Is Singapore Post (SGX:S08) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Singapore Post Limited (SGX:S08) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Singapore Post

What Is Singapore Post's Net Debt?

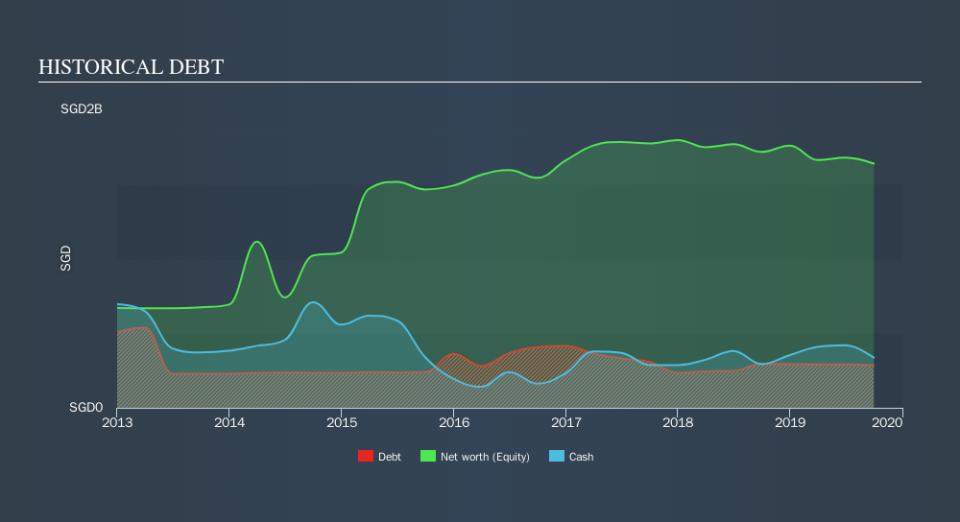

The chart below, which you can click on for greater detail, shows that Singapore Post had S$286.1m in debt in September 2019; about the same as the year before. However, its balance sheet shows it holds S$335.9m in cash, so it actually has S$49.8m net cash.

How Healthy Is Singapore Post's Balance Sheet?

According to the last reported balance sheet, Singapore Post had liabilities of S$792.0m due within 12 months, and liabilities of S$164.1m due beyond 12 months. Offsetting this, it had S$335.9m in cash and S$250.2m in receivables that were due within 12 months. So its liabilities total S$369.9m more than the combination of its cash and short-term receivables.

Given Singapore Post has a market capitalization of S$2.09b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, Singapore Post also has more cash than debt, so we're pretty confident it can manage its debt safely.

The modesty of its debt load may become crucial for Singapore Post if management cannot prevent a repeat of the 32% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Singapore Post can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Singapore Post has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, Singapore Post recorded free cash flow worth 71% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing up

While Singapore Post does have more liabilities than liquid assets, it also has net cash of S$49.8m. The cherry on top was that in converted 71% of that EBIT to free cash flow, bringing in S$160m. So we are not troubled with Singapore Post's debt use. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check Singapore Post's dividend history, without delay!

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.