.”

Letter to CFPB by Aarthi on Scribd

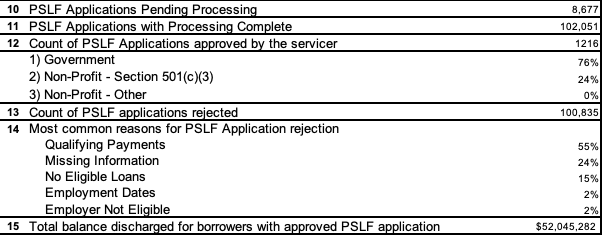

PSLF has a rejection rate of over 99%

Kraninger previously came under criticism from multiple senators on Capitol Hill in October when she appeared in front of the House Banking Committee.

They told her that they wanted her to launch examinations into the failings of the Public Service Loan Forgiveness (PSLF) plan. The program, which entitles public service workers to have their loans discharged after they make 120 monthly payments, had a 99% rejection rate at one point and has been a frustrating process for many. (One explanation for the ridiculously high rate is because many haven’t met the qualifying criteria, such as completing 120 payments.)

Kraninger, DeVos, and their respective agencies have since been sued by consumer advocates for “shirking their legal obligation” in supervising student loan servicers, especially those who handle federal loans.

“The Trump administration is breaking the law and our supporters can no longer trust the government to work in their best interests,” Student Debt Crisis Executive Director Natalia Abrams stated. “They truly feel they have no one to turn to.”

Overall, outstanding student loans rose to $1.5 trillion — a $20 billion increase and a 1.4% growth from the previous quarter, according to the NY Fed. The data also determined that 11% of student debt was more than 90 days delinquent or in default in the last quarter.

‘Dire consequences for borrowers’

In a previous letter to Massachusetts Senator Warren, Kraninger had indicated that when the CFPB had tried to undertake supervisory examinations, ED had stonewalled her and terminated Memoranda of Understanding (MOUs) with the CFPB on information-sharing over complaints, and supervisory and oversight cooperation.

The department — which is “the largest participant in the student lending market” — had “declined to produce information” that the agency needed, she wrote.

The obstruction “has had dire consequences for borrowers,” the senators wrote on Tuesday. They noted reports by the Government Accountability Office and the Department’s Inspector General indicating “widespread mistakes and mismanagement by federal student loan servicers that have harmed student loan borrowers.”

“I did what I was asked to do. I called, I made my payments on time. I paid every month,” public school teacher Kelly Finlaw told Congress in September. "After 10 years of making student loan payments, October 2017 was my month — my light at the end of the tunnel. I remember standing in my living room when the light at the tunnel went dark." Her application was rejected.

Others recounted similar experiences. “I called my then loan servicer to inquire about the [PSLF] program. And I was told by the person on the other end, you need to make 120 payments … [so] I thought, 'Well, okay, I'm going to follow this, this guidance that I've been given and continue making my payments,’” Gloria Evans, also a teacher, said in a press conference held by a teachers’ union. “I later learned that I was on the wrong payment plan — and had been for six years — and so those payments wouldn't be counted.”

Back in October, New Jersey Senator Menendez had told Kraninger that she had the power to overrule DeVos and force examinations on ED and seek court orders to make the student loan servicers turn over documents and added: “You don’t have to follow her lead.”

“We call on you to take immediate steps, including seeking a court order requiring the Department to provide access to the borrower information,” Menendez and the other senators argued in the letter, “so that the Bureau can resume examinations of student loan servicers’ handling of loans owned by the federal government.”

—

Aarthi is a writer for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

DeVos says Obama 'weaponized' rules created for defrauded students

Student loan reform group sues Education Secretary Betsy DeVos and CFPB Director Kathy Kraninger

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.