Shareholders Are Thrilled That The Retail Opportunity Investments (NASDAQ:ROIC) Share Price Increased 119%

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right stock, you can make a lot more than 100%. For example, the Retail Opportunity Investments Corp. (NASDAQ:ROIC) share price had more than doubled in just one year - up 119%. Also pleasing for shareholders was the 19% gain in the last three months. But this could be related to the strong market, which is up 8.6% in the last three months. Having said that, the longer term returns aren't so impressive, with stock gaining just 1.0% in three years.

Check out our latest analysis for Retail Opportunity Investments

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over the last twelve months, Retail Opportunity Investments actually shrank its EPS by 36%.

Given the share price gain, we doubt the market is measuring progress with EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Unfortunately Retail Opportunity Investments' fell 3.7% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

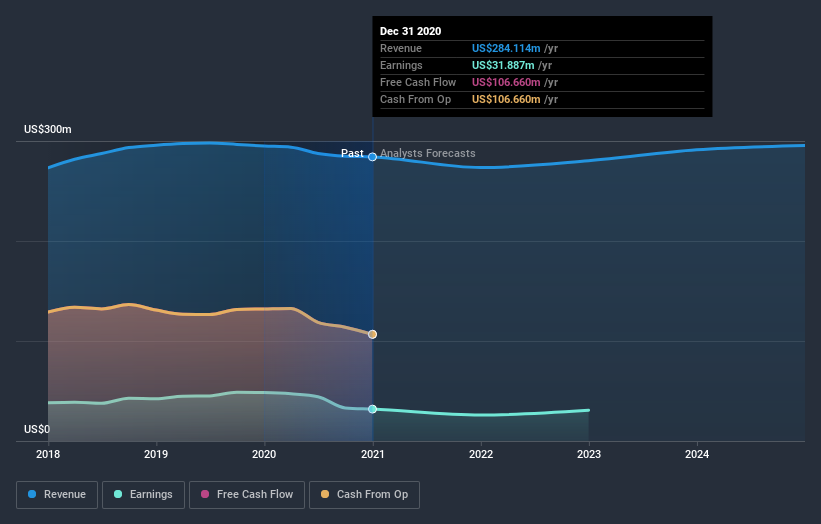

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Retail Opportunity Investments will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that Retail Opportunity Investments shareholders have received a total shareholder return of 121% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 1.4% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Retail Opportunity Investments has 5 warning signs (and 2 which are a bit concerning) we think you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.