The Simplex Infrastructures (NSE:SIMPLEXINF) Share Price Is Down 79% So Some Shareholders Are Rather Upset

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it's not unreasonable to try to avoid truly shocking capital losses. So we hope that those who held Simplex Infrastructures Limited (NSE:SIMPLEXINF) during the last year don't lose the lesson, in addition to the 79% hit to the value of their shares. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. Notably, shareholders had a tough run over the longer term, too, with a drop of 67% in the last three years. The falls have accelerated recently, with the share price down 43% in the last three months.

Check out our latest analysis for Simplex Infrastructures

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

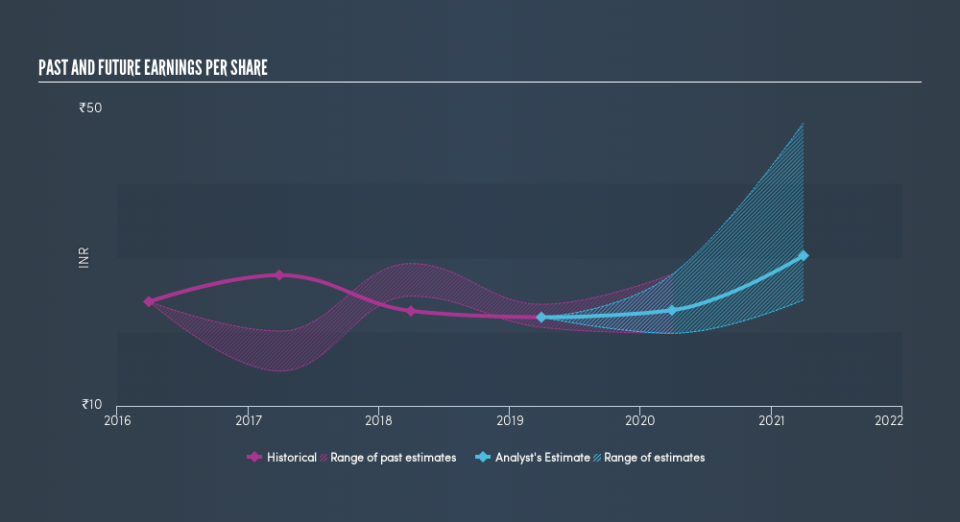

Unfortunately Simplex Infrastructures reported an EPS drop of 3.7% for the last year. The share price decline of 79% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago. The P/E ratio of 4.56 also points to the negative market sentiment.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Simplex Infrastructures's key metrics by checking this interactive graph of Simplex Infrastructures's earnings, revenue and cash flow.

A Different Perspective

While the broader market lost about 1.7% in the twelve months, Simplex Infrastructures shareholders did even worse, losing 79% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 21% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.