Seniors — and sometimes their children — face special income tax concerns

My 90-year-old mother's health got to the point where she was no longer ambulatory and could not take care of herself. An orthopedic surgeon told her she would need assisted living. If a doctor declares it, is the cost of assisted living deductible on an income tax return? S.P., snail mail

The above scenario and question lead us to point out some of the unique issues that can challenge taxpayers as they age. This week's column will focus on income tax ramifications for seniors and, in some situations, their children.

Tax Talk:High deductible health plans offer employees some benefits and a few burdens

Here's a checklist of some income tax items seniors (and their children) should be considering:

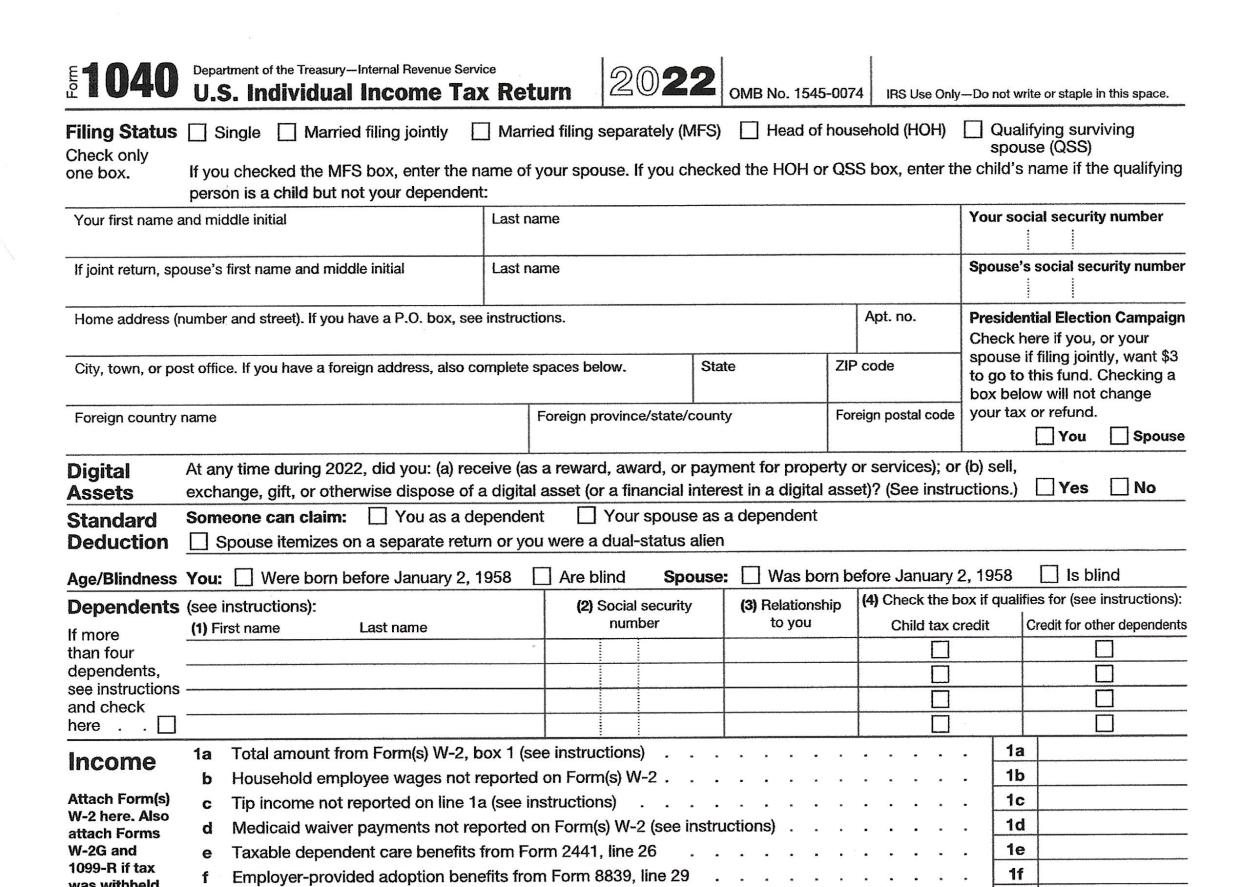

1. Do I still need to file federal or state income tax returns after I retire? (Short Answer is YES, because there are several provisions that specifically pertain to taxpayers who are at least 65 years old).

2. Can I still contribute to an IRA? (Short Answer is YES).

3. Do the contribution amounts and deductions change as I age? (Short Answer is check out Publication 554, Tax Guide for Seniors).

4. Does it make sense to itemize deductions?

5. Medical costs — which of these payments are deductible?

6. Can I take my parent as a dependent on my tax return?

7. Any special tax credits available for the elderly and/or their children? (Short answer is YES and Publication 554 cited above is helpful).

8. If I am no longer working and no payroll taxes are being withheld, do I need to make quarterly estimated payments? (Short answer is YES).

Because each of the above questions could fill several of our weekly columns, we'll address the items where a "Short Answer" is not provided.

Farm and Food:Paying the price for being sick, old or poor in rural America

SP's mother's medical expenses will come into play only if Mom's itemized deductions (Note: in addition to medical, they typically include state income and property taxes, charitable contributions, and mortgage interest) are higher than her standard deduction (i.e., $14,700 for Mom by herself; $28,700 if Mom and Dad are filing jointly in 2022, assuming both are over 65). Mom's medical expenses must be more than 7.5% of her Adjusted Gross Income (AGI). It's likely that assisted living expenses will exceed the 7.5% threshold, while IRS Publication 502, Medical and Dental Expenses provides a pretty exhaustive list of items (including capital expenditure) eligible for itemized deduction treatment.

The IRS requires two tests to be passed for "qualified long-term care services" (like assisted living) to be included in medical expenses. Namely: The expenses are (1) required by a "chronically ill individual” and (2) provided pursuant to a plan of care prescribed by a licensed health care practitioner.

To qualify as "chronically ill" (using the previous 12 months as a time horizon), a licensed health care practitioner must have certified (in writing) that the individual either is unable to perform at least two activities of daily living (ADL) without substantial assistance (Note: ADL are eating, toileting, transferring, bathing, dressing and continence) OR the individual requires substantial supervision due to severe cognitive impairment.

How about taking a parent as a dependent? There are rules for both the parent (i.e., typically must be single, pass citizenship and relational tests, and have gross taxable income under $4,400 in 2022) and the child (i.e., must provide over half of their parent's support for the year). The support total includes all money spent on support, including food stamps, housing assistance and other government assistance. If the parent is mentally incapable of caring for themselves, the child may be eligible for a dependent care credit. Details are available in Publication 503, Child and Dependent Care Expenses.

Rick Klee served as the tax director at the University of Notre Dame from 1998 through August 2019. A retired CPA, Klee is a graduate of Notre Dame. You can contact him at rklee@nd.edu.

Ken Milani is a professor of accountancy at Notre Dame where he served as the faculty coordinator of the Notre Dame Tax Assistance Program. Contact him at milani.1@nd.edu.

E-mail questions to either.

This article originally appeared on South Bend Tribune: Seniors face unique concerns regarding income taxes