Should Sino Land (HKG:83) Be Disappointed With Their 15% Profit?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Sino Land Company Limited (HKG:83) shareholders might be concerned after seeing the share price drop 12% in the last quarter. On the other hand the share price is higher than it was three years ago. Arguably you'd have been better off buying an index fund, because the gain of 15% in three years isn't amazing.

View our latest analysis for Sino Land

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last three years, Sino Land failed to grow earnings per share, which fell 13% (annualized). The strong decline in earnings per share suggests the market isn't using EPS to judge the company. So we'll need to take a look at some different metrics to try to understand why the share price remains solid.

Interestingly, the dividend has increased over time; so that may have given the share price a boost. Sometimes yield-chasing investors will flock to a company if they think the dividend can grow over time.

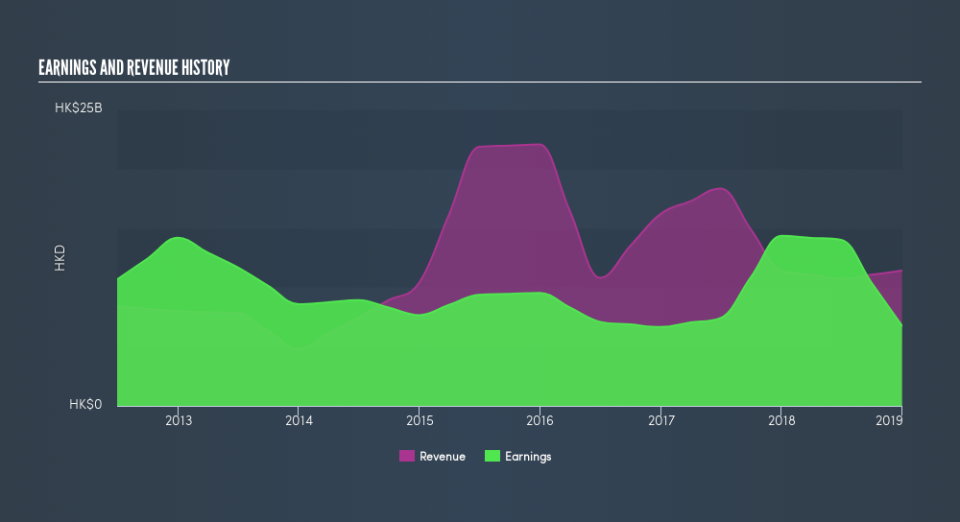

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This free report showing analyst forecasts should help you form a view on Sino Land

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Sino Land's TSR for the last 3 years was 33%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While it's certainly disappointing to see that Sino Land shares lost 0.6% throughout the year, that wasn't as bad as the market loss of 11%. Longer term investors wouldn't be so upset, since they would have made 6.5%, each year, over five years. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.