Shareholders Are Raving About How The Dropsuite (ASX:DSE) Share Price Increased 387%

Dropsuite Limited (ASX:DSE) shareholders might be concerned after seeing the share price drop 12% in the last month. But that doesn't displace its brilliant performance over three years. Indeed, the share price is up a whopping 387% in that time. Arguably, the recent fall is to be expected after such a strong rise. The thing to consider is whether there is still too much elation around the company's prospects.

View our latest analysis for Dropsuite

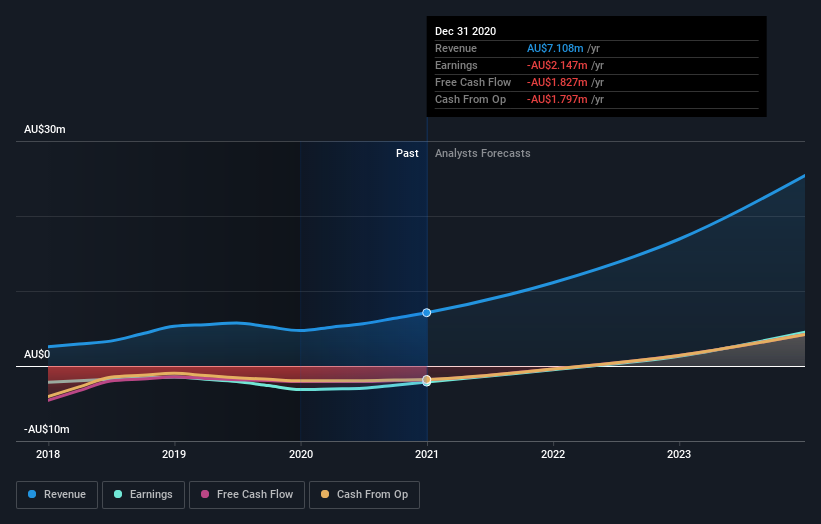

Given that Dropsuite didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years Dropsuite has grown its revenue at 25% annually. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 69% per year, over the same period. Despite the strong run, top performers like Dropsuite have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Dropsuite's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Dropsuite shareholders have gained 219% (in total) over the last year. That gain actually surpasses the 69% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Dropsuite on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Dropsuite better, we need to consider many other factors. Take risks, for example - Dropsuite has 2 warning signs we think you should be aware of.

We will like Dropsuite better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.