Shareholders Are Thrilled That The Kornit Digital (NASDAQ:KRNT) Share Price Increased 132%

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Kornit Digital Ltd. (NASDAQ:KRNT) share price has soared 132% in the last three years. That sort of return is as solid as granite.

Check out our latest analysis for Kornit Digital

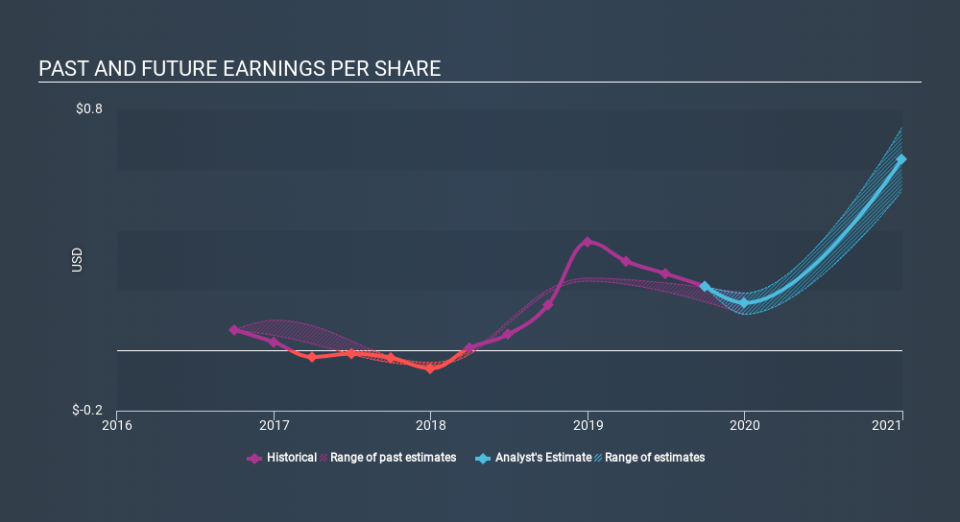

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, Kornit Digital achieved compound earnings per share growth of 46% per year. This EPS growth is higher than the 32% average annual increase in the share price. So it seems investors have become more cautious about the company, over time. Having said that, the market is still optimistic, given the P/E ratio of 153.11.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Kornit Digital's earnings, revenue and cash flow.

A Different Perspective

Pleasingly, Kornit Digital's total shareholder return last year was 83%. So this year's TSR was actually better than the three-year TSR (annualized) of 32%. These improved returns may hint at some real business momentum, implying that now could be a great time to delve deeper. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Kornit Digital better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.