Shareholders in Surface Oncology (NASDAQ:SURF) are in the red if they invested a year ago

Surface Oncology, Inc. (NASDAQ:SURF) shareholders should be happy to see the share price up 25% in the last month. But that doesn't change the fact that the returns over the last year have been stomach churning. During that time the share price has plummeted like a stone, down 73%. Arguably, the recent bounce is to be expected after such a bad drop. The real question is whether the company can turn around its fortunes.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Surface Oncology

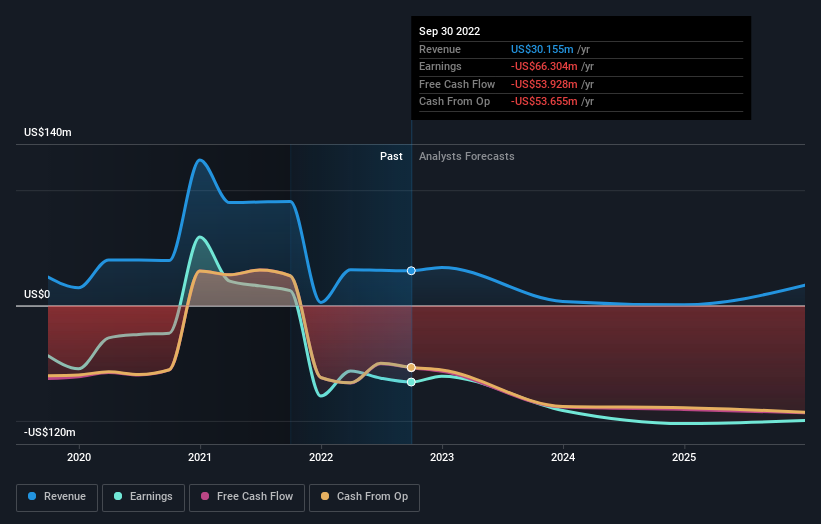

Surface Oncology wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Surface Oncology's revenue didn't grow at all in the last year. In fact, it fell 67%. That looks like a train-wreck result to investors far and wide. The market didn't mess around, sending shares down the garbage shute. (Or down 73% to be specific). Our mindset doesn't have a lot of time for stocks like this. While some losers redeem themselves, most remain losers and we prefer winners anyway.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Surface Oncology stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Surface Oncology shareholders are down 73% for the year, falling short of the market return. The market shed around 8.1%, no doubt weighing on the stock price. Shareholders have lost 19% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 4 warning signs we've spotted with Surface Oncology .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here