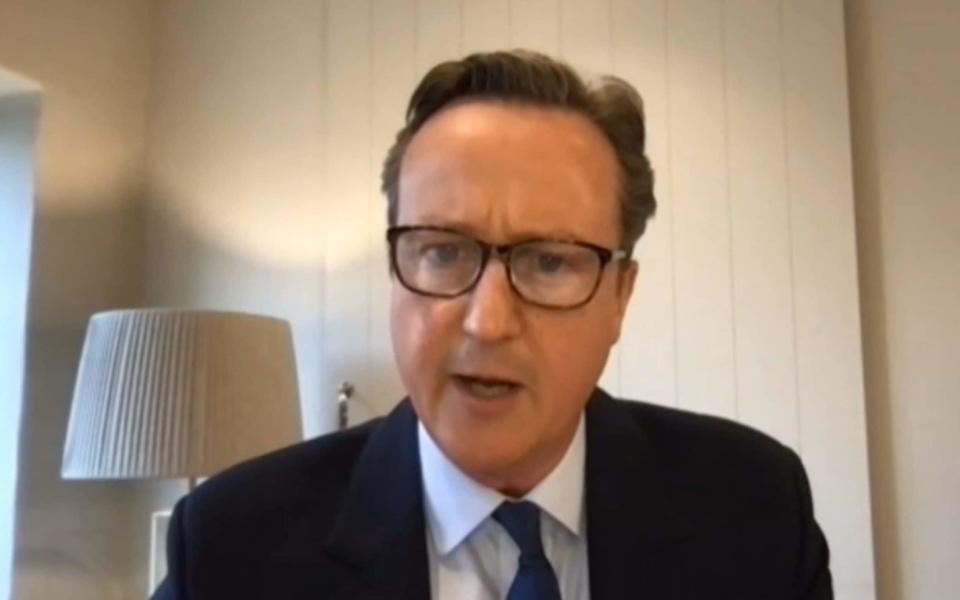

David Cameron at risk of being drawn into fraud inquiry over Sanjeev Gupta's steel empire

David Cameron is at risk of being drawn into a criminal inquiry after the Serious Fraud Office launched an investigation into the business empire of steel tycoon Sanjeev Gupta.

The SFO is investigating allegations of fraud and money laundering at Mr Gupta's company GFG - including the company's relationship with Greensill, its biggest lender. Greensill executives are expected to be interviewed as part of this process.

Mr Cameron worked as a senior adviser to Greensill and told MPs this week that he had attended board meetings at the lender.

The former prime minister was not involved in the day-to-day running of the business or credit decisions, however, including lending decisions to Mr Gupta. It is understood that he has never met the businessman. There is no suggestion that Greensill or Mr Cameron have done anything wrong.

Mr Gupta is now running out of options to save his empire, with 5,000 jobs at some of Britain's last remaining steelworks hanging in the balance. An investor lined up to provide vital emergency funding pulled out after the SFO announcement. The Government is understood to have ramped up preparations for a potential insolvency.

Mr Cameron was quizzed by the Commons Treasury committee on Thursday about his relationship with Lex Greensill, the Australian financier who founded Greensill. He characterised ties between Greensill and GFG as "a symbiotic relationship that obviously went wrong" and insisted he “did not know about the exact nature” of loans Greensill had made to GFG.

Mr Cameron said he could not remember whether credit committee reports on loans to Mr Gupta’s businesses were discussed during board meetings.

He added that he attended meetings of directors, listened to discussions and made contributions but had no role in lending decisions.

"On the issue of client concentration, and specifically on Gupta and GFG, this was something that I did ask about before joining and asked a lot of questions about while I was there," he said.

"The reassurance I always got was that there was a plan to deal with this concentration and over time reduce this concentration, but obviously that is not something that happened satisfactorily."

Whitehall sources said that the Government’s Official Receiver is being readied so it can step in if Mr Gupta’s businesses file for bankruptcy. That would mean ministers effectively taking over running the steel plants in Rotherham and elsewhere until a new owner could be found.

Sources added that matters have been complicated by the “opaque” financial structure of GFG’s Liberty Steel operations in the UK.

One government insider said: “The problem with Liberty Steel is that it is made up of eight or nine distinct entities. No-one knows how this is going to fall.”

The SFO said it was "investigating suspected fraud, fraudulent trading and money laundering in relation to the financing and conduct of the business of companies within the Gupta Family Group Alliance (GFG), including its financing arrangements with Greensill Capital".

Hopes are now fading that Mr Gupta will be able to secure rescue funding with the investigation continuing. White Oak Capital, which was lined up earlier this month to provide £200m of emergency funding to keep the Liberty Steel businesses alive, pulled out of talks following the announcement.

However, a spokesman for GFG said the company is still making progress in refinancing. Ministers are now believed to have privately conceded that it will be difficult for Mr Gupta to borrow more money to keep the company trading.

Kwasi Kwarteng, the Business Secretary, previously rejected a £170m bailout plea from Mr Gupta. He is believed to be focused on protected steel worker jobs and is continuing to consider all options.

Many of Mr Gupta’s sites manufacture steel using relatively low-carbon technology and will play a role in Boris Johnson fulfilling his climate change commitments.

A Whitehall source said: “We do see a future for this type of steel."

The SFO investigation follows an announcement by the Financial Conduct Authority watchdog that it is investigating Greensill and cooperating with counterparts in other enforcement and regulatory agencies.

Greensill was Mr Gupta’s largest source of financing before it collapsed in March. The London-based lender supplied billions of dollars in loans to GFG, many of which were packaged and sold onto investors in funds run by Credit Suisse.

But Greensill fell into administration after a key insurance partner declined to renew coverage on loans made to some of its customers, including GFG.

A spokesman for GFG said: “GFG Alliance notes the UK Serious Fraud Office's announcement that it has opened an investigation into GFG Alliance. GFG Alliance will cooperate fully with the investigation.

“As these matters are the subject of an SFO investigation we cannot make any further comment.GFG Alliance continues to serve its customers around the world and is making progress in the refinancing of its operations which are benefitting from the operational improvements it has made and the very strong steel, aluminium and iron ore markets.”

A spokesman for Mr Cameron declined to comment on the SFO probe. A spokesman for Grant Thornton, administrator of Greensill Capital, also declined to comment.