Would Shareholders Who Purchased Tenneco's (NYSE:TEN) Stock Three Years Be Happy With The Share price Today?

While not a mind-blowing move, it is good to see that the Tenneco Inc. (NYSE:TEN) share price has gained 16% in the last three months. But the last three years have seen a terrible decline. To wit, the share price sky-dived 82% in that time. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Tenneco

Tenneco isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

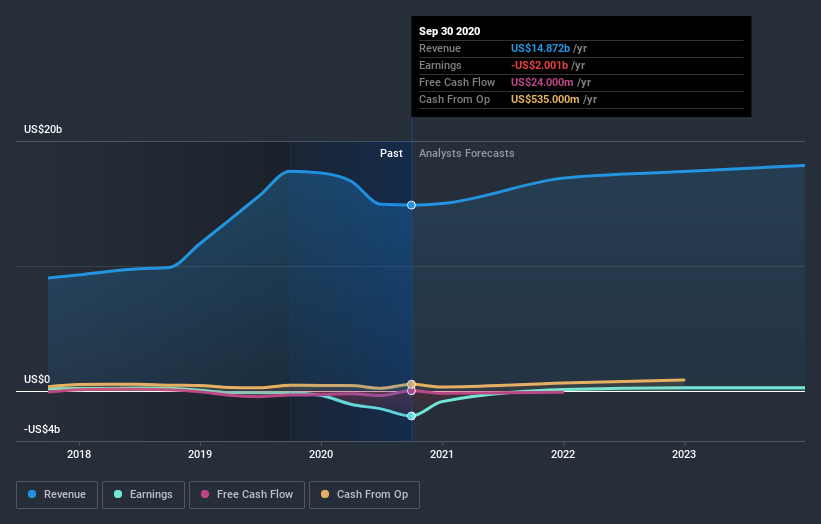

In the last three years, Tenneco saw its revenue grow by 23% per year, compound. That is faster than most pre-profit companies. So why has the share priced crashed 22% per year, in the same time? The share price makes us wonder if there is an issue with profitability. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling Tenneco stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Tenneco shareholders are up 5.9% for the year. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 11% endured over half a decade. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Tenneco better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Tenneco .

Tenneco is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.