Shenzhou International Group Holdings Limited (HKG:2313) Analysts Just Slashed This Year's Estimates

Today is shaping up negative for Shenzhou International Group Holdings Limited (HKG:2313) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as the analysts factored in the latest outlook for the business, concluding that they were too optimistic previously. Surprisingly the share price has been buoyant, rising 12% to CN¥82.40 in the past 7 days. With such a sharp increase, it seems brokers may have seen something that is not yet being priced in by the wider market.

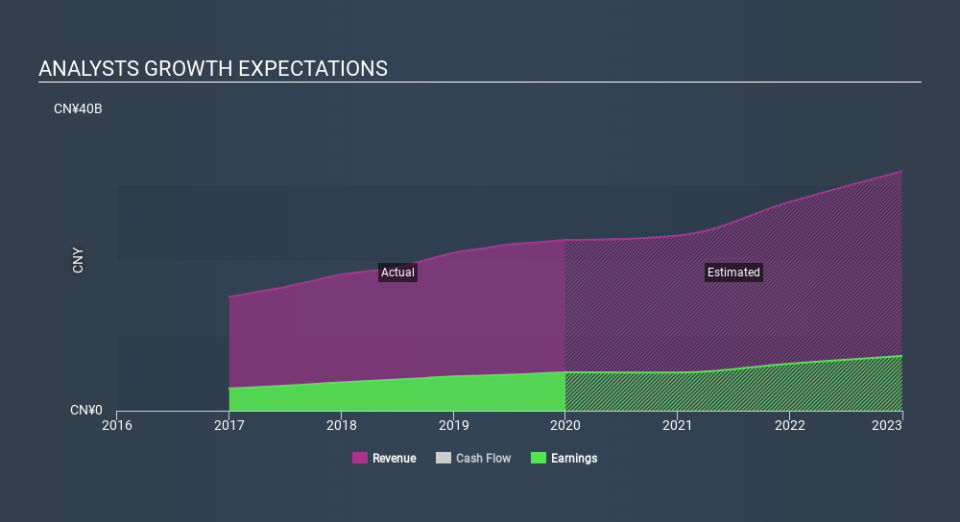

After the downgrade, the 25 analysts covering Shenzhou International Group Holdings are now predicting revenues of CN¥23b in 2020. If met, this would reflect a satisfactory 2.5% improvement in sales compared to the last 12 months. Statutory earnings per share are supposed to decrease 3.1% to CN¥3.28 in the same period. Prior to this update, the analysts had been forecasting revenues of CN¥27b and earnings per share (EPS) of CN¥4.00 in 2020. It looks like analyst sentiment has declined substantially, with a substantial drop in revenue estimates and a considerable drop in earnings per share numbers as well.

View our latest analysis for Shenzhou International Group Holdings

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. It's pretty clear that there is an expectation that Shenzhou International Group Holdings' revenue growth will slow down substantially, with revenues next year expected to grow 2.5%, compared to a historical growth rate of 15% over the past five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 11% next year. Factoring in the forecast slowdown in growth, it seems obvious that Shenzhou International Group Holdings is also expected to grow slower than other industry participants.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like analysts have become a lot more bearish on Shenzhou International Group Holdings, and their negativity could be grounds for caution.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Shenzhou International Group Holdings analysts - going out to 2022, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.