SFK Construction Holdings (HKG:1447) Has A Rock Solid Balance Sheet

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that SFK Construction Holdings Limited (HKG:1447) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for SFK Construction Holdings

What Is SFK Construction Holdings's Debt?

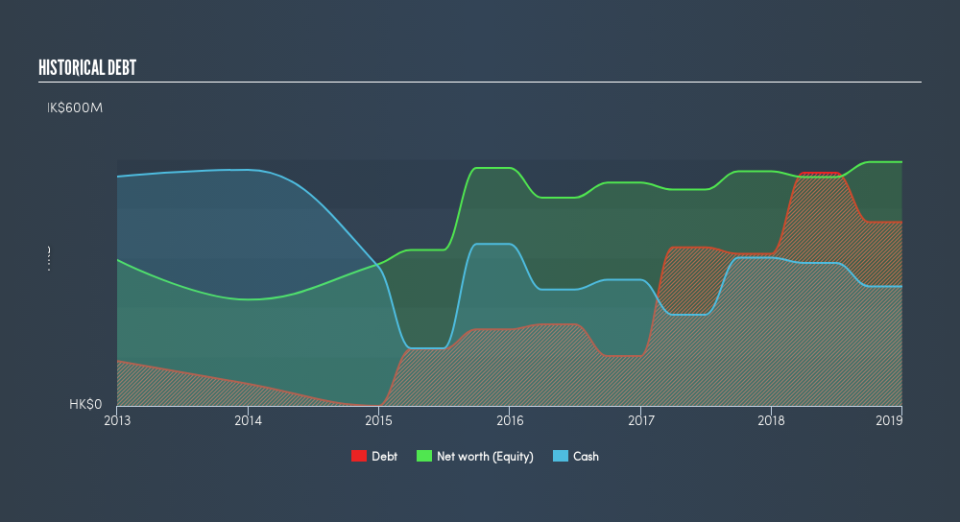

You can click the graphic below for the historical numbers, but it shows that as of December 2018 SFK Construction Holdings had HK$371.7m of debt, an increase on HK$307.7m, over one year. On the flip side, it has HK$241.8m in cash leading to net debt of about HK$129.9m.

How Healthy Is SFK Construction Holdings's Balance Sheet?

According to the last reported balance sheet, SFK Construction Holdings had liabilities of HK$1.66b due within 12 months, and liabilities of HK$4.72m due beyond 12 months. Offsetting these obligations, it had cash of HK$241.8m as well as receivables valued at HK$1.81b due within 12 months. So it can boast HK$389.2m more liquid assets than total liabilities.

This surplus strongly suggests that SFK Construction Holdings has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this basis we think its balance sheet is strong like a sleek panther or even a proud lion.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

SFK Construction Holdings has a low net debt to EBITDA ratio of only 0.65. And its EBIT covers its interest expense a whopping 15.5 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The good news is that SFK Construction Holdings has increased its EBIT by 6.2% over twelve months, which should ease any concerns about debt repayment. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since SFK Construction Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, SFK Construction Holdings produced sturdy free cash flow equating to 59% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Happily, SFK Construction Holdings's impressive interest cover implies it has the upper hand on its debt. And the good news does not stop there, as its level of total liabilities also supports that impression! It looks SFK Construction Holdings has no trouble standing on its own two feet, and it has no reason to fear its lenders. For investing nerds like us its balance sheet is almost charming. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check SFK Construction Holdings's dividend history, without delay!

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.