Single Women Homeowners Share Their Best Advice for First-Time Solo Buyers

Did you know single women are the second largest group of homeowners after married couples? They far outpace their male counterparts when it comes to purchasing solo, and their numbers are only growing. Over the past six months, House Beautiful and Marie Claire have interviewed dozens of single women buyers—and surveyed hundreds more—to learn more about how and why they purchased. As you might expect, they had some great advice to offer. Below, we've compiled some of the most helpful tips.

Understand your finances

This is, without a doubt, the most frequently-offered piece of advice. Knowledge is power, and the more you know about what you can afford, the better prepared you'll be for the buying process. "Many people are intimidated to even begin because it seems so impossible," says Brooklyn homeowner Malene Barnett. "But you just have to get started. Meet with a mortgage broker and figure out what you need to do." If your finances aren't in great shape, turn to a financial adviser, who can help you get your savings on track. It worked for homeowner Candice Walsh, who went from $17,000 in debt to owning a home in just three years.

Create a strict budget

Which brings us to a related point: successful saving starts with a strict regimen. Tanya Brown, a homeowner in Hoboken, New Jersey, began keeping fastidious track of her spending in a spreadsheet, then found places she could cut. "I started telling my friends, 'if we're going out, it has to be cheap,'" she laughs. "I was very focused; I'd say, 'ok, you're not going on a trip this year, you're paying off your credit card bill. The reality of it was knowing where my money was going actually gave me a feeling of power."

Hire a realtor early

Think you'll reach out to a realtor the moment you're ready to buy? You may want to think again. "Our favorite clients are those who come to us two or three years out," says Danielle Lurie, who leads an all-female realtor team at Compass. That way, the agent can work with you to find your options while you prepare.

Consider all your options

One thing we learned from talking to hundreds of buyers? There's no one size fits all when it comes to loans, mortgages, and assistance. Pennsylvania homeowner Emily Palen secured a mortgage from Veterans United because her stepfather is a veteran; in New Jersey, Beth Diana Smith discovered a program in her town that contributed several thousand dollars to her closing costs. In perhaps the most extreme example, Nasozi Kakembo trawled assistance and loan programs until she found one that would cover all but $0.73 of her down payment. “You have to do your research,” says Carmelita Pickett, who has owned homes solo in Texas, Virginia, and Georgia.

Stay up to date on mortgage rates

If you've had one meeting with a mortgage broker and then decided to hold off and save, you might want to check in again. "If you had x amount 6 months ago you may have not been able to afford something, but now with new interest rates, there might be a little more room there," advises Danielle Lurie team member Lindsay Proud. Adds Lurie, "It’s good to be in touch with someone who is keeping track so they can be alerting you."

Get second opinions

The home-buying process involves interacting with a lot of people, and an unfortunate encounter with one of them can be a big deal. Many of the women we spoke to urged future buyers to interview several potential realtors and look for second opinions from inspectors and contractors.

Plan on additional costs

Another realization nearly all buyers had? You'll always need a little more than you thought you would. That is to say, don't just save enough for your down payment; set aside a few percent more for unforeseen costs, which can range from inspections to repairs to lesser-known fees (one owner suggests $10,000 to spare). "I never considered that at my closing, I’d have to buy whatever fuel was left over in the tank," laughs New Hampshire homeowner Rebecca Scholand.

"You need to prepare for all the bills related to the home being due in a close time frame," adds one anonymous buyer. "The largest bills were due within 3-5 days of each other, which I had not planned on. There are many unexpected costs that need to be allocated for, so it would be a wonderful idea to have a contingency fund set aside for these costs."

In terms of longer-term costs, make sure you take stock of taxes on the home you're looking to purchase, as well as any fees for Homeowners Associations or CoOp boards.

Be prepared to compromise

Just because you don't have to take another person's wants into consideration doesn't mean you won't have to compromise on your purchase. Several homeowners suggested sitting down early to make a list of the things you want in a home, defining what you're prepared to be flexible on—and what you're not. Some buyers opted to move from urban areas to suburban ones; others changed states completely; others compromised square footage for certain neighborhoods. "Make a list of must-have before starting the process of looking," advises one owner.

Don't overexert yourself

Looking to get the most you possibly can? That may not be a good idea, say some owners. "Buy within your means," advises one. "Do NOT buy more than you can afford. You may not always have that perfect job and you'll need a home that will provide the stability you need without worrying about whether you can make the payment."

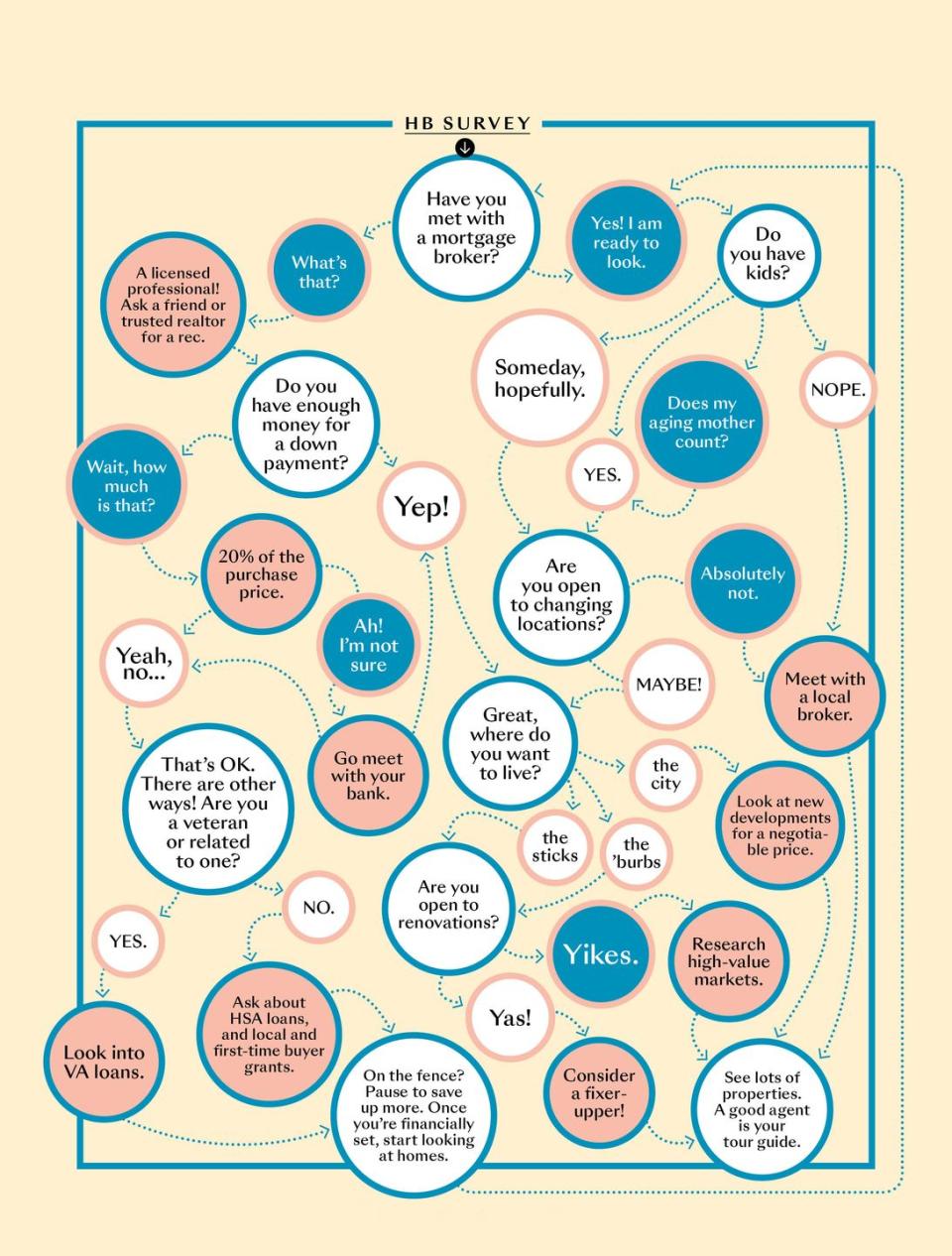

So You Want To Buy A Home...

You Might Also Like