Shareholders Are Thrilled That The Wellington Drive Technologies (NZSE:WDT) Share Price Increased 112%

It hasn't been the best quarter for Wellington Drive Technologies Limited (NZSE:WDT) shareholders, since the share price has fallen 18% in that time. But that scarcely detracts from the really solid long term returns generated by the company over five years. It's fair to say most would be happy with 112% the gain in that time. To some, the recent pullback wouldn't be surprising after such a fast rise. Ultimately business performance will determine whether the stock price continues the positive long term trend.

Check out our latest analysis for Wellington Drive Technologies

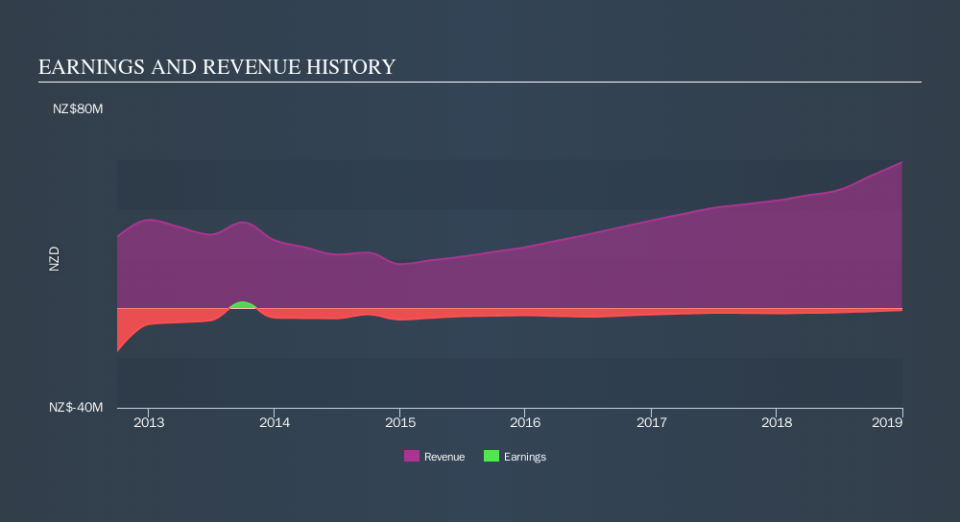

Because Wellington Drive Technologies is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Wellington Drive Technologies saw its revenue grow at 21% per year. That's well above most pre-profit companies. Meanwhile, its share price performance certainly reflects the strong growth, given the share price grew at 16% per year, compound, during the period. This suggests the market has well and truly recognized the progress the business has made. Wellington Drive Technologies seems like a high growth stock - so growth investors might want to add it to their watchlist.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Take a more thorough look at Wellington Drive Technologies's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We've already covered Wellington Drive Technologies's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Wellington Drive Technologies's TSR, at 150% is higher than its share price return of 112%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Wellington Drive Technologies shareholders gained a total return of 13% during the year. But that return falls short of the market. If we look back over five years, the returns are even better, coming in at 20% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Wellington Drive Technologies better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.