Shaky Ground: The link between the Permian Basin's fossil fuel industry and earthquakes

This article is part of Shaky Ground, a collaborative reporting project between the Carlsbad Current-Argus and KRWG Public Media.

PECOS, TEXAS – Teresa Winkles was sitting at her office at the Reeves County Groundwater Conservation District when the ground began to shake.

A magnitude 5.4 earthquake struck the region Nov. 16, 2022 sending shockwaves throughout the Permian Basin and beyond: as far north as Albuquerque and as far west as El Paso.

Winkles, a native of Midland who has lived with the oil and gas industry in her community for her entire life, said she'd never felt anything like it before.

"I thought somebody literally had hit the building. It shook the whole building. It felt like it was a roll, it was a wave that kind of went under the building," she recalled. "And then my boss came out in the hallway and I'm like 'I think that was just an earthquake.'"

Months later in May, Winkles was elected mayor of Pecos and said that while tremors like the one she felt that day were scary, they could be a necessary reality for the rural West Texas community along U.S. Highway 285 and deep in one of the world’s busiest oilfields.

A view of Pecos’ busiest area, a stretch of U.S. Highway 285 dotted by gas stations and almost constantly snarled by the semi tractor-trailers and work trucks that define oilfield traffic, reflects the boosted activity brought to town since oil boomed in 2017.

Today, the Permian Basin produces more than 5.5 million barrels of oil per day, records show, a boon for oil towns like Pecos or Carlsbad, which lies about 80 miles north in southeast New Mexico.

Note to readers: Our newsroom hopes you find value in this article. Please consider becoming a financial supporter of local journalism. Subscribe to the Carlsbad Current-Argus.

But that also meant byproducts are created, like waste water — known as produced water in industry terms — that is incidentally brought to the surface with the economy-defining oil and gas.

Recent estimates show the Permian Basin could generate up to four to 10 barrels – about 42 gallons each – of waste water per barrel of oil.

It's high in brine, toxic for human consumption and largely disposed of by pumping back into the underground shale formations it came from.

These disposal injection wells were linked to a rash of quakes throughout the historically seismically inactive region, leaving public officials like Winkles grappling with the economic benefits of an industry that is changing the ground their communities stand on.

Her husband Kenneth Winkles is the executive director of the Pecos Economic Development Corporation, tasked with recruiting business and overseeing development in the town known as the home of the first rodeo on the Fourth of July 1883.

He said oil and gas companies are powerful community partners, donating to local charities and events like Pecos’ biggest and longest-standing tradition that most recently saw riders compete for an about $200,000 purse.

The fossil fuel extraction industry first boomed in Pecos in about 2014, but "the rocket really took off" in 2017, Winkles said.

Today, he estimated oil and gas to be "65 to 70 percent of our activity" in the town of 14,000, increasing tax revenue and business for local restaurants and other establishments.

"The impact of oil and gas really has been positive," Winkles said. "Most people think it would be negative, but the more people it brings in, the more sales tax that comes to the city. The drawbacks are yes you're going to stand in line at the restaurants, and yes you're going to stand in line at the grocery stores. But overall the impact has always been good."

Furthermore, Winkles said the quakes reported were miles away from Pecos closer to Toyah, Texas – a community of about 60 according to the 2020 Census and about 20 miles southwest from Pecos, yet still in Reeves County.

"I don't put much emphasis on the earthquakes," he said. "They have increased in the last five years. We did not have them before, so we know that somewhat, somehow, the oil and gas industry could be responsible for it. But for me, we haven't had any infrastructure harmed whether underground or above ground. The economic benefit and the activity far outweigh the problems with the small earthquakes."

He said while some sounded alarms when the ground began to shake last year, the benefits remained strong from an industry that’s become almost as defining to Pecos as the centuries-old rodeo.

That meant more housing and hotels going in, and recently Pecos grew enough, thanks to oil and gas, to get the town's first Starbucks, serving up coffee above a shale deposit Winkles said holds "at least" 85 billion barrels of oil.

"There are some negatives that come with, but overall the positives outweigh the negatives," he said. "The oil and gas is a positive. The oil and gas is not going anywhere."

More oil, more quakes in Permian Basin

Earthquake reports from the U.S. Geological Society (USGS) in the Permian Basin juxtaposed with oil production numbers from the Energy Information Administration (EIA) show rapidly increasing extraction instep with growing seismicity.

Oil and gas production boomed in the Permian Basin in the last decade, driven by the use of hydraulic fracturing, also known as fracking.

That process sees water, chemicals, and sand pumped thousands of feet underground to break up hard-to-reach shale rock formations that contain crude oil and natural gas.

While fracking helped drive Permian Basin oil production to unprecedented levels of more than 5 million barrels per day, it also generated millions more barrels of waste water.

To dispose of the byproduct, often heavy in toxic metals, chemicals and brine, oil and gas operators treated it as waste, pumping the water back underground into the shale using disposal wells.

This practice went on for years until the quakes began.

In 2015, when the Permian was producing about 1.8 million barrels per day, according to the Energy Information Administration (EIA), there were 12 earthquakes regionwide of a magnitude 2 or greater reported by the U.S. Geological Survey (USGS).

As production grew, so did seismicity. The Carlsbad Current-Argus gathered seismic data from a defined area in southeast New Mexico and West Texas using the USGS' earthquake database.

The quakes are caused when fluid injected beneath the surface for disposal increases pressure on faults, read a USGS report, causing the earth to shift and bringing disturbance to the surface.

In 2019, with oil production at about 4.3 million bpd, there were 119 earthquakes at M 2 or higher.

The number of recorded quakes skyrocketed in the years since from 311 events in 2020 to 1,773 in 2021.

In 2022, there were 2,404 earthquakes at M 2 or greater, with 583 such events in the first quarter 2023, meaning the region was on pace for 2,332 seismic events by the end of the year.

This seismicity happened as oil production continued a steady rise to about 5.3 million bpd in 2022 and 5.7 million bpd as of May 2023.

Scientists soon became aware of the link between seismicity and waste water disposal amid the fracking boom.

A 2021 report from New Mexico Tech’s Bureau of Geology pointed to the Delaware sub-basin of the Permian – on the western side of the basin straddling the border between southeast New Mexico and West Texas – as a hotspot for seismicity in the state.

The increased seismicity started in 2015 near Pecos, Texas, about an hour from the New Mexico border, the report read.

In March 2020, an M 5 earthquake was recorded in the region about 25 miles west of Mentone and felt in Carlsbad and as far west as El Paso.

“Seismicity in the area continued to rise into 2020, and studies have associated the seismicity with nearby waste water injection and fracking activities,” read the study.

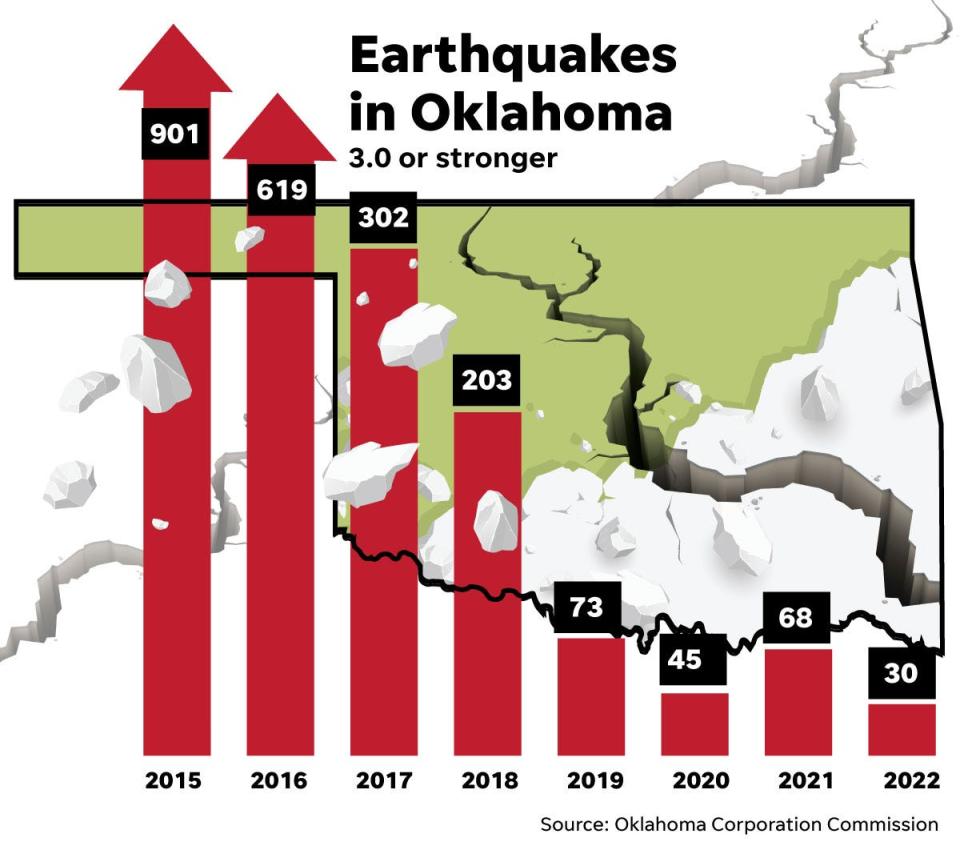

Oil and gas operations were previously tied to earthquakes in Oklahoma, with drillers targeting the Anadarko Basin for oil and subsequently pumping waste water back underground.

The surge in that state started in 2009, the USGS reported, with just 90 M 2 or larger earthquakes reported in Oklahoma by the USGS in the nine years before and 10,671 reported between 2010 and 2019.

“The majority of earthquakes in Oklahoma are caused by the industrial practice known as ‘waste water disposal,’" read a USGS report.

Oklahoma State Seismologist Jake Walter, based at the University of Oklahoma said it began in that state as operators were targeting the Arbuckle Group of ancient underground shale rocks where oil and brine water were brought to the surface.

The cheapest, most affordable path to managing this water, Walter said, was to pump it back into the Arbuckle.

But while that was cost-efficient, he said it soon led to a string of quakes in the region.

"The problem was that when you inject these waste fluids into these rocks, especially if your neighbors are utilizing the same processes, you pressurize the subsurface. What we now in the scientific community understand is that that process has promoted fault activity.

"The increased pressure can push these faults to failure."

Before oil boomed and injection began, Walter said Oklahoma had "one or two" M 3 quakes a year, skyrocketing to 900 or more per month in 2014 and 2015.

"It really sort of exponentially increased pretty rapidly," he said. "The regulatory agencies noticed it was directly linked to the Arbuckle waste water disposal."

That led the Oklahoma Corporation Commission, the agency that permits oil and gas activities in the state, to require operators submit along with permit applications proof their activities would not impact seismicity.

Some were also not allowed to drill through the Arbuckle into the bottom of the formation known as "the basement," where much of the seismicity was known to occur.

Volumes of the water injected were capped and some wells were paused or shut in, guided by data on where the earthquake occurred and at what depth the rocks were stimulated.

It worked, Walter said, and seismicity began to decline.

USGS data showed only 87 M 3 or higher seismic events in Oklahoma since 2020.

"I can't say there's any kind of easy solution," Walter said. "I'm constantly concerned about the potential for hydrocarbon extraction processes to trigger large earthquakes that can be damaging to people, not only to their lives but their livelihoods.

"It's a tough balance between the economic drivers in the state, against the protection of Oklahoman households and lives. We're guided by the science."

The problems with induced seismicity in Oklahoma could one day be shared by New Mexico and Texas said Mairi Litherland, geologist at New Mexico Tech who manages its Seismological Observatory, a network of 25 monitoring stations throughout the state.

“Based on what we've seen elsewhere, we can be very confident that that rise in seismicity is attributable to the fluid injection that's going on throughout the region,” she said. “The Permian Basin where this is happening or the Delaware Basin specifically spans the Texas, New Mexico border and on both sides of the border, there has been a lot of the gas production.”

She said lessons learned by Oklahoma could help New Mexico and Texas lower the injection volumes in the Permian Basin, reducing stress the activity places on faults.

“So, both New Mexico and Texas are fortunate to have been able to learn from what happened in Oklahoma and just the awareness that we know that this is a thing that can happen and that we need to be prepared for has allowed us to be sort of more responsive,” Litherland said.

What happened in Oklahoma isn’t going to happen in New Mexico if state officials have their way.

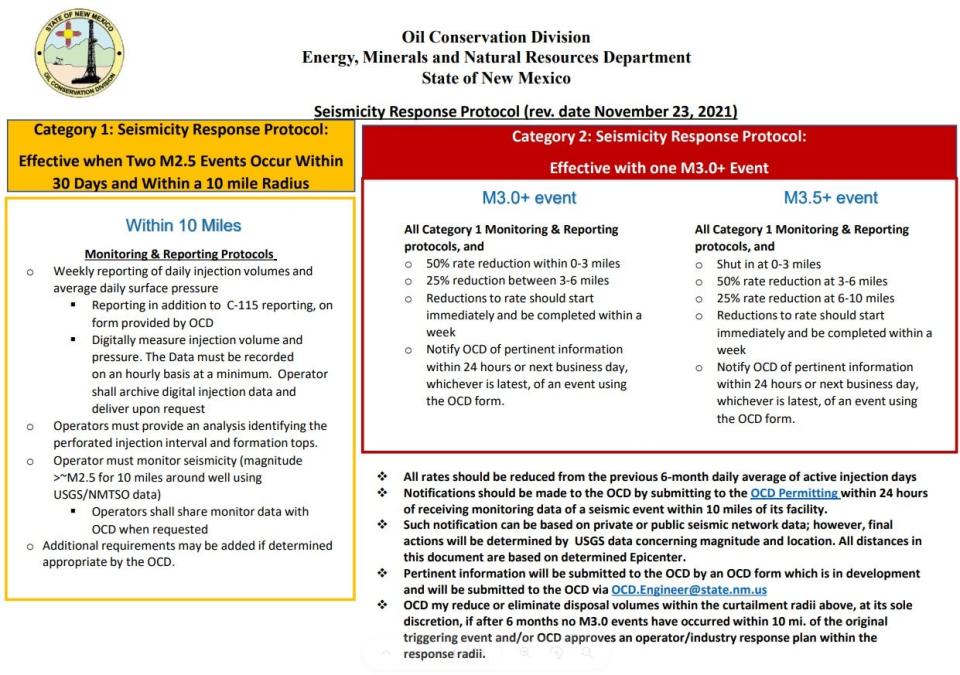

The response came quickly from the State of New Mexico, using its Oil Conservation Division (OCD) to curb water injection volumes along the state’s southeast border to Texas – where the biggest earthquakes were reported.

OCD Director Dylan Fuge said the agency, which leads compliance efforts for oil and gas facilities on state, federal and private land, targeted injection, establishing a sliding scale of volume curtailments and outright well shut-ins based on a facility’s proximity to the epicenter of an earthquake and its magnitude.

“The seismicity that everyone is concerned about is associated with saltwater disposal wells. These are underground injections,” Fuge said. “You're pressurizing formations. That pressure in the wrong locations can trigger faults to move. You’re seeing seismicity in Texas and we saw seismicity in New Mexico.”

Starting Nov. 23, 2021, whenever two M 2.5 quakes occur within 30 days and a 10-mile radius, the OCD required weekly reporting of injection volumes at sites within 10 miles of the events.

But after an M 3 event, injection rates must reduce by 50 percent within 0 to 3 miles of the epicenter, and 25 percent within 3 to 6 miles.

If an M 3.5 event occurs, wells up to 3 miles away are shutdown, and volumes are curbed by 50 percent within 3 to 6 miles and 25 percent within 6 to 10 miles from the epicenter.

Fuge said these policies did result in some reductions in the quakes, but the area remained seismically active years later.

He suggested New Mexico might need to shift into a more preventative style of regulation, establishing permanent caps on injection volumes in certain areas known to be especially active.

The state is also considering shifting to shallower disposal wells, about 4,000 feet deep compared to the typical 10,000-foot wells that target the same formations containing oil and gas, to further avoid stress on faults.

All this work is important in New Mexico, Fuge said, as it did not historically see much seismicity, meaning buildings and structures throughout the state were constructed without that consideration or proper codes to address earthquakes.

“We don’t want to have a repeat of the situation in Oklahoma. It was regular, high magnitude seismic events that were shaking and causing disruptions,” Fuge said. “We are not seismically active meaning we are not subject to seismic building codes. This is a risk we need to actively manage for.”

The OCD has authority over produced water and its disposal within the oil and gas industry, but in 2019 the Produced Water Act tasked the New Mexico Environment Department (NMED) with a rulemaking and to develop technologies aimed at using some of this water outside of the extraction industry.

NMED quickly formed a consortium with New Mexico State University the year the bill passed, which gathered stakeholders from the industry and scientists throughout the Permian Basin to develop ways to treat the water to a quality that could be used by other sectors like agriculture.

During the Produced Water Research Consortium's mid-year meeting in June, Laura Capper with EnergyMakers Advisory Group, an oil and gas consultant based in Houston, said New Mexico needs to find these new uses quickly or risk oil production itself.

She estimated New Mexico sends about half of its produced water, about 2 million barrels a day, into Texas for disposal. This is because New Mexico lacks the capacity to dispose of all the water.

Meanwhile, only about 20 percent of produced water is recycled and reused by the industry, and Capper said an alternative means of using it or moving it out of the Permian Basin must be found.

And if another M 4.5 or greater earthquake occurs in Texas' Culberson-Reeves county seismic response area (SRA), just over the border near Pecos, the Texas Railroad Commission will likely halt disposal injection, meaning New Mexico's oil production would need to be reduced to curb water production.

"Our disposal capacity is going to be diminished in Texas," Capper said. "The question is how is Texas going to respond? Are they going to let New Mexico continue to take water over the border, or will they say they want to take care of their own oil and gas producers? I think a savvy operator is planning for that eventual reality."

So should New Mexico plan for a loss in its revenue from oil and gas, Capper said, money that provided about half of the state's General Fund revenue, about $7 billion last year, according to the most recent budget analysis from the Legislative Finance Committee.

"Texas just cannot handle the volumes of water coming over from New Mexico," Capper said. "If you can’t find beneficial use, you’re going to have to cut back on water produced and that means cutting back on oil and gas revenue. That’s going to mean a hit to your state (gross domestic product)."

Director of the Consortium Mike Hightower said that while it was formed initially to address water scarcity and using produced water as a new source of water in New Mexico, the chokepoint created recently by the earthquakes increased the pressure on the Consortium to move quickly in developing data for decisionmakers considering a path forward.

"It puts it into perspective. It reinforces this whole concept of treatment technologies," he said. "Getting cost and performance data to regulatory agencies is very important. "

Some of the world's largest fossil fuel producers that operate in the Permian Basin, are also taking notice of the quakes in the region.

Chevron spokesperson Deena McMullen said the global energy giant is making "proactive" efforts to address the growing seismicity.

The company already cut its waste water injection volume in half at a disposal well in Lea County, located in the OCD's County Line Seismic Response Area, McMullen said and is analyzing additional mitigation tactics in the region.

She said the company works closely with regulatory agencies in both Texas and New Mexico to manage water disposal volumes, share data and curb injection in vulnerable areas.

"Chevron has taken a leading position to work alongside regulators, policy makers, academic institutions, oil and gas producers and other stakeholders to manage issues associated with produced water injection,' McMullen said in an emailed statement.

"We are actively involved in building industry-led operator response plans and use operational and subsurface data to curtail deep saltwater disposal injection volumes in areas of the basin identified by regulatory agencies as seismicity concerns."

She said the company also uses recycled produced water in much of its drilling and well completion operations, reducing the amount of fluid that is sent downhole. In 2022, McMullen said 99 percent of Chevron's water needs were met with recycled or brackish water.

"As we look to the future, more optionality is required to manage produced water in the Permian Basin — we are actively working alongside a variety of stakeholders to create new options, including those that consider treated produced water reuse outside the oil and gas industry," McMullen continued.

And as it pushes to increase its sustainability in the long-term, McMullen said the company is working with other operators in the region on a "Joint Industry Project," to test out three different desalination technologies that she said could be developed at a large scale for water reuse.

"We expect to see progress in development of technical capabilities and regulatory standards needed to implement large-scale reuse of treated produced water for industrial and other applications outside the oilfield," McMullen said.

When should New Mexico care about earthquakes?

In November 2022, from his office on the second floor of a building along the Pecos River in Carlsbad, John Waters saw his plants shake.

That was the extent of the city’s connection to the seismicity, he said, as the oil industry boomed, and Waters saw his hometown grow.

The growth is undeniable.

Eddy County, of which Carlsbad is the seat, saw more population growth between the 2010 and 2020 Census than any other part of New Mexico – seeing an about 15.8 percent population increase many credited to a surging fossil fuel industry.

Despite concerns for impacts like the quakes or air pollution or increasingly scarce water supplies and climate change many believe driven by the petroleum production that defines Carlsbad’s economy, Waters said there was little to worry about.

"If you're here, you know. We rarely feel anything," he said. "We don't see the seismicity. It's in Texas. It's not a problem for us. But, we watch and we've always watched. I'm not going to get concerned if I don't get the data."

But data did show earthquakes were occurring in the Permian, and not just in Texas.

On June 5, an M 3.1 was centered in an area just west of U.S. 285 near Carlsbad, following an M 3.4 and M 2.5 also west of the city on April 18. Another quake at M 2.6 was reported on April 24, according to the USGS.

Also, a cluster of events along the border of Texas and New Mexico, just south of Malaga, was reported this spring: an M 3.4 on March 26, an M 2.9 on Feb. 27, and two M 2.5 quakes on April 11 and March 29.

An M 3.3 earthquake was also reported in that area Jan. 15.

Quakes of those magnitudes aren't often felt, and despite assertions they could indicate a growing pattern of seismicity in southeast New Mexico, Waters suggested environmentalists should instead focus on issues in other countries, which he posited often have environmental regulations far laxer than the U.S.

"To be clear: New Mexico does not have earthquakes," he said. "We're doing a much better job than anywhere else on the planet. There's some scary places that you don't want to drink the water. When was the last time you were worried about drinking Carlsbad water?"

Kayley Shoup is not convinced.

She grew up in Carlsbad, and recently returned to her hometown, finding streams of oilfield traffic, smog and clusters of cancer diagnosis Shoup said she suspected could be tied to increased industrial activities.

She quickly joined local environmental group Citizens Caring for the Future as an organizer, and was passing out information to people in Eunice, another oil town almost directly on the Texas state line to the east of Carlsbad, when the ground shook.

She soon heard from her mother back in Carlsbad and "in a panic," Shoup said.

"My mom felt it here in town and she called me immediately because she knew I was out in the field. She was just like in a total panic," Shoup said. "I heard from many folks that felt the earthquake and it really seemed to spook them."

In the months since, Shoup's organization learned more about the impact of seismicity from oil and gas, adding it to the growing list of problems she believes are tied to oil and gas and targeted by the group.

For the bourgeoning environmental community in Carlsbad, Shoup said the incident proved a unifying force, bringing concerns seemingly dormant into the local consciousness.

"An earthquake is something where the environmental impacts are suddenly in your face," she said. "This is something that is totally brand new."

Along a fence line near Cherry Lane Park near the north Carlsbad community of La Huerta sits an oil well, mere feet from a group of new-build homes going in.

Shoup looked over the oil storage tanks, pipelines and flare stacks that made up the industrial facility, contrasting with houses and backyards feet away and only shielded by a short wall of cinderblocks.

It made her wonder if the quakes, like oil and gas, were here to stay in the Permian, passing at will into neighborhoods and across the border between Texas and New Mexico.

"Even the things happening in Texas, we feel them here," Shoup said. "These things do not have borders. All the impacts do not stop at the state line."

Adrian Hedden can be reached at 575-628-5516, achedden@currentargus.com or @AdrianHedden on Twitter.

This article originally appeared on Carlsbad Current-Argus: Earthquakes tied to fossil fuels rack New Mexico, Texas