Shops discriminate against cash users over misguided contagion fears

One in three shoppers has been turned away when trying to use cash because of contagion fears, despite official guidance stating there is virtually no risk of coins or notes spreading coronavirus.

Supermarkets, pubs and restaurants were the most common place people were blocked, with 34pc of people told they could not pay without a bank card, according to research from consumer group Which?.

It has warned the new obsession with contactless payments, brought on by the pandemic, could speed up the chronic decline of traditional money. Which? said this could “crumble” Britain’s cash network and leave millions who depend on physical currency “abandoned”.

Which? revealed a number of shocking reports about obstinate businesses refusing to serve vulnerable customers because they could only pay in the traditional way.

One 39-year-old diabetic man was turned away from two restaurants including a Nando's at a service station on the M25 for trying to pay in cash. This is despite telling staff his blood sugar was plummeting to dangerously low levels after he was caught in a three-hour traffic jam.

Nando's has since apologised and said an exception to Covid-19 safety measures should have been made given the circumstances.

A 62-year-old woman with a broken ankle was blocked from getting on a bus for a short ride to see her GP. The driver said she could not pay for her fare in coins.

Which?’s Jenny Ross said the misguided belief physical money could help spread the virus posed a huge threat.

“Cash is still a vital way to pay for millions, so to see such a high proportion of people have difficulty spending it is very concerning,” she said.

More than half of consumers said they have replaced some or all of their cash use since the first lockdown. Close to half of these said this was as a result of shops prohibiting or discouraging it, the consumer group found.

Contagion fears fly in the face of an official study from the Bank of England which found the risk of transmission from banknotes was “no greater than touching any other common surface, such as handrails doorknobs or credit cards”, and particularly low compared with “high-touch” objects such as shopping baskets or self-checkout touchscreens.

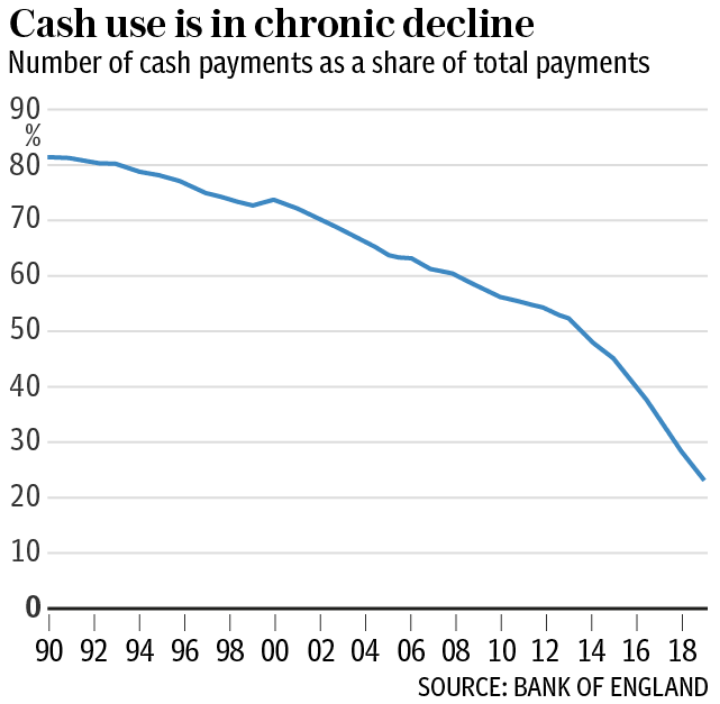

Cash use has fallen dramatically in recent years, as bank branches and cash machines have closed and more have turned to using debit and credit cards and shopping online.

Less than a quarter of all payments in 2019 were made using cash, down from close to 60pc a decade earlier, according to the bank. More than two million people still depend on physical money every day, it found.