Shareholders Are Thrilled That The Sterling Construction Company (NASDAQ:STRL) Share Price Increased 148%

Sterling Construction Company, Inc. (NASDAQ:STRL) shareholders might be concerned after seeing the share price drop 15% in the last month. But in three years the returns have been great. In three years the stock price has launched 148% higher: a great result. So the recent fall in the share price should be viewed in that context. If the business can perform well for years to come, then the recent drop could be an opportunity.

See our latest analysis for Sterling Construction Company

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

To quote Buffett, ‘Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace…’ One way to examine how market sentiment has changed over time is to look at the interaction between a company’s share price and its earnings per share (EPS).

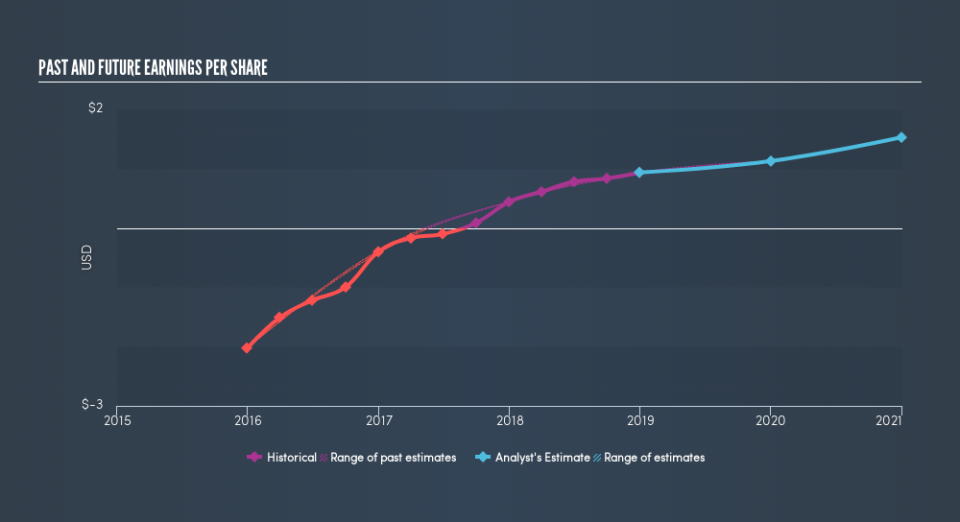

Sterling Construction Company became profitable within the last three years. Given the importance of this milestone, it’s not overly surprising that the share price has increased strongly.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Sterling Construction Company has grown profits over the years, but the future is more important for shareholders. This free interactive report on Sterling Construction Company’s balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It’s good to see that Sterling Construction Company has rewarded shareholders with a total shareholder return of 13% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 7.5% per year), it would seem that the stock’s performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. If you would like to research Sterling Construction Company in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you would prefer to check out another company — one with potentially superior financials — then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.