Seth Klarman Buys HCA Healthcare, Slims 4 Positions in the 2nd Quarter

Seth Klarman (Trades, Portfolio), manager of Baupost Group, disclosed this week that his top five trades included a new holding in HCA Healthcare Inc. (NYSE:HCA) and sells in the following four companies: Cheniere Energy Inc. (LNG), Facebook Inc. (NASDAQ:FB), Alphabet Inc. (NASDAQ:GOOG) and Energy Transfer LP (NYSE:ET).

A Harvard MBA graduate, Klarman wrote the book "Margin of Safety," which discusses risk-averse value investing strategies for the thoughtful investor. The manager of the Boston-based firm invests in a wide range of securities, including common stock, distressed debt, liquidations, foreign equities and bonds. Despite this, Klarman does not mind sitting on cash during times of scarce investment opportunities. For Klarman warned that investing is not only about producing absolute returns, but also focusing on the risks of generating absolute returns.

Baupost manages approximately $30 billion in total assets according to its latest ADV filing. As of quarter-end, the firm's $6.75 billion equity portfolio contains 32 stocks, with eight new holdings and a turnover ratio of 25%. The top four sectors in terms of weight are communication services, technology, consumer cyclical and health care, with weights of 43.30%, 16.12%, 14.49% and 13.33%.

HCA Healthcare

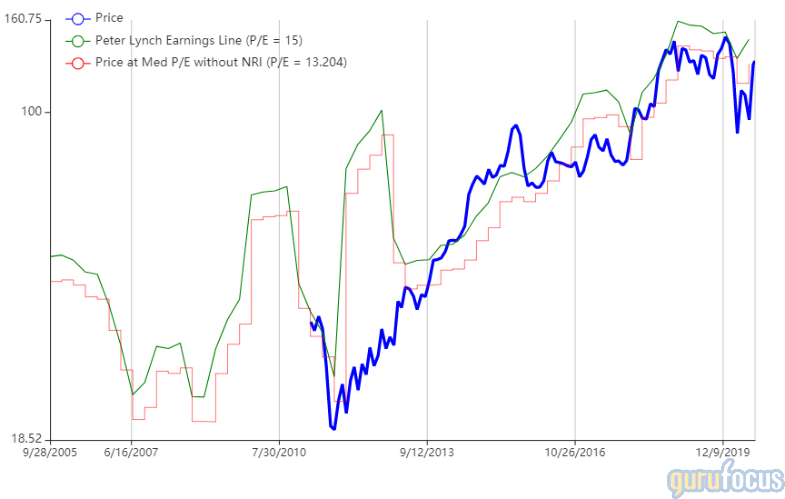

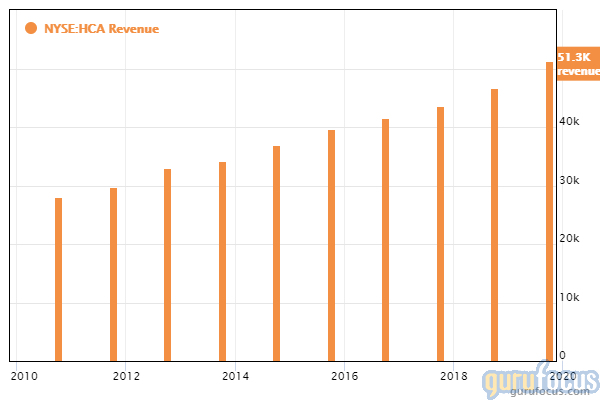

Klarman purchased 1 million shares of HCA Healthcare, giving the position 1.22% weight in the equity portfolio. Shares averaged $103.85 during the second quarter.

The Nashville-based company operates a network of over 179 hospitals and 120 outpatient surgery centers across 20 states in the U.S. GuruFocus ranks HCA Healthcare's profitability 8 out of 10 on several positive investing signs, which include a three-star business predictability rank and an operating margin that outperforms 81.89% of global competitors.

Gurus with large holdings in HCA Healthcare include the Vanguard Health Care Fund (Trades, Portfolio), Larry Robbins (Trades, Portfolio), First Eagle Investment (Trades, Portfolio) and Bill Nygren (Trades, Portfolio).

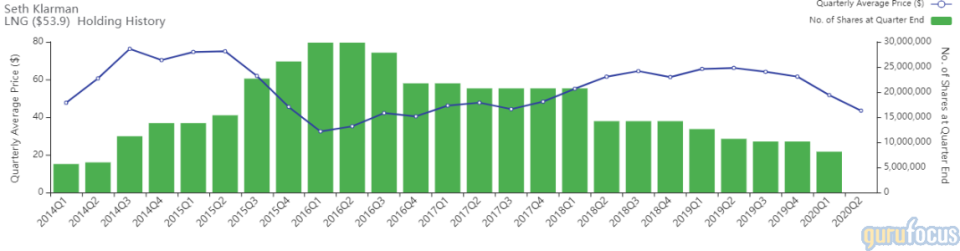

Cheniere Energy

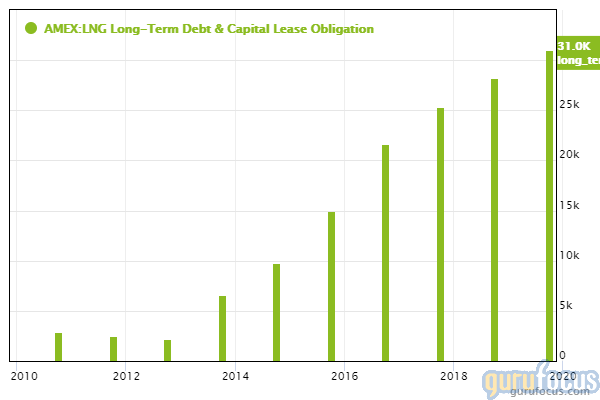

Klarman sold 8,124,235 shares of Cheniere Energy, dumping 4.03% of the equity portfolio. Shares averaged $43.48 during the second quarter. Based on GuruFocus estimates, the Baupost manager took a loss of approximately 12.32% on the stock since he established the position during the first quarter of 2014.

The Houston-based company owns and operates the Sabine Pass liquefied natural gas terminal through its stake in Cheniere Partners. GuruFocus ranks the company's financial strength 3 out of 10 on several warning signs, which include interest coverage and debt ratios underperforming over 70% of global competitors. Although the company has a perfect Piotroski F-score of 9, Cheniere Energy has increased its long-term debt by $5.8 billion over the past three years, suggesting high use of financial leverage.

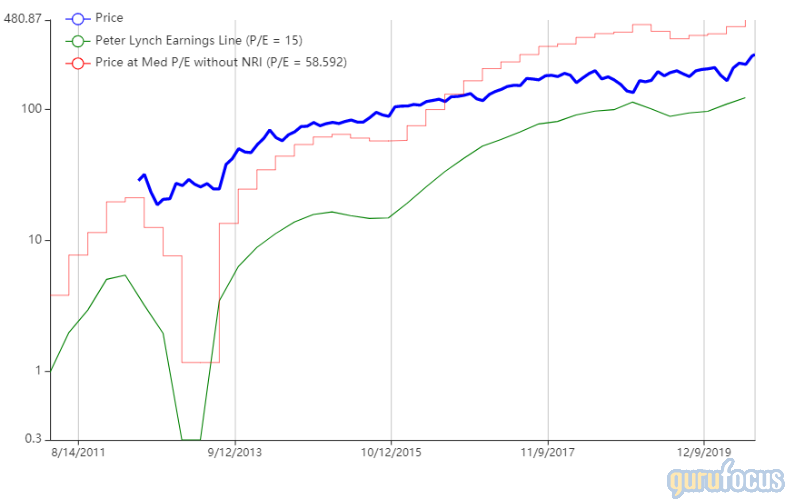

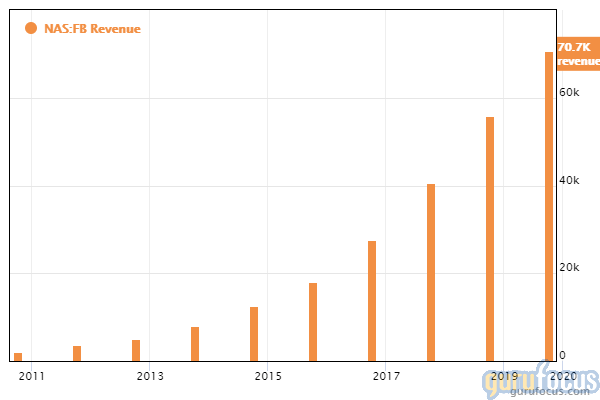

Klarman sold 1,132,500 shares of Facebook, reducing the position 57.08% and the equity portfolio 2.80%. Shares averaged $208.03 during the second quarter.

GuruFocus ranks the Menlo Park, California-based social media giant's profitability 9 out of 10 on several positive investing signs, which include profit margins and returns outperforming over 90% of global competitors.

Alphabet

Klarman sold 85,820 shares of Google's parent company, reducing the position 28.56% and the equity portfolio 1.48%. Shares averaged $1,345.56 during the second quarter.

GuruFocus ranks the Mountain View, California-based online search giant's financial strength and profitability 9 out of 10 on several positive investing signs, which include interest coverage and debt ratios that outperform over 70% of global competitors and profit margins and returns that outperform over 82% of global interactive media companies.

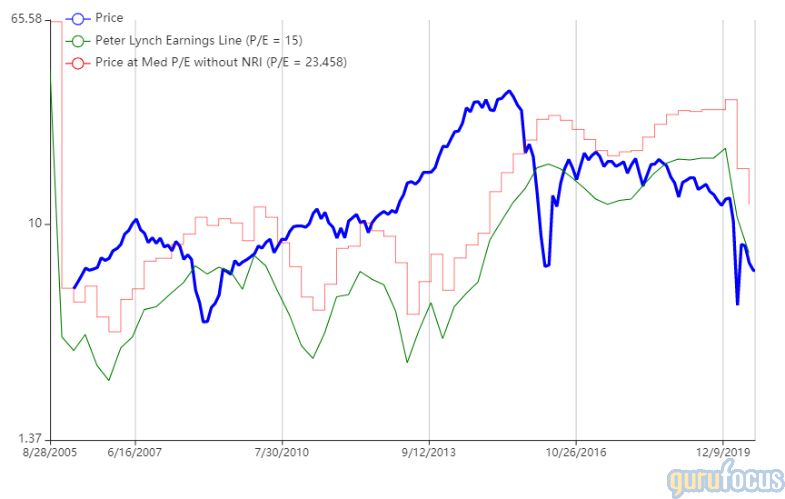

Energy Transfer

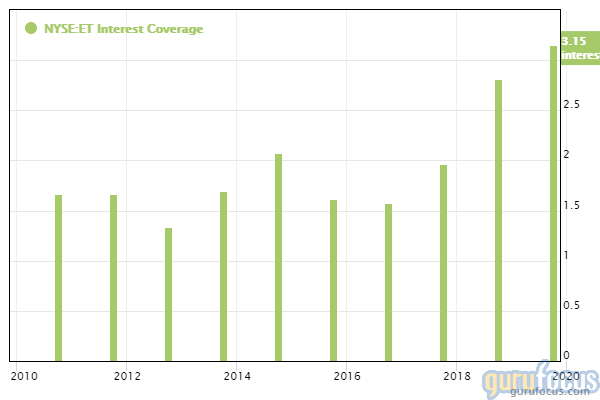

Having purchased 12,105,005 shares of Energy Transfer during the previous quarter, Klarman sold all shares during the second quarter, trimming 0.83% of the equity portfolio. Shares averaged $7.36 during the second quarter, down from the first quarter-average price of $10.77.

GuruFocus ranks the Dallas-based energy company's financial strength 3 out of 10 on several warning signs, which include a weak Altman Z-score of 0.81 and interest coverage and debt ratios that underperform over 70% of global competitors.

Disclosure: No positions.

Read more here:

David Abrams Sells 2 Holdings, Drills Into Kinder Morgan in 2nd Quarter

Ray Dalio's Bridgewater Dumps Treasury Bond ETF, Boosts 5 Positions in 2nd Quarter

Top 5 Buys of Chuck Akre's Firm in the 2nd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.