The SHS Holdings (SGX:566) Share Price Is Down 44% So Some Shareholders Are Getting Worried

For many, the main point of investing is to generate higher returns than the overall market. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term SHS Holdings Ltd. (SGX:566) shareholders for doubting their decision to hold, with the stock down 44% over a half decade. And it's not just long term holders hurting, because the stock is down 25% in the last year.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for SHS Holdings

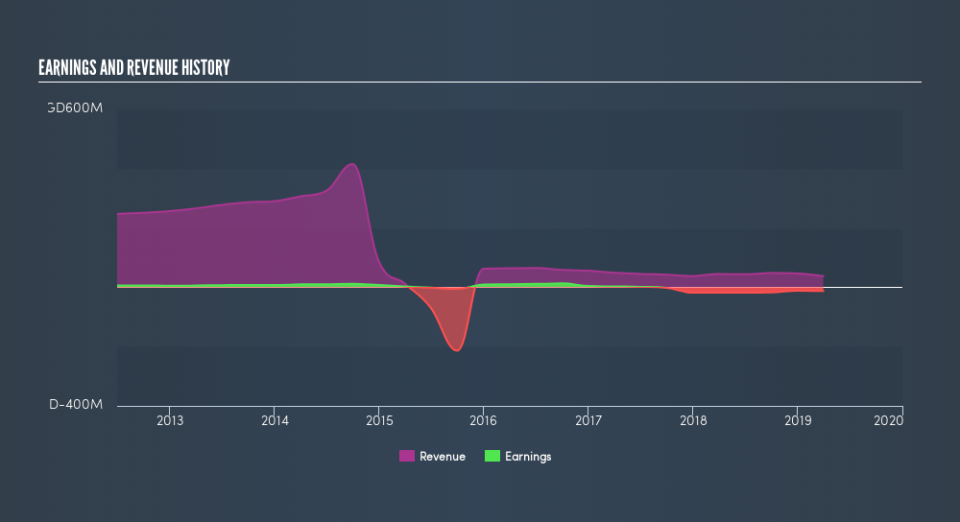

SHS Holdings isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last five years SHS Holdings saw its revenue shrink by 35% per year. That puts it in an unattractive cohort, to put it mildly. It seems pretty reasonable to us that the share price dipped 11% per year in that time. We doubt many shareholders are delighted with this share price performance. Risk averse investors probably wouldn't like this one much.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free interactive report on SHS Holdings's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. SHS Holdings's TSR over the last 5 years is -29%; better than its share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

While the broader market lost about 5.8% in the twelve months, SHS Holdings shareholders did even worse, losing 25%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6.7% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of SHS Holdings by clicking this link.

SHS Holdings is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.