The SergeFerrari Group (EPA:SEFER) Share Price Is Down 51% So Some Shareholders Are Wishing They Sold

As an investor its worth striving to ensure your overall portfolio beats the market average. But if you try your hand at stock picking, your risk returning less than the market. Unfortunately, that's been the case for longer term SergeFerrari Group SA (EPA:SEFER) shareholders, since the share price is down 51% in the last three years, falling well short of the market return of around 43%. And the ride hasn't got any smoother in recent times over the last year, with the price 48% lower in that time. Contrary to the longer term story, the last month has been good for stockholders, with a share price gain of 9.0%. However, this may be a matter of broader market optimism, since stocks are up 5.8% in the same time.

Check out our latest analysis for SergeFerrari Group

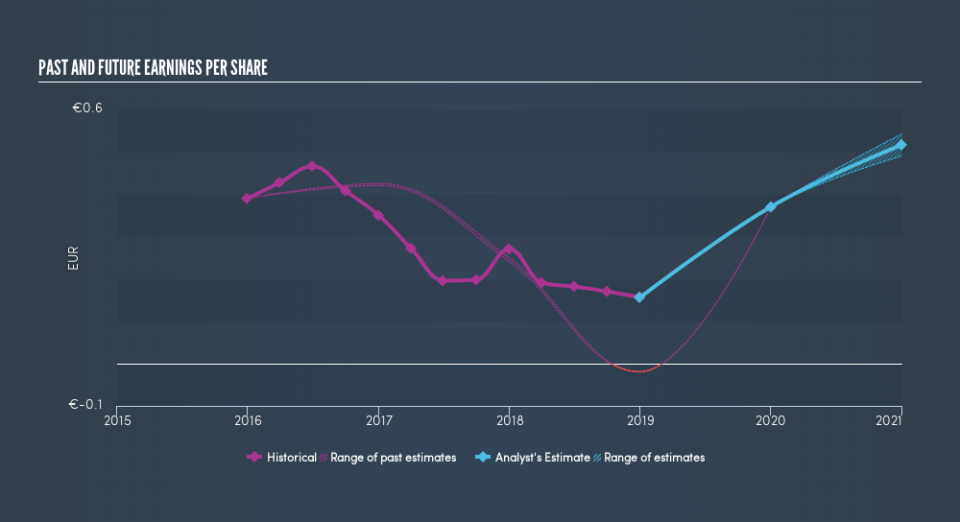

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, SergeFerrari Group's earnings per share (EPS) dropped by 26% each year. In comparison the 21% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on SergeFerrari Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

SergeFerrari Group shareholders are down 47% for the year (even including dividends), but the broader market is up 6.4%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 21% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Is SergeFerrari Group cheap compared to other companies? These 3 valuation measures might help you decide.

We will like SergeFerrari Group better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.