Should Shareholders Reconsider First Capital Real Estate Investment Trust's (TSE:FCR.UN) CEO Compensation Package?

The results at First Capital Real Estate Investment Trust (TSE:FCR.UN) have been quite disappointing recently and CEO Adam Paul bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 22 June 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

See our latest analysis for First Capital Real Estate Investment Trust

How Does Total Compensation For Adam Paul Compare With Other Companies In The Industry?

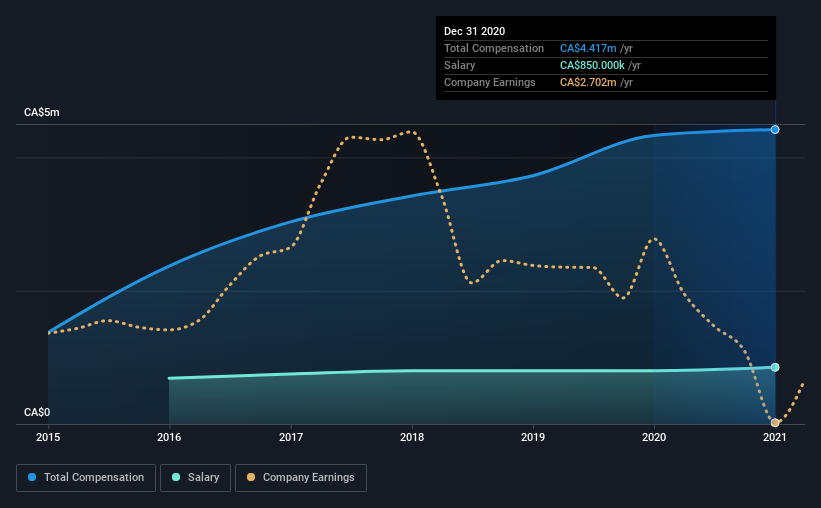

Our data indicates that First Capital Real Estate Investment Trust has a market capitalization of CA$3.9b, and total annual CEO compensation was reported as CA$4.4m for the year to December 2020. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CA$850k.

In comparison with other companies in the industry with market capitalizations ranging from CA$2.4b to CA$7.8b, the reported median CEO total compensation was CA$2.5m. Hence, we can conclude that Adam Paul is remunerated higher than the industry median. Furthermore, Adam Paul directly owns CA$5.1m worth of shares in the company, implying that they are deeply invested in the company's success.

Component | 2020 | 2019 | Proportion (2020) |

Salary | CA$850k | CA$800k | 19% |

Other | CA$3.6m | CA$3.5m | 81% |

Total Compensation | CA$4.4m | CA$4.3m | 100% |

On an industry level, roughly 36% of total compensation represents salary and 64% is other remuneration. First Capital Real Estate Investment Trust pays a modest slice of remuneration through salary, as compared to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at First Capital Real Estate Investment Trust's Growth Numbers

First Capital Real Estate Investment Trust's funds from operations (FFO) improved greatly this year, rising from -CA$22m last year to CA$1.2m at the last update. . In the last year, its revenue is down 11%.

Few shareholders would be pleased to read that FFO have declined. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has First Capital Real Estate Investment Trust Been A Good Investment?

Since shareholders would have lost about 3.4% over three years, some First Capital Real Estate Investment Trust investors would surely be feeling negative emotions. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 5 warning signs for First Capital Real Estate Investment Trust (2 are significant!) that you should be aware of before investing here.

Important note: First Capital Real Estate Investment Trust is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.