Some Silk Road Energy Services Group (HKG:8250) Shareholders Have Copped A 96% Share Price Wipe Out

Long term investing works well, but it doesn't always work for each individual stock. It hits us in the gut when we see fellow investors suffer a loss. Imagine if you held Silk Road Energy Services Group Limited (HKG:8250) for half a decade as the share price tanked 96%. And it's not just long term holders hurting, because the stock is down 42% in the last year. Furthermore, it's down 21% in about a quarter. That's not much fun for holders. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Silk Road Energy Services Group

Silk Road Energy Services Group isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

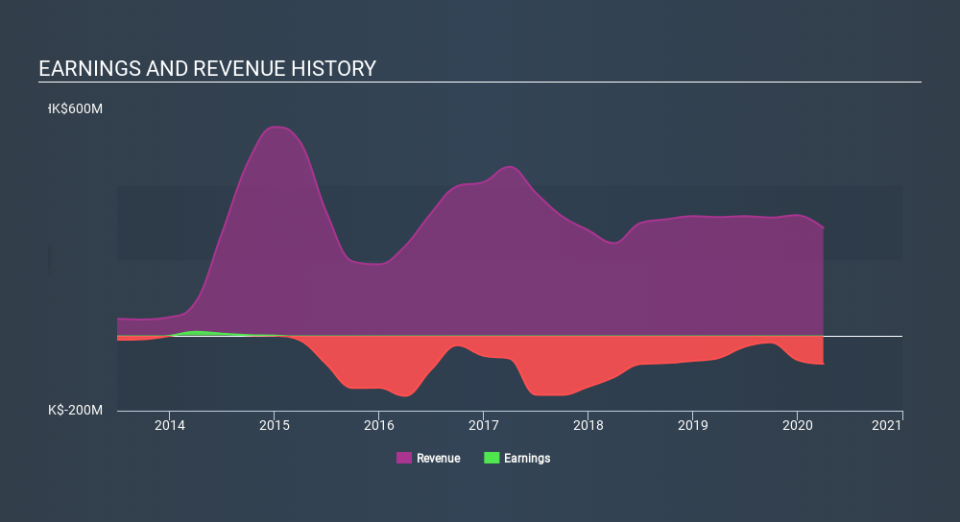

Over half a decade Silk Road Energy Services Group reduced its trailing twelve month revenue by 2.1% for each year. That's not what investors generally want to see. If a business loses money, you want it to grow, so no surprises that the share price has dropped 48% each year in that time. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. Fear of becoming a 'bagholder' may be keeping people away from this stock.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. This free interactive report on Silk Road Energy Services Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Silk Road Energy Services Group shareholders are down 42% for the year. Unfortunately, that's worse than the broader market decline of 3.8%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, longer term shareholders are suffering worse, given the loss of 48% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Silk Road Energy Services Group better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Silk Road Energy Services Group , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.